GCash offers different ways to Send Money, so let’s examine them in depth. The GCash app’s core feature is Send Money. Fund transfers between users are essential for a digital wallet.

As far as money transfer is concerned, we all need to do so in some way or another – the only difference between sending money and paying money is that payments often come with receipts and records. They are, however, essentially the same thing.

What are the different options Money Transfer using GCash through app?

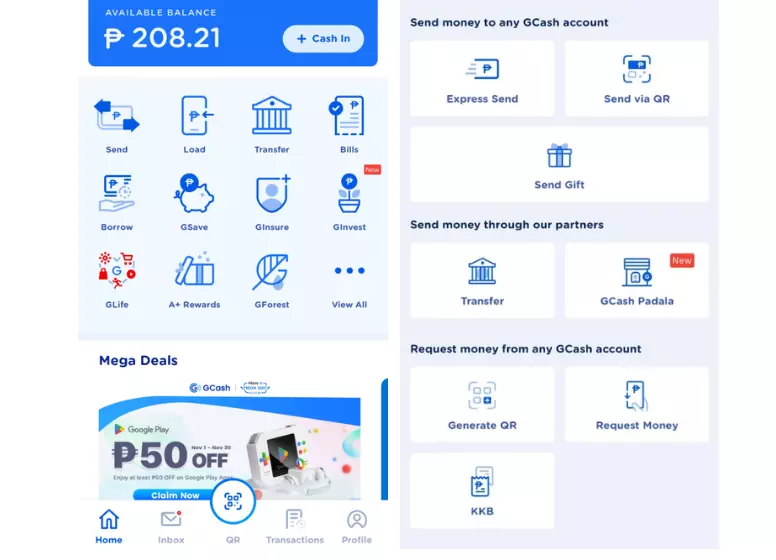

It is currently possible to send money using nine different options in the GCash app. Here are some details about each:

- Sending by express

- QR code sending

- Ang Pao/Gift/Pamasko/Gifts

- Remittance

- Pay with Gcash Padala

- QR code generation

- Get money by requesting it

- KBK

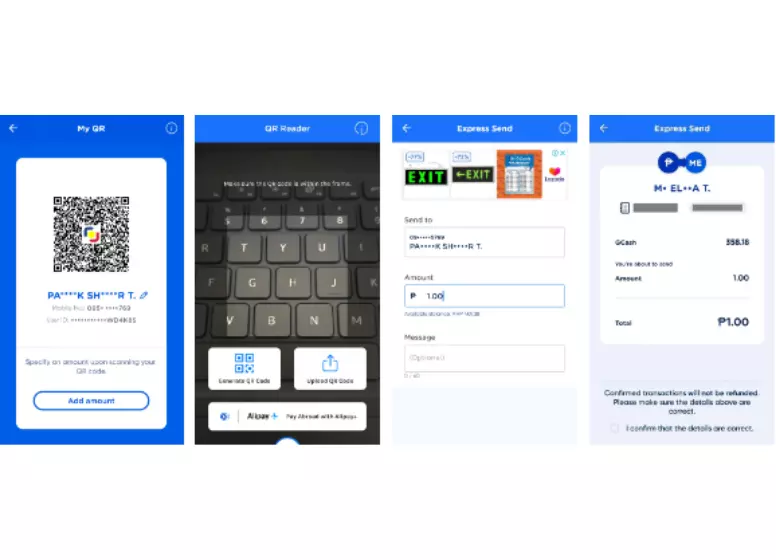

What is Express Send?

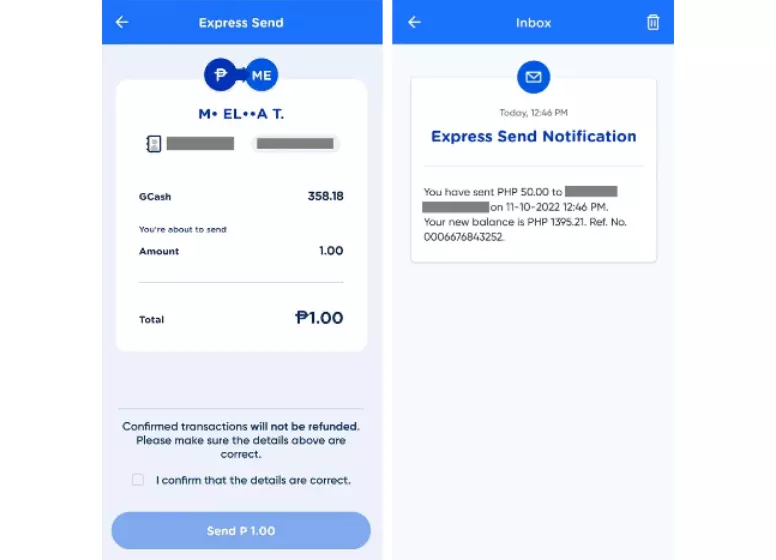

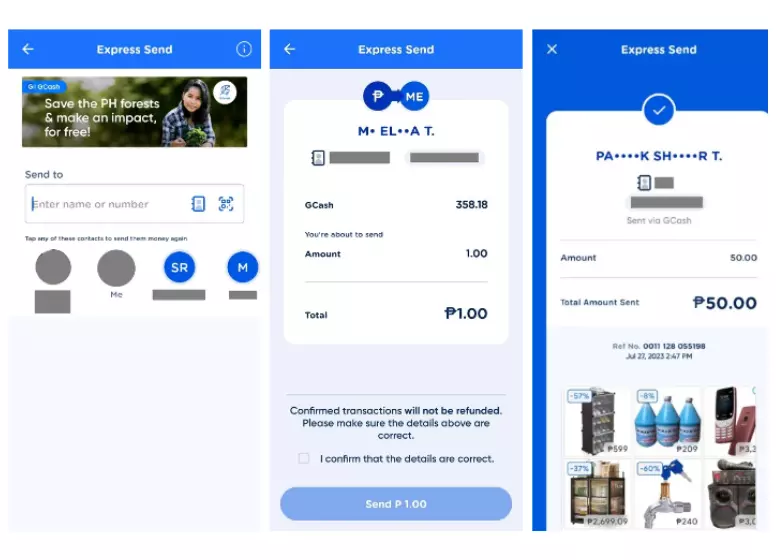

GCash’s mainstay is Express Send. If you know the mobile number of a GCash user, you can send them money. Adding a message to the recipient is also an option. Since there are many scams that use actual names and numbers, the recipient’s name is obfuscated to protect his privacy.

GCash Inbox is currently used to send notifications. The Inbox will be used for sending notifications, and SMS will be used for receiving notifications.

Cash sent using Express Send cannot be undone, unlike Send with a Clip and Send Gift. Directly returning it is the only way to return it. The sender may also need to provide an OTP when sending amounts above Php 1k.

How to do Express Send in GCash

- To send your message, click the Send button on the main page. Select Express Send once you have reached the Send screen.

- You will need to enter the recipient’s phone number, amount, and message if applicable. By clicking the checkbox, you confirm the sending. The previous numbers to which you have sent money can also be selected.

- As soon as the money is received, the recipient will receive an SMS notification. A notification would also be sent to the sender’s inbox.

What is Send via QR?

You can create your own QR code and save or print it for use when receiving money regularly. This is the counterpart to Receive via QR. In the following sections, you will find more information about Receive via QR.

The QR code generated by Send via QR can be scanned. GCash QR codes, including payment QR codes, can also be scanned using this app.

GCash QR Code Sending

- This QR code must be shown by the receiver.

- GCash’s QR scanner is then used by the sender to scan the code.

- It is the seller’s responsibility to input the amount and confirm the sending if the receiver QR code is not customized.

- A message informing the recipient that the message has been sent should be sent to them.

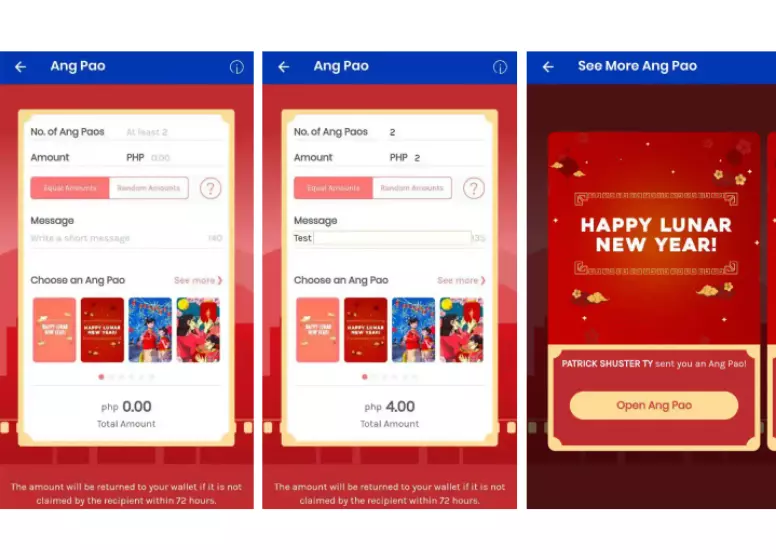

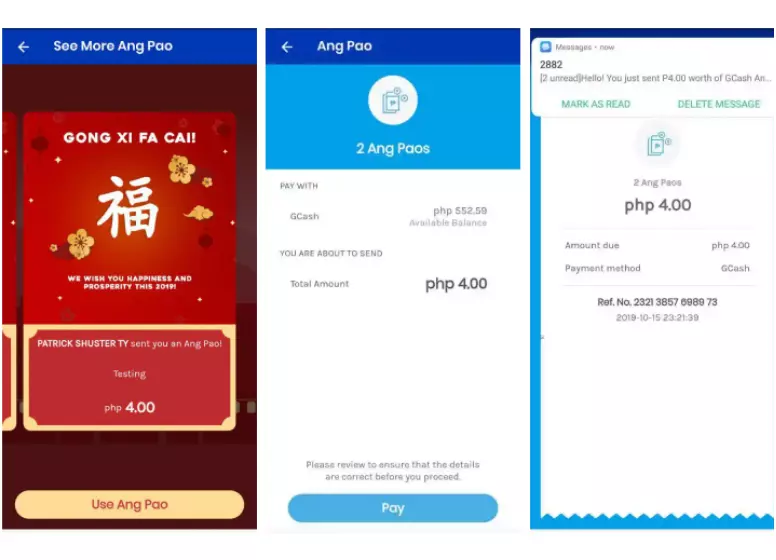

What is Send Gift/Pamasko/Ang Pao?

It is similar to giving those little red envelopes on special occasions with Send Gift/Pamasko/Ang Pao, which is the GCash equivalent. In situations when at least two people need cash gifts, this is a very handy tool. You can only give to 10 people at a time.

When you select “Equal Amounts“, the amount input will be multiplied by the number of recipients. If you select “Random Amounts,” the share of each recipients will be determined by GCash. It’s pretty useful to send an equivalent amount even if it isn’t a cash gift.

How to Sending Gift/Pamasko/Ang Pao in GCash

- Click on the Send button on the main page. Click Send Gift/Ang Pao once you reach the Send screen.

- Provide the recipient’s details – how many people to send to, amount per person, and message.

- Verify that the message was sent. SMS and Inbox messages would be sent to the recipient. Confirm receipt by clicking on the message.

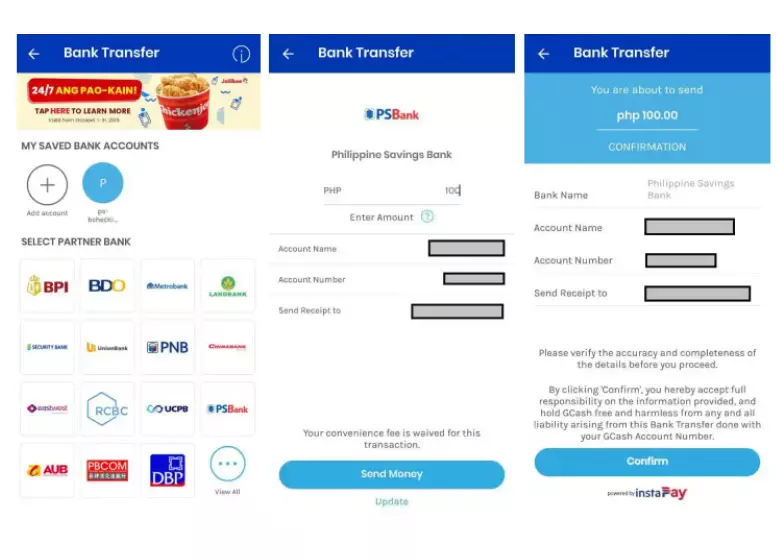

What is Transfer?

GCash offers Instapay transfers from another bank, making it possible to transfer money between banks. Php 15 will be charged for this service. The details of your bank can also be saved so that you can access them quickly in the future. It is now possible to use Instapay to automatically transfer funds to a specific bank account by scanning the QR code of a bank.

Like Express Send, once funds have been sent to a bank, you cannot reverse it. Inputing account numbers and names requires care.

How long would the Bank Transfer take?

Instant transfers are preferred. There is usually a settlement the following day if funds are delayed or not received.

Also, can I schedule a transfer and save my bank details?

Using a saved bank, you can schedule up to five transfers.

Are there any transaction limits?

Incoming transactions still follow the Full Verification limits (Php 100k). This limit can be increased by linking a bank account to your GCash (such as BPI or Union Bank), which will increase your wallet limit to Php 500k per month.

How to Transfer to Bank in GCash

- Click on the Send button at the top of the main page. Choose Send via Bank on the Send screen, then choose the partner bank you wish to send funds to.

- Verify your account details and send the message.

- It takes almost a second for instapay to send a payment. Additionally, you will receive an SMS.

In addition to banks, other e-Wallets such as Coins.ph (DCPay Philippines, Inc.), GrabPay, and Maya are also listed on the growing list. The funds can be transferred from GCash to those accounts.

What is GCash Padala?

Through GCash Padala, you can send money to individuals who are not GCash users. Funds must be claimed at a GCash Partner Outlet. In order to accommodate users who do not use GCash, there are fees associated with claiming the funds.

How to do GCash Padala in GCash

- Click on the Send button on the main page. Select GCash Padala when you reach the Send screen.

- Send the message to the recipient by entering his or her details and confirming it. There ought to be a match between the name on the valid ID and the details entered.

- A confirmation SMS will let you know that the recipient has received your payment.

What is Generate QR?

Sending money without inputting the recipient’s number is possible with Generate QR/Receive via QR. Sending the QR code to the sender will allow the recipient to scan it once he generates it. Similar to Send via QR, this feature allows you to send via QR code.

How to Generate QR in GCash

- Click on the Send button from the main page. Select Generate QR when you’re in the Send screen.

- GCash’s QR scanner is used to scan the code and send funds.

- It is the seller’s responsibility to input the amount and confirm the sending if the receiver QR code is not customized.

- A message informing the recipient that the message has been sent should be sent to them.

Can I generate and save QRs beforehand?

You can customize your QR code so that it accepts a fixed amount or has a nickname attached. Besides saving the code, you can also share it with others.

What is Request Money?

A Request Money request enables you to request money from a sender on your own initiative. Only acknowledgement and confirmation would be required from the sender.

Using this method would save you time since you wouldn’t have to repeat your request every time you receive an amount.

How to Request Money in GCash

- Click the Send button on the main page. Choose Request Money once you have reached the Send screen. Click on the New Request link on the request page.

- Provide the number, amount, and note of the requestee for the new request.

- The list page will display the request once you have confirmed it.

How to authorize the Request Money on the side of the sender

- The app will notify you when a request is ready to be sent. The request will be displayed under the “Requests Received” tab once you’ve logged into Request Money.

- Pay or decline the payment by clicking on the request details.

- It will appear on the list page once you confirm the payment.

What is KKB?

GCash provides a way for users to share payments through KKB or Split Bill. Splitting checks/bills can be easier when used correctly since there is a certain procedure involved. Receiving money from different people is essentially this, but with fewer complications.

The facilitator will then request money from several of GCash’s companions simultaneously after setting the amount. All that would be needed is for the companions to confirm the payment.

Also, you can add a group, so you and your regular companions can do this even more easily. Also, you have the option of splitting by item or evenly.

FAQs

Why is my recipient’s name during Express Send obscured?

Why am I receiving an “unable to process request” error during Express Send?

Do I need to be Fully Verified to be able to use Send Money?

Is Send Money free to use?

That’s right. Cash movement within the GCash ecosystem is the only time GCash is charging fees. Cashing out or paying bills in any way is expensive because of this.

Are there sending limits?

In the meantime, in order to unlock the Php 500k wallet limit, you must meet the cash-in requirements. There is also a Php 500k sending limit in this case.

Unlocking Higher Account Limits

The following will be unlocked once you have done so:

There should be a larger wallet limit – at least Php 500,000

There are no limits on the amount of money you can receive in your wallet and you can withdraw up to Php 500,000 daily.

The monthly withdrawal limit has been increased to Php 10,000 per day, and withdrawals will not be limited per month

The increased limits will be notified to you via SMS.

What if I’ve sent the money to the wrong account?

Bank transfers also fall under this category. It is impossible to retrieve funds once they have been sent.

We would like to remind you to please take note of the mobile number or account number before sending it. It is for this reason that every Send Money option has a confirmation screen. You might also consider assigning a picture of a certain person to the confirmation screen if you send them money regularly.

Can you send money to a non-GCash user?

Can you send money to a nonverified GCash user?

Does sending money increase GScore? How about GCash Forest Energy Points?

GCash Forest EPs are not also added by Send Money.

Summary

In this discussion, we discussed how the GCash app offers different options for sending money. Further, we explained how Express Send differs from Send with a Clip, Send Gift/Pamasko/Ang Pao, Send/Receive via QR, and GCash Padala.