There is a growing trend towards going cashless and using digital payments. For purposes like online shopping, bills payment, bank transfers, investments, and more, users increasingly turn to e-wallets such as GCash , which makes payments the easiest they’ve ever been.

In addition to its benefits, increased digitization poses several security risks. It is as possible to fall victim to modern-day scams as it is to use e-wallets. It is important for you to be aware of the risks associated with your GCash account so that you can avoid fraud when protecting your hard-earned money.

The guide ahead is designed to assist active GCash users in protecting their funds with their personal cybersecurity efforts.

Seven Practical Ways to Prevent Becoming a Victim of GCash Scams

A preventive approach is better than a reactive approach when it comes to account protection. A scam report can be filed to retrieve stolen funds, but preventing getting scammed in the first place takes a lot less effort. You can avoid being scammed by fraudsters by following these steps.

Avoid clicking on suspicious links

If a fraudster sends you an SMS message claiming that you have won a GCash raffle, for example, the message will ask you to click on a link to claim your prize. In addition to granting them access to your funds, this will also allow them to steal your identity as well.

Please be advised that official announcements from GCash will never be made by personal telephone numbers. In addition, verified links should be directed to the app rather than a website. GCash SMSes that look suspicious should be blocked from your phone as soon as possible.

Protect MPINs, OTPs, and CVV

If you would like to access your GCash account, you will need your mobile personal identification number (MPIN) and a one-time password (OTP) in order to do so. Do not share either of these two with anyone else.

It is even possible for scammers to request the CVV number on your bank card in some cases. It is important to note that these numbers should not be shared with anyone. It is also important to remember that GCash will never ask for these details outside the app.

Review the seller before paying

It’s no secret that e-commerce is on the rise-and that is what criminals are exploiting. Scammers now target online stores.

Verify customer reviews and ratings to determine which shops are legitimate. Most likely, the shop is a scam if there are mostly complaints. Make a report to the hosting website to flag and then shut down the store to prevent others from being victimized.

Make donations through official channels

It is common for fraudsters to use donation channels during crises and calamities to claim financial aid. Donate only through trusted and transparent channels, such as GCash, to ensure your contributions reach their intended recipients.

Account security checkups

To avoid scams, you should regularly secure your account by performing security sweeps. You can update the security of your account by changing your MPIN on a regular basis. In addition, you can enable GCash’s biometric login feature to ensure that only you have access to your account.

You should never sell GCash

Fraudsters have bought verified GCash accounts from users unknowingly. The unfortunate thing about these cases is that they do not understand it’s possible, too, for their accounts to be used as fake identities to commit crimes. Never sell or give anyone access to your account – don’t be an accessory to a crime.

GCash can transfer your services to your new number if your phone is lost or stolen.

Hacked accounts should be ignored

In addition to stealing from you, hackers can steal from your loved ones’ profiles as well. When scammers hack an account, they often use this tactic.

You should always call your friend or family member to verify if the message they sent you is legitimate if a scammer sends you a message posing as a friend or relative. In addition to visiting your friend or family in person, you could also arrange to meet them in person. There is a good chance that scammers have hacked your loved ones’ Facebook and/or LinkedIn pages if they reject your request, or if they are unaware that you have sent them a request.

How to Report a GCash Scam

Despite your caution, scammers can still find other ways of gaining access to your account even after you have taken precautions. Reporting the incident as soon as possible is the best course of action in this case.

GCash scams can be reported by submitting a ticket through the GCash Help Center. Following are the steps simply enter your email address, full name as registered with GCash, and mobile number as registered with GCash.

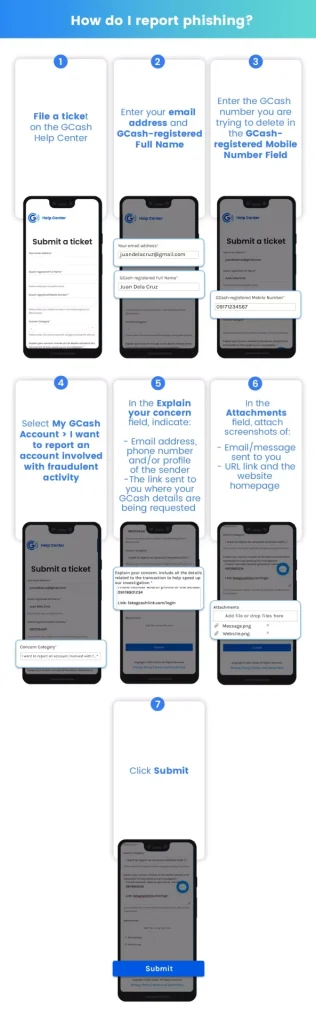

Phishing

1. Select “My GCash Account” from the Concern Category. Next, tap “I want to report an account involved with fraudulent activity.”

2. Describe your concern under “Explain your concern” as follows:

- Contact information for the sender, including his/her email address and/or phone number

- A link was sent asking for your GCash information

3. Provide screenshots, including the website URL, of the fraudulent message.

4. Tap on the “Submit” button. A live agent will get in touch with you via email within 24 hours. GCash’s virtual assistant, Gigi, can assist you with your ticket in the GCash Help Center.

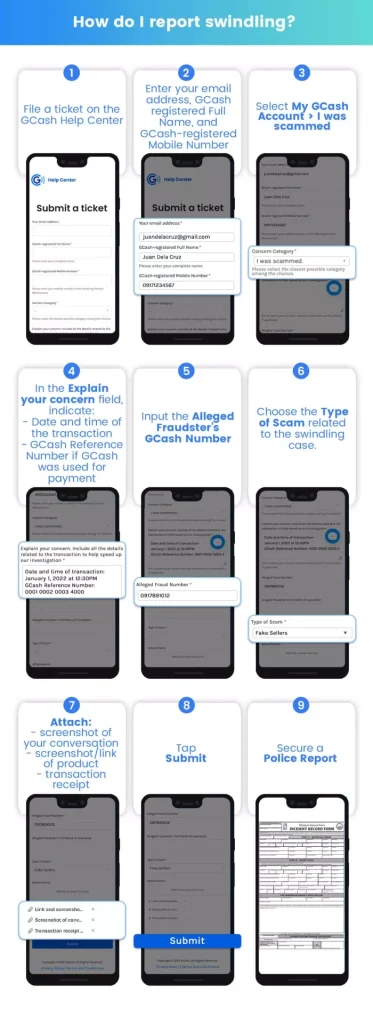

Swindling

1. Choose “My GCash Account” from the Concern Category, and then tap “I was scammedChoose “My GCash Account” from the Concern Category, and then tap “I was scammed.”

2. Include the following information under “Explain your concern”:

- Time and date of transaction

- If paying with GCash, please provide the reference number

3. Include the Alleged Fraud Number and the Alleged Fraud Name, if available.

4. State what type of scam it is.

5. You will need to attach screenshots of the following:

- Fraudster’s conversation

- Promotion of a product

- Recipients of transactions

6. Tap on “Submit”.

7. Get a report from your local police station specifying the wallet’s name and the GCash wallet’s address. GCash will provide instructions on how to submit your police report.

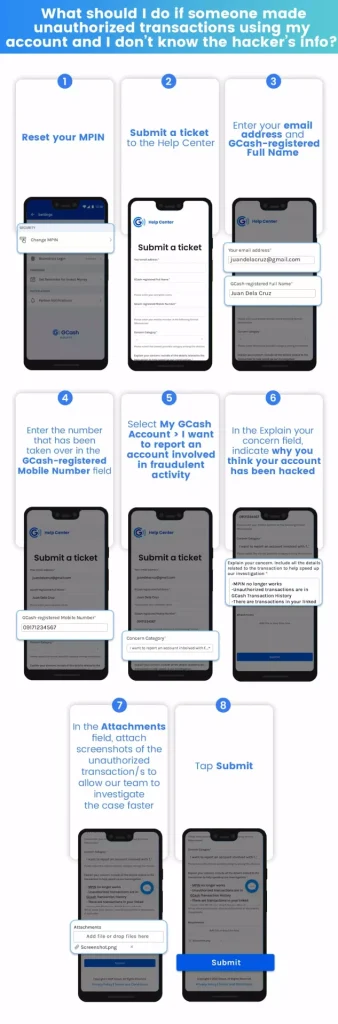

The taking over of an account

GCash Account Takeovers usually exhibit three signs:

- You no longer have access to your MPIN

- GCash Transaction History shows unauthorized transactions

- Your GCash account has been compromised by unauthorized transactions

If you are still able to access your account, reset your MPIN first. If the unauthorized transactions involve a card or cards, submit a ticket within 15 days of the transaction. Depending on whether you know anything about the hacker, here are the remaining steps:

Without knowing the hacker’s information:

- Select “My GCash Account” in the ” Concern Category” and then tap “ I want to report an account that has been involved in fraudulent activity.”

- The details of the takeover should be indicated under ” Explain your concern “.

- Take screenshots of the transactions that were unauthorized.

- Click on “Submit.”

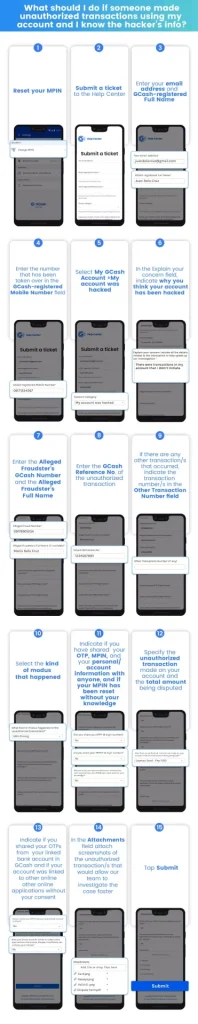

In case you have the hacker’s information:

- Choose “My GCash Account” under the “ Concern Category,” then select “My account was hacked.”

- Indicate the details of the takeover under “Explain your concern.”.

- If available, enter the “Alleged Fraud Number and Name.”

- A GCash Reference Number must be entered to identify the unauthorized transaction. Those who have lost access to their accounts may want to check their SMS for this information.

- Please indicate the reference numbers of any other transactions under “ Other Transaction Number.”

- Click on “Kind of modus.”

- You should indicate whether you shared your OTP, MPIN, or other account information and whether your MPIN was re-set without your knowledge.

- Include the total disputed amount as well as details about the unauthorized transaction.

- Please confirm whether you have shared any One-Time Passwords (OTPs) related to your bank accounts connected to GCash, and also inform if your account has been linked to other online applications without your authorization.

- Please provide screenshots of the transactions that were made without your authorization.

- Tap on “Submit.”

FAQs:

How can I report an online scam in the Philippines?

Is it possible to receive a refund from GCash if scammed?

Is it safe to share my GCash MPIN or OTP with anyone?

How can I ensure the legitimacy of an online store or seller on GCash?

What steps can I take to secure my GCash account?

What steps should I take to retrieve money lost to a scammer in the Philippines?

What should I do if my account shows unauthorized transactions?

Can I sell or give access to my GCash account to someone else?

Conclusion: Ensure the Security of Your Funds with GCash

The comprehensive guide on avoiding and reporting GCash scams serves as an essential resource for users navigating the digital payment landscape. With the increasing reliance on e-wallets like GCash for various transactions, including online shopping, bill payments, and bank transfers, the risk of digital scams has escalated.

This guide emphasizes the importance of being vigilant and adopting proactive measures to safeguard one’s finances. It reinforces the principle that prevention is better than cure, especially in the context of digital fraud. By educating users on practical steps like avoiding suspicious links, protecting sensitive information like MPINs, OTPs, and CVVs, and conducting due diligence before transactions, the guide empowers GCash users to take control of their financial security. Additionally, it underscores the responsibility of users to remain alert and report any suspicious activities, thereby contributing to a safer digital transaction environment.