With GCash, you can make convenient digital financial transactions and access a world of convenience. GCash, one of the most widely used mobile wallet services in the Philippines, simplifies everyday transactions with features like bill payments, money transfers, online shopping, and more. GCash allows users to easily create their own digital wallet which is both secure and accessible. We’ll show you how to set one up in this guide.

GCash Sign-up: Steps to follow to create a accoutn

It is easy to register for a GCash account in just a few steps. You can unlock a world of digital convenience with GCash by following the steps below:

Here’s how to download GCash App:

If you have an iOS device, you can download the GCash app from the App Store, and if you have an Android device, you can download it from the Google Play Store. Download the app by searching for “GCash” on your mobile device.

Open the app and select “Create an Account ”:

Open the GCash app after it has been successfully installed, and select the “Create an Account” option. You will receive step-by-step instructions on how to complete the registration process.

You will need to provide your mobile number:

Click “Next” after you enter your mobile number in the designated field. In order to verify your account, please make sure that the number you provide is active and accessible. GCash will send an one-time PIN to this number.

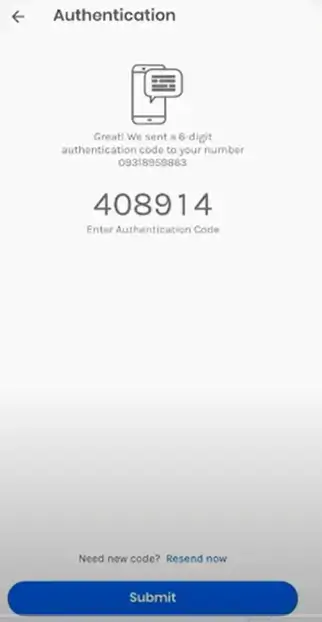

You need to verify your account:

Make sure you have received the 6-digit OTP from GCash on your mobile device. Verify your account by entering this code and clicking “Submit“. The purpose of this step is to confirm the ownership of the mobile number you have provided.

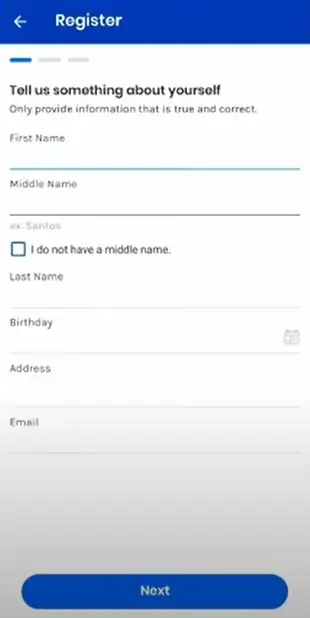

Register by filling out the following form:

After registering, you’ll be asked to provide your personal information. The requested information includes your full name, date of birth, and email address. Click “Next” to proceed after providing the necessary information.

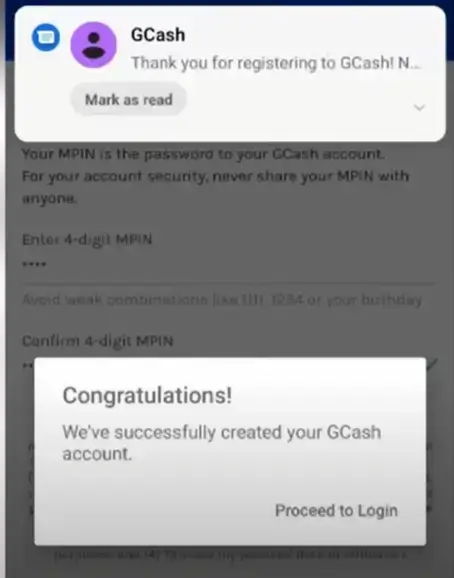

Create a four-digit MPIN as follows:

Please review and conform the given details. As a security measure, you will also need to create a four-digit MPIN (Mobile Personal Identification Number) that serves as the access code to your GCash account. To complete the registration process, select a unique combination that you can remember easily and click “Submit“.

Verification of Accounts and Activation:

Your account will be verified by GCash once you have completed the registration process. It may take a short time for this verification to be completed. Following the verification process, you’ll receive a confirmation notification, indicating that the GCash account you created and activated has been successfully created.

Here’s how you can start using GCash:

As soon as your GCash account has been activated, you will be able to take advantage of its features and services. GCash offers a variety of services such as paying bills, buying prepaid load for your mobile phone, and sending money to other GCash users.

As a GCash customer, you can take advantage of a whole world of digital financial opportunities, making transactions easier and more efficient. Get started with GCash today and discover how convenient it is.

Here are some alternative registration methods for GCash:

As part of the standard registration process, GCash primarily uses mobile phone numbers. For those without mobile numbers or who wish to register for GCash through an alternative method, the following options are available:

Globe Stores or GCash Partner Outlets:

Please visit any of the GCash partner outlets or Globe Stores in your area. It is possible to open a GCash account with the help of the staff. Registration will be guided by them after you present a valid identification document.

KYC (Know Your Customer) Centers at GCash:

You can register for an account at a KYC Center designated by GCash. With the assistance of their staff, you can complete the registration process by visiting one of these centers, providing the required identification and personal information.

With GCash’s website, you can complete your KYC online:

There is a possibility that GCash’s official website will offer online KYC registration. To learn whether GCash offers an online registration option, visit their website. The steps for registering for GCash can be found in the instructions.

You can get the most up-to-date information about alternative registration options by visiting the official GCash website or contacting GCash customer support.

Organizations can create GCash accounts as follows:

Aside from individual accounts, GCash also provides organizations with the option of setting up their own accounts to take advantage of the benefits and convenience it offers. The following steps will guide you through creating a GCash account for your organization:

- Prepare the Required Documents: Ensure that you have all the required documentation to verify your organization before you proceed. A valid business registration document (such as an SEC or DTI registration), a city permit, and proof of residency are typical documents required.

- GCash Business Support: If you need help creating your account, contact GCash Business Support. The company can be contacted through its website, by email, or by phone. Describe your organization’s need for a GCash account and provide them with the necessary information.

- Submission of Required Documents: GCash Business Support will guide you through the document submission process as soon as you contact them. In accordance with their instructions, prepare and submit the documents mentioned earlier. In order to facilitate the verification process, make sure the documents are accurate and complete.

- GCash will verify the information provided: GCash will verify the information provided after submitting the necessary documents. It may take some time for the verification process to complete, so you should be patient during the process. If your application is still pending, you may receive an update.

- Account Activation: When your organization’s account is successfully verified, your GCash account for the organization will be activated. GCash’s various features and services can then be used to streamline your organization’s financial transactions at this point.

You can use GCash to transfer funds, pay bills, and disburse payroll with an organization’s GCash account. Organizations can manage their financial transactions digitally with GCash in a secure and efficient manner.

To ensure a smooth account creation process for your organization, it’s important to comply with all GCash requirements and procedures. In case of further questions, please contact GCash Business Support.

Learn how to manage your business’s finances better with GCash and experience the convenience and efficiency it offers.

GCash offers you a new level of convenience when it comes to your financial life.

Can I create a GCash account for free?

Does GCash work without a smartphone?

For GCash, can I use a landline number?

Is it possible to change the mobile number I registered later on?

With the same mobile number, can I register multiple GCash accounts?

If I forget my MPIN, how do I reset it?

Is it possible for a foreigner to open a GCash account?

Conclusion

In summary, the blog guides users effortlessly through the GCash account creation process, making digital financial empowerment accessible to everyone. The clarity in the step-by-step instructions ensures a seamless experience, underlining GCash’s commitment to user-friendly interfaces. By offering alternative registration methods, the platform extends its reach, addressing the diverse needs of users without mobile numbers and enhancing overall accessibility.

The inclusion of organizational account creation details expands the narrative, showcasing GCash’s versatility. The emphasis on proper documentation and support for businesses underscores GCash’s role as a facilitator of efficient financial transactions, both for individuals and organizations. With a focus on convenience, security, and accessibility, GCash emerges as a transformative force in the digital financial landscape, promising a new level of control and efficiency for users and businesses alike.