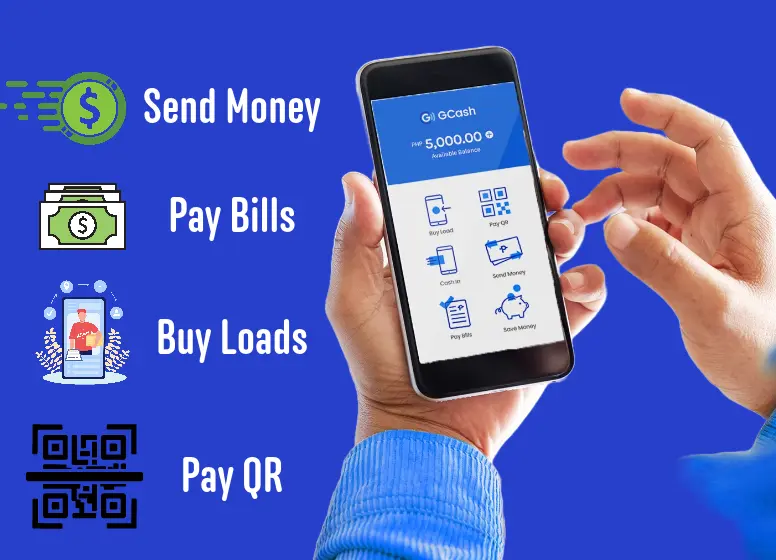

GCash is a revolutionary app that allows you to manage your finances on the go with the GCash app. In the Philippines, it is one of the most popular mobile wallet apps due to its user-friendly interface and wide range of features.

Modern life demands efficient financial management. Good news! Traditional banking methods and cumbersome paperwork are a thing of the past. It is now possible to manage your finances on the move with the GCash App, thanks to the digital revolution.

Mobile wallet apps such as GCash provide users with a wide array of financial services and features. We’ll explore why GCash is a necessary tool for modern living in this article, and how it can help you take control of your finances.

The purpose of this article is to give you an overview of the GCash app and explain how you can use it to make your life easier.

Advantages of using GCash

- Convenience at Your Fingertips

Your financial resources are accessible anywhere, anytime with GCash. It gives you easy access to functions such as bill payments, money transfers, and account balance checks. The convenience of this service is especially valuable to those who are busy and do not have the time to visit a branch bank of their choice.

- Secure Transactions

GCash places a high priority on security. Financial data remains safe thanks to the app’s robust security measures. You can protect your data by using features like fingerprint authentication and PIN authentication, as well as encryption technology.

- Pay Bills with Ease

It’s never been easier to pay your bills. Mobile payments made with GCash include utility bills, credit card bills, and other payments. By eliminating cash transactions, not only will time be saved, but the risk of theft and losses will be reduced.

- Money Transfer Made Simple

The GCash system is a convenient and hassle-free way to transfer money to loved ones, family members, and coworkers. Transferring funds to bank accounts is just as easy as sending it to anyone with a GCash account. Furthermore, you can keep a record of all the transactions you’ve made for easy reference.

- Buy Load and Make Online Purchases

In addition to making online purchases, you can also buy mobile loads with GCash. The convenience of buying items, accessing services, and staying connected without ever leaving home is made possible by this system.

- Invest and Save

In addition to everyday transactions, GCash offers a range of other services. You can also grow your wealth through investing and saving. A competitive interest rate complements the GInvest feature that lets you invest in a variety of funds. Meanwhile, GSave lets you save and invest your money.

- Cashless Shopping and Dining

The GCash payment method is now accepted by many establishments. With this technology, you can engage in various activities such as shopping, dining out, and engaging in activities that require cashless transactions. GCash eliminates the hassle of carrying cash in your wallet.

- QR Code Payments

In addition to simplifying payments, the GCash app uses QR codes to make them even easier. Now that GCash can be paid via QR code scans, many retailers, restaurants, and other businesses accept it.

- Rewarding Loyalty

A variety of exclusive deals and cashback rewards are available to GCash users. This app offers cashback on a wide variety of transactions, and it frequently features promotions that can help you save money on your daily purchases.

- Budget Tracking

With GCash, you can track your expenses effectively to improve your financial management. Spending habits can be categorized, saving goals can be set, and insights into your finances can be gained.

The GCash app has the following key features

GCash is a mobile wallet and financial management platform that makes payments and manages finances conveniently. Some of the notable features of the GCash app are as follows:

- You can pay for goods and services using your mobile phone

- Purchase groceries, pay bills, and cover everyday expenses

- Payments can be made online

- GCash users can transfer money to each other

- ATM withdrawals

- Check out the history of transactions

- Plan your budget

- Virtual wallets allow you to save money

- Put your money in mutual funds and government securities

- A flexible tool for managing finances

Manage your finances on the go with the GCash App

GCash App: How to Use It

GCash is a simple and easy-to-use application. You can follow this step-by-step guide:

Step 1: You need to download the GCash app and create an account with it.

Step 2: In order to make a payment, you need to choose the service or merchant and enter the amount you wish to pay.

Step 3: Verify the transaction.

Step 4: Click “Transfer” to transfer money to another GCash user.

Step 5: If you would like to pay your bills, you will need to choose the “Pay Bills” option.

Step 6: Select “Buy Load” to purchase a load for your phone.

Step 7: In the “My Wallet” section, you can view your transaction history, set budgets, or add money to your virtual wallet.

Step 8: Go to the “Invest” section to invest in mutual funds and government securities.

GCash App: Security Measures

In order to protect its users’ personal and financial information, GCash takes security very seriously. For security, the app uses encryption and biometric authentication to keep user accounts secure.

To prevent unauthorized transactions and fraud, the app also uses multiple layers of security.

The best mobile wallet in the Philippines is the GCash App

GCash is much more than a mobile wallet; it is a complete financial solution for Filipinos. This app is the go-to app for managing finances on the go thanks to its extensive features and services.

GCash is the best mobile wallet in the Philippines for the following reasons:

1. It’s convenient

The GCash app makes it easy to buy goods and services, transfer money, pay bills, and even purchase loads for your phone without having to use cash or a credit card. Managing your finances on the go has never been easier.

2. Safety

A number of security measures have been implemented by GCash in order to protect the personal and financial information of its users. The combination of encryption and biometric authentication ensures the safety and security of your personal and financial information.

3. Features that are unique

GCash app is constantly being updated and added new features to make user experience even better. With the new GCash Mastercard, users can make purchases wherever Mastercard is accepted using their GCash balance.

4. User-friendly

With its user-friendly interface, the GCash app is easy to use for anyone. This app offers a simple and intuitive interface that makes it easy to access all its features and services.

5. Incentives & Rewards

GCash offers its users a variety of rewards and incentives. With the GCash app, you can save money and gain more value through cashback and discounts.

GCash App: How to Make the Most of It

You can manage your finances on the go with the GCash app. If you want to make the most of the app, here are some tips:

1. Budgeting

Setting a budget is one of the best ways to manage your finances. You can easily set a budget and track your expenses using the GCash app.

2. Take advantage of the savings feature

There is a virtual wallet feature in the GCash app that allows you to save money. Your virtual wallet allows you to easily save money for your future needs by setting a savings goal and adding money regularly.

3. Benefit From Rewards And Incentives

There are many rewards and incentives offered by the GCash app for its users. When using the GCash app, be sure to take advantage of these offers to save money and get more value.

4. Mutual Funds & Government Securities

Investments can be made in mutual funds and government securities through the GCash app. You can earn higher returns and grow your wealth over time by investing your money.

5. Take advantage of the Gcash Mastercard

GCash Mastercard is a great way to take advantage of the GCash app’s offline features. If you have a GCash Mastercard, you can use it anywhere Mastercard is accepted to make purchases.

GCash’s additional benefits

Additionally, the GCash app offers a number of additional features and services that make it an even more valuable tool for managing your finances. GCash has a number of additional benefits you should consider:

1. Shopping online

You can shop online using the GCash app on your mobile phone. With many e-commerce platforms, you can pay for your purchases without using a credit card.

2. Providing loan services

GCash also offers loans, such as cash loans and salary loans, so you can get the money you need when you need it.

3. Services related to insurance

The GCash app also offers insurance services such as health and life insurance through partnerships with different insurance companies.

4. Fundraising

Users of the GCash app can also donate to various charities and foundations through the app.

5. Remittances

Users of the GCash app can also send money to other countries via remittance services, making it easier for overseas Filipinos to send money back home.

Make your business more efficient with GCash

Not only can you manage your personal finances with the GCash app, but you can also use it to manage your business finances. GCash can be used by businesses in the following ways:

1. Payment Acceptance

With the GCash app, businesses can accept payments from customers using their mobile devices.

2. Gateway for payments

The GCash app can also be integrated as a payment gateway to enable customers to make payments on businesses’ websites.

3. Promotions and marketing

To attract more customers, businesses can also use GCash to run marketing and promotional campaigns.

4. Remittances & Payroll

In addition to paying employee salaries and remitting payments to vendors, businesses can also use the GCash app to pay vendors and suppliers. Individuals and businesses can manage their finances more effectively with the GCash app, which offers a wide range of features and services.

The user-friendly interface and innovative features make it the perfect tool for anyone seeking convenience and security in their financial lives.

Conclusion

You can manage your finances on the go with the GCash app. In the Philippines, it has become the go-to app for managing finances due to its wide range of features and services.

With the GCash app, you can pay for goods and services, transfer money, and manage your finances. Anyone looking for a convenient and secure way to manage their finances will love its user-friendly interface and innovative features.

Related Posts: