Empower Your Investments:Buying Stocks in COLFinancial Using GCash

Get an overview of the basics of stock investing while buying stocks in COLFinancial with GCash.

Most Filipinos have no deep knowledge of stock trading and mutual funds. The tangible assets most people associate with assets like jewelry, cash, and real estate are usually what people think about when speaking about assets. Intangible assets such as stocks, bonds, securities, and patents are often overlooked.

Philippine stock investors may feel intimidated by stock investing, but this isn’t the case. By providing information on how to make more money, we are helping people become more successful. The ease of investing has never been greater thanks to the tools available online.

What You Need to Know About Buying Stocks in COLFinancial Using GCash

As the purpose of this document is to introduce GCash as well as COLFinancial, let’s start with some introductions.

How do stocks work?

A stock is an ownership unit or share in a company. You become part owner of a company when you purchase shares of stock. As an example, in the Philippines, the PSE (Philippine Stock Exchange) is the local stock market, and multiple accredited brokers (like CitisecOnline and AB Capital) have access to these shares.

What are the benefits of investing in stocks?

It is very easy to make money from stocks without putting in much effort or time. The cost of starting and maintaining some investments is either time or money. You can usually reap the benefits of stocks by putting in money only.

The stock market generally offers higher returns than other types of investments, such as government bonds and time deposits. Investing here involves greater risk, so be sure not to touch the investment for a long period of time after you have made the initial investment. A long-term investment will usually provide a better return on investment if you examine a stock price over a sufficient period of time (usually decades).

There is no fixed price for stocks, as the price is determined by a company’s (or the market’s) performance. Investments are made based on price differences. A profit can be made by buying low and selling high.

What are the best strategies for making money in the stock market?

The two most common methods are when your stock values increase, and when you receive dividends from your stocks. Some companies share dividends with their shareholders as a form of revenue. Profits gained by the company are usually used to pay dividends.

Do stocks make good investments at certain times of the year?

In general, recessions are the best times for buyers. Bullish markets are ideal for selling. Due to the fact that we are beginners, we do not know what the appropriate time is to invest our money. Therefore, a recommendation is to invest over a set period of time, through cost averaging – which means accumulating stocks at a set price over a specified period.

Similarly, you should take this into account when selling your shares. Reverse cost averaging is also an option. Regularly needing money works well with this method.

Do stock market investments require a lot of effort?

Taking all the information into account at first is difficult. Learning from mistakes can, however, be lessened if you work hard to learn.

An Internet connection is all that’s needed to invest. A platform like COLFinancial offers such investment opportunities. GStocks PH is another option. Additionally, there is FAMI (First Metro) and Phil Stocks.

The SmartPinoyInvestor beginner’s guide can provide you with tips on how to invest. Books about this subject are also available. If you want to learn more about Warren Buffett’s mentor, Benjamin Graham, you can read The Intelligent Investor. There are still important principles in this book even though it is over 70 years old.

Which stocks should I buy?

Stocks that serve public needs and remain popular for a long time would make good easy picks. Finding the best stocks that fit your investment appetite is an essential part of being an investor.

Investing in REIT (real estate investment trust) stocks can provide you with consistent dividends since they derive their income from the rental income of large properties.

What is the best place to look up available stocks?

When you are searching for companies to invest in, you can use the PSE Lookup Tool, which is available on several platforms (like COLFinancial and GStocks PH).

The stock market presents many considerations when it comes to buying and selling stocks. What are some of those considerations?

Stock purchases and sales take time to complete, as the local stock market is only open from 9:30-12:00 PM and 1:00-2:30 PM on weekdays.

As well as that, topping up your account wallet does not occur instantly since it must be processed within 1 banking day.

Stocks cannot be purchased in single units when you buy them. You can only purchase a minimum number of units in lots (groups) of stock. Lot sizes range from 10 to 100 for some stocks, and there are others as well.

You must create a COLFinancial Account in order to use COLFinancial

GCash and COLFinancial are the topics of this guide, so below are some how-tos:

Is it easy to become a COLFinancial customer?

COL accounts fall into three categories:

- It is necessary to invest at least Php 1,000 to join COL Starter

- It costs Php 25,000 to invest in COL Plus

- Investment requirement for COL Premium is Php 1,000,000

COL Plus is a good choice for beginners. In my experience, a COL Starter’s minimum investment is not sufficient to buy shares in even a single company. Stocks are typically divided into lots when you purchase them. Lot sizes can vary depending on the share price, for instance 5, 10, 100, or 1000.

A stock such as PLDT (ABBREVIATION: TEL) is currently selling with a lot size of 5 shares for around Php 1,200 per share. The total cost of purchasing this stock can reach Php 6,000 if you buy it once.

You may choose COL Starter if it is not comfortable for you. If you want to test the waters, you can find cheaper stocks.

Can I open an account if I meet the requirements?

To create one, you need to meet the following requirements:

- TIN

- ID issued by a government agency

- Numbers of Social Security/GSIS/CRNs (UMIDs)

- Withdrawal information (for withdrawals)

- Your ID and a selfie

- Your ID and specimen signatures

You can register in this portal once you have collected your requirements. Signing some documents is also required.

TINs (Tax Identification Numbers) aren’t available to me. What is the process for getting one?

We are unable to get one online due to a technical problem. This would require you to go to your local BIR RDO (Revenue District Office).

There are different requirements for different types of taxpayers. Form 1904 can be used if you are unemployed. In the case of self-employment, you must use Form 1901. A processing fee of PHP 500 is also required.

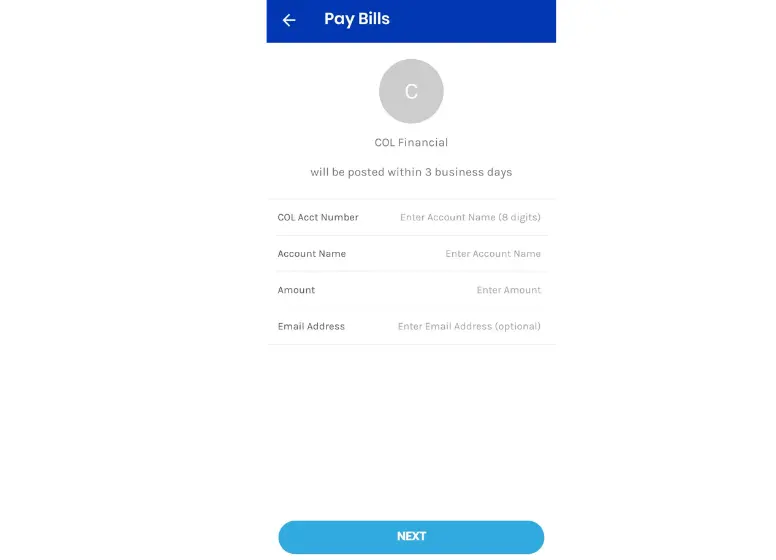

What is the process for funding my account?

A new account must be funded after it has been created. Funding your account can be done in several ways, but most involve paying bills over your preferred channel (such as bank transfers or over-the-counter transactions). Our GCash account can be funded using pay bills since we have GCash.

Upon successful payment, you will be charged Php 20 as a transaction fee. The login details will be sent to your registered email address as soon as your payment has been accepted.

Your COLFinancial Account Can Be Used to Buy Stocks

My account is a beginner’s account. What do I need to do to make it work?

Prior to purchasing stocks, you should conduct research. Stock codes for companies on the stock market can be found using this tool. Analyze the fundamentals of companies you admire, and find out what suits your risk appetite.

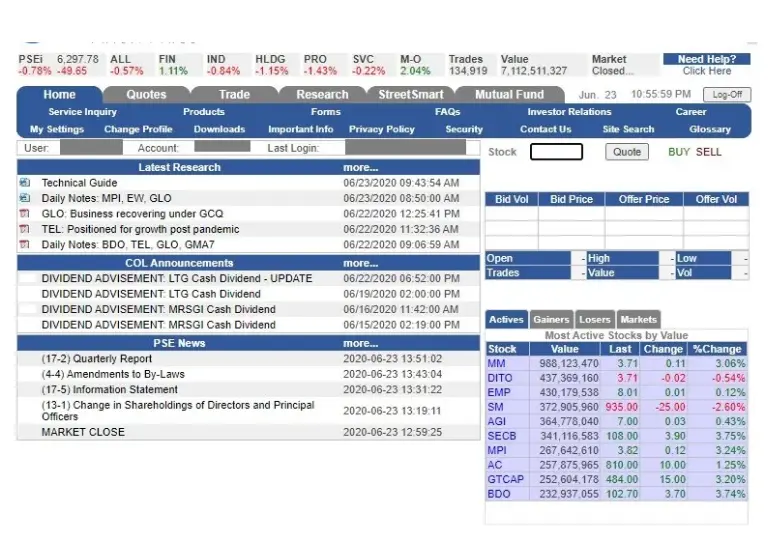

The following screen will appear once you login to your account.

Quotes, Trade, and Research are the main tabs to note.

In the Quotes section of the menu, you have the option to check out specific stock information and put it on your watch list. The Trade button allows you to view your portfolio, buy and sell stocks, and monitor your trading history. COLFinancial analysts provide some insights and analysis regarding company-specific information and general market trends when it comes to Research.

Learn about the interface by exploring and tinkering.

What is the procedure for buying and selling stocks?

Your research has been thorough. What is the process for buying shares? The steps are as follows:

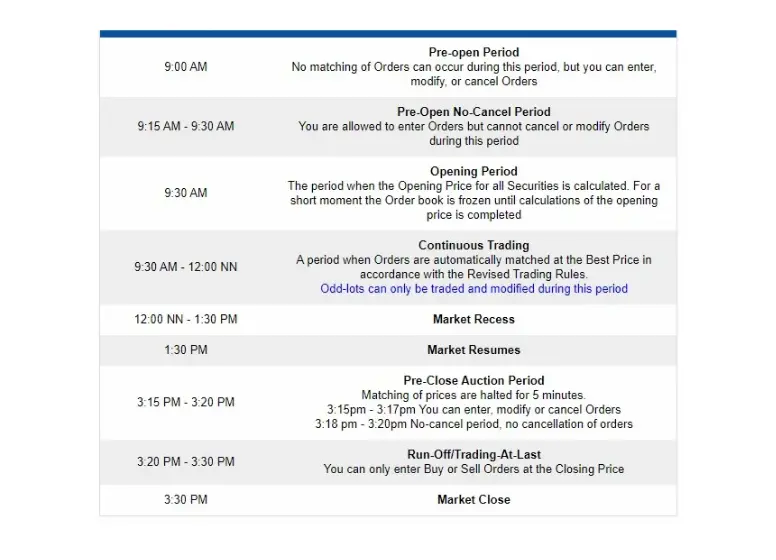

In order to buy during trading hours, you need to do so first. There are certain hours during the week when you can trade. A schedule can be found here:

Make sure your funds have been credited to your portfolio by clicking Trade > Portfolio.

In order to buy shares, you must obtain their price by clicking the Quotes tab and entering their stock code.

An example of a quote is shown below. Buyers are those who bid, while sellers are those who ask.

According to the first row of the Bid column, 14 buyers are bidding at 1.99. There are 28 sellers bidding at 2.00. There is no such thing as a perfect price for buyers, and no such thing as an ideal price for sellers.

As a fourth option, place your purchase price as close as possible to the lowest offer price. The Trade tab allows you to enter orders by clicking “Enter Order”. Then enter your password and order details. A post will be sent to you once your order has been processed.

Your shares will be visible in Trade > Portfolio once your order has been fulfilled. You will need to post a sell order instead of a buy order if you wish to sell your shares.

FAQs

Can I sell and buy mutual funds at COLFinancial?

Can I replenish my account with additional funds?

How do I withdraw money from my account?

Are there any surefire ways to earn money through stock investments?

The key to becoming a better investor is to remove the emotional component from investing.

Can I use Gcash for COL FINANCIAL?

How Filipinos can invest in the stock market through COL FINANCIAL?

Investors of all ages, income levels, and experience levels can take advantage of the COL Easy Investment Program, allowing them to invest in the stock market more easily. By attending a COL investor seminar, you can gain a deeper understanding of stock market investing.

Conclusion

Following some stock trading basics, we talked about setting up a COLFinancial account, funding it with GCash, and buying your first stocks.

It is recommended that you do good research before investing in stocks since they are generally volatile investments. Moreover, if you do not day trade stocks, you are better off buying and holding them for a long time.