GCash Mastercard Application: ATM With-drawal: Experience the future of banking with GCash MasterCard application and ATM withdrawal delivery. Simplify your financial transactions by applying for the GCash MasterCard, enabling seamless access to funds through convenient ATM withdrawals. Explore the convenience and flexibility of gcash-mastercard-application-atm-withdrawal-delivery and revolutionize your banking experience today.”

As a mobile wallet and online payment platform, GCash issued the GCash MasterCard virtual prepaid card in the Philippines. The GCash MasterCard is convenient, easy to use, and safe for monetary transactions. It can be used for online and in-store shopping, cash withdrawals, bill payments, and other financial transactions. Furthermore, you can link the card to the GCash app or withdraw money from Bancnet ATMs and Card ATMs nationwide.

GCash Mastercard Application: ATM With-drawal

What is a GCash MasterCard?

Prepaid GCash MasterCard cards can be reloaded with any amount of money. It can be used to withdraw money from ATMs and pay for online and in-store purchases. The card works as a credit and debit card.

What bank is GCash MasterCard?

In partnership with CIMB Bank Philippines, GCash and CIMB Bank Philippines jointly launched the GCash MasterCard. In the country, it is the first bank account that can be opened and maintained through the GCash app. There is no initial deposit or maintenance balance required for the account. In addition, it does not have a lock-in period and it is easy to move funds between your GCash wallet and your bank account.

What is the requirement for a GCash Mastercard?

When applying for a GCash Mastercard, you must have a GCash account and a verified mobile number. Learn how to request a GCash card here.

How to get a GCash MasterCard?

To apply for a GCash Mastercard, you must have a GCash account and a verified mobile number. There are three ways to request a GCash card:

- GCash app

- GCash online MasterCard order link

- Partner convenience stores

How to apply for GCash MasterCard online via the GCash app

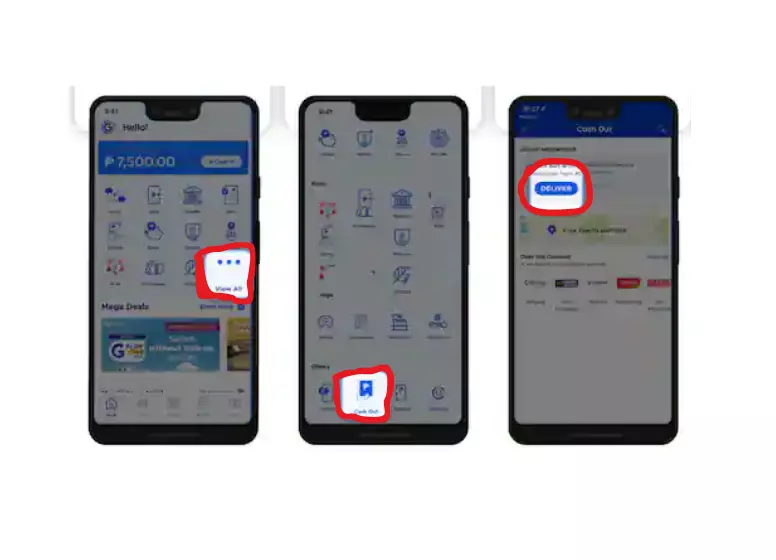

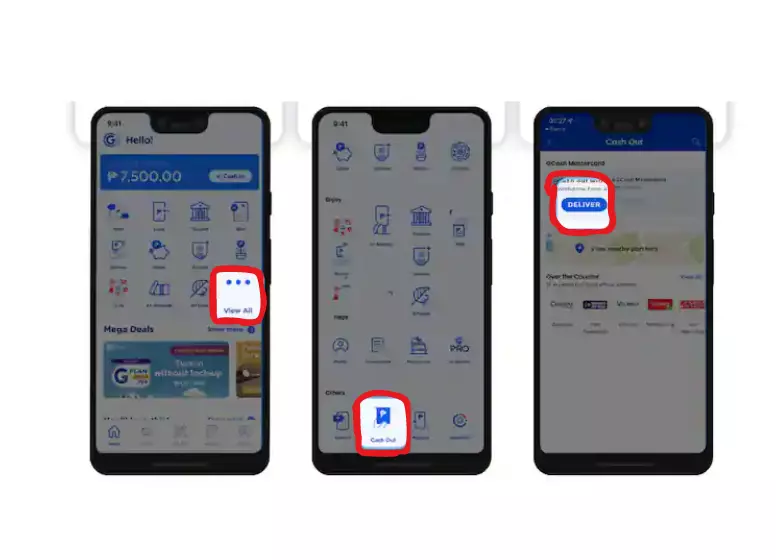

Follow these steps to order the GCash MasterCard via the GCash app:

Open the GCash app and enter your MPIN to log in.

Tap “View All” on the GCash homepage.

Tap “Cash Out” under “Others.

Click “Deliver” under “GCash Mastercard.”

Read the instructions on how to order the card online.

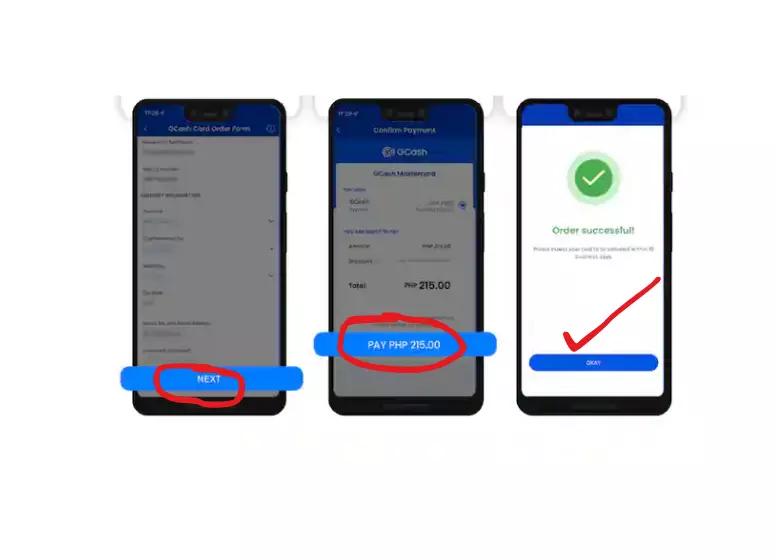

Scroll down to the “GCash Mastercard Order Form” and fill it.

Click the small box to accept the Terms and Conditions.

Click “Next” and pay attention to the Order ID on the screen.

Tap “Pay” and pay ₱215.

A message will pop up on your screen to confirm your payment.

How to order a GCash MasterCard online via the order link

It is temporarily not possible to apply for GCash through the online MasterCard order link. Beware of online merchants who sell fake Mastercards.

How do I apply for a GCash Card through partner convenience stores

These convenience stores accept the GCash card:

- 7-Eleven

- Lawson

- Ministop

- All Day Convenience Store

- All Day Supermarket

In a convenience store, you only pay $150 to apply for the card.

Can I use GCash Mastercard immediately?

Activate the card once you receive it by linking it to your GCash app. These two steps are required to use your Mastercard.

How long does it take for GCash Mastercard to deliver?

After confirmation of your payment, your card will be sent within ten business days (online applications) or within five business days (applications at affiliated convenience stores).

How to track my GCash Mastercard

There is no way for you to track your GCash Mastercard online on your own. To check the status of your GCash Mastercard delivery, please contact GCash customer support at 2882 / (02) 782-2882 or email [email protected].

How to activate a GCash Mastercard

Your Mastercard can be activated by linking it to your GCash account. An activation manual is included with the card, along with instructions for using it once your account has been linked. The card can be activated in two ways:

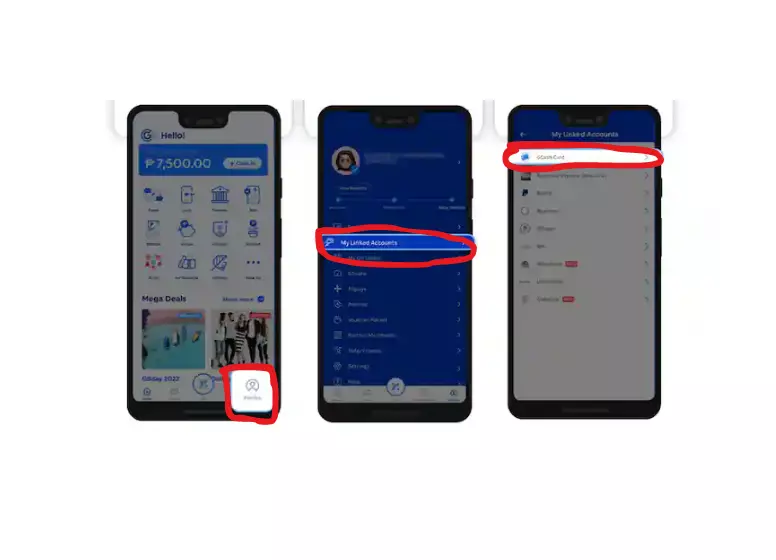

How to activate your GCash MasterCard via the GCash app

Log in to your GCash app with your MPIN.

On the GCash homepage, click “Profile“.

Choose “My Linked Accounts”

Select “GCash card“.

Click “Add a Card” to add a card.

You will receive a 6-digit authentication code via SMS to the mobile number you have registered with GCash.

The last four digits of your GCash Mastercard number should be entered here.

Please enter the 12-digit GCash Virtual Account number.

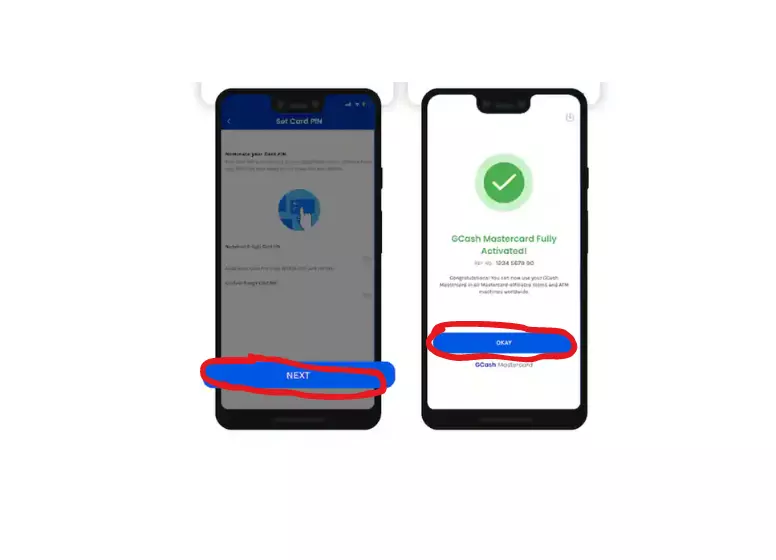

Then click “Next”

Please enter your 6-digit PIN.

Click on the “Link Card” button.

How to activate your GCash MasterCard via USSD code

- Please dial *143#

- To activate the card, select GCash > 2 GCash Cards > 1.

- You’ll need to fill in the details from your Mastercard.

- A message will be sent to you if the card has been successfully activated.

Ways of using the GCash MasterCard

Paying bills, sending & withdrawing money, and making online/offline shopping payments locally and internationally are all possible with the MasterCard’s many features. GCash wallets can also be accessed through Payoneer and PayPal.

Can GCash Mastercard be used internationally?

Around 35.9 million card merchants in 210 countries and 150 currencies accept this Mastercard.

How can I register to Payoneer using GCash?

Payoneer allows you to transfer money to your GCash account. Payoneer registration using the GCash app is as follows:

Log in to your GCash app with your MPIN.

On the GCash homepage, tap the “Profile” icon.

Choose “My Linked Accounts”

From the list, select “Payoneer“.

Click “Create an account”

Enter your details manually by clicking “Create an Account“. Alternatively, you can use the “Register with GCash” option to fill out your GCash information automatically.

Create an account by filling out the required information.

As soon as your application is processed, a confirmation message will appear on the screen. To exit, click “Okay“.

If you’ve submitted your Payoneer application, you can check your account status by logging into your Payoneer account. As soon as Payoneer has reviewed your application, you will receive an email.

Generally, new applications are reviewed immediately, but some may take up to three (3) business days. When your application is successful, Payoneer will email you to confirm.

How can I link my Payoneer to GCash?

Verify your Payoneer and GCash accounts before you link your Payoneer account to GCash. If your Payoneer account has not received money for more than a month, you may need to re-link it to GCash. The following steps will guide you through the process of linking your Payoneer account to GCash:

Log in to your GCash app with your MPIN.

On the GCash homepage, tap the “Profile” icon.

Choose “My Linked Accounts”

From the list, select “Payoneer“.

Click “Link Account”

Please enter your “Payoneer login credentials“

Please enter the SMS verification code you received.

After the linking has been completed, you will receive a confirmation via text message.

How can I cash into GCash with my Payoneer account?

Transferring money from Payoneer to GCash is as simple as following these steps:

Log in to your GCash app with your MPIN.

From the GCash homepage, click “Cash In“.

Click on “Payoneer”

Enter the “desired amount” for the “currency balance”

Click “Next”

A peso conversion will be made on the cashier page. Select “Confirm” after reviewing the amount.

You will receive an OTP code via SMS to your GCash-registered mobile number.

You will receive a blue confirmation page once your Cash In has been processed. Your GCash wallet balance will reflect the balance of your Cash In once you receive an SMS confirmation.

How do I link my PayPal to GCash?

You can get started with GCash MasterCard and PayPal by following the steps below

Log in to your GCash app with your MPIN.

On the GCash homepage, click “Profile“.

Choose “PayPal”

You can link your Gcash account to your PayPal email account.

Click “Link”

On the next screen, click “Authorize“.

PayPal will redirect you to the login page.

Please enter your PayPal username and password.

Tap “Close and Continue” after you confirm your mobile number.

How do I cash in with PayPal?

The following steps will guide you through the process of transferring money from PayPal to GCash:

Log in to your GCash app with your MPIN.

On the GCash homepage, click “Cash In“.

Click on “PayPal” under Global Partners and Remittance.

Please enter the amount you would like to add to your wallet (minimum ₱500).

Once you have confirmed the amount, click “Next“.

The majority of Globe GCash and PayPal transactions are processed within the next 24 to 48 hours. As soon as the funds are added to your GCash wallet, you will receive an email and SMS notification. Make sure your PayPal funds are converted into Pesos before making transactions or withdrawals. It is also possible to increase the amount of money you can keep in your wallet by checking and increasing the cash limit.

Where can I withdraw money using GCash MasterCard?

There are affiliated Bancnet ATMs (nationwide) and Card ATMs (worldwide) where you can withdraw money. You can identify an ATM by the Mastercard or BancNet logo. In addition to GCash Partner Outlets, you can withdraw money from any of these locations:

- Cebuana Lhuillier

- CVM Pawnshop

- DA5

- ECPay

- ExpressPay

- HanepBuhay

- Jaro Pawnshop

- Panalo Express

- PeraHUB

- Posible

- Puregold

- Robinsons

- SM Store

- Tambunting

- Pawnshop

- TrueMoney

- Villarica

- Pawnshop

There are different withdrawal steps for each Partner Outlet. If you have a non-Philippine SIM card, you should also learn how to Cash Out.

What is the GCash MasterCard withdrawal fee?

GCash MasterCard withdrawal fees are as follows:

GCash Partner Outlets will charge you 2% of the amount you withdraw over the counter.

In most cases, ATM withdrawal fees are between $10 and $18 (depending on the bank servicing the ATMs).

There is a $150 ATM withdrawal fee (International).

DISCLAIMER:

The author of this article is not sponsored by any third party. This article is intended for general information only and does not address individual circumstances. Any decisions should not be based on it without seeking professional advice or assistance. You are strictly responsible for any actions you take as a result of the information presented in this article! According to Kami.com.ph, you can apply for a BPI Blue Mastercard online.

Bank of the Philippine Islands (BPI), the first bank to be established in the Philippines and Southeast Asia, owns the BPI card. Cardholders are only allowed to use the card for their own personal use. There is a list of requirements to qualify for this card in the article, as well as information on how to check if your application has been approved.

Conclusion:

In conclusion, the GCash MasterCard application and ATM withdrawals redefine modern banking convenience. When you apply for a GCash MasterCard, you open the door to hassle-free financial transactions and quick access to funds at ATMs. With gcash-mastercard-application-atm-withdrawal-delivery, manage your finances in a whole new way, and experience a new level of flexibility and accessibility. Begin your journey of effortless transactions today and elevate your banking experience.