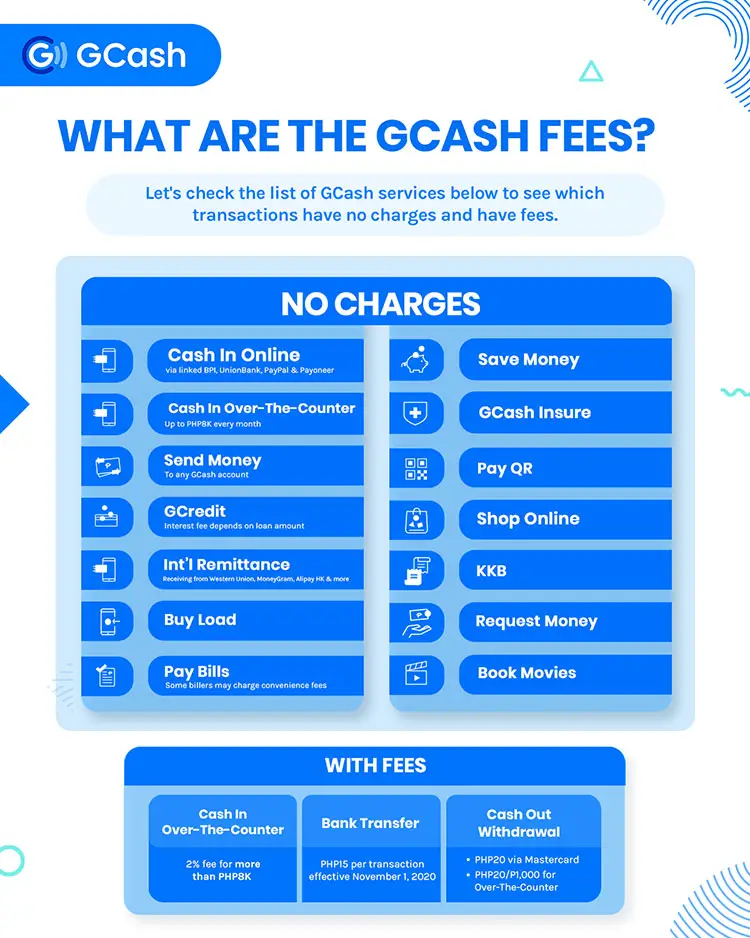

If you use GCash, do you want to know how much the various GCash fees and service charges cost? Here’s where you’ll find what you need. To help you understand the additional charges associated with cashing in, cashing out, or sending money using GCash, I’m providing you with a complete and updated list of GCash fees.

It offers the convenience of sending money, paying bills, and shopping online through GCash. Your smartphone can be used to pay with GCash rather than carrying wads of cash. In spite of GCash’s ease of use, every user should be aware that there are fees and charges associated with it.

You can transfer funds to another GCash user for free using GCash. Despite this. Since November 1, 2020, withdrawing money to banks via InstaPay incurs a fee of ₱15 per transaction.

There are definitely many users who were surprised by the recent increase in GCash fees, especially when transferring money via InstaPay. To avoid paying additional fees, some GCash users are looking for alternatives to avoid shouldering the fees.

If you plan to use GCash, you might want to find out how much it costs to send and receive money. By doing so, you will know whether or not the GCash fee is worth it.

GCash Fees: Cash In

Here are GCash’s fees when adding money to your wallet (that is, when cashing in your account):

| Description | Fee |

| Using online or mobile banking, cash in | Free to ₱50 |

| GCash app cash in from linked BPI bank account | ₱5 (effective October 2, 2023) |

| In the GCash app, you can cash in from your UnionBank account | Free (₱5 fee to take effect on November 2, 2023) |

| Cash in from a remittance partner (e.g. Western Union) into the GCash app | Free |

| With PayPal, you can cash in | Free |

| You can cash in from over-the-counter outlets up to $8,000 per month | 2% of cash-in amount |

| Over-the-counter outlets with free cash-ins under 8,000 per month | Free |

Cash-in transactions made at over-the-counter outlets like Palawan Pawnshop, Cebuana Lhuillier, and Bayad Center are free as long as they do not exceed the monthly cash-in limit of ₱8,000. The charge will be deducted directly from the overall cash-in amount.

You will need to pay GCash cash in fees depending on the bank you are using. In accordance with each of partner banks, these are the GCash cash in fees:

| Description | Fees |

| From DBP to GUCash | ₱10 |

| From EastWest Bank to GCash | ₱25 |

| From Landbank to GCash | ₱15 |

| From Maybank to GCash | ₱10 |

| From Metrobank to GCash | ₱25 |

| From PBCOM to GCash | ₱20 |

| From PNB to GCash | ₱20 |

| From PSBank to GCash | ₱15 |

| From RCBC to GCash | ₱25 |

| From Robinsons Bank to GCash | ₱10 |

| From Security Bank to GCash | ₱25 |

| From UCPB to GCash | ₱25 |

| From UnionBank to GCash | Free for transfers below ₱1,000. ₱10 fee for transfers above ₱1,000. |

| From AUB to GCash | ₱8 |

| From Bank of Commerce to GCash | ₱15 |

| From BDO to GCash | ₱25 |

| From BPI to GCash | ₱25 |

| From Chinabank to GCash | ₱10 to ₱15 |

| From CIMB to GCash | Free |

GCash allows you to add money instantly on the GCash app and avoid transaction fees when you cash in from BPI or UnionBank accounts. In contrast, GCash will charge a 5 percent fee on cash in transactions for BPI and UnionBank accounts linked to GCash.

Learn how to cash out to GCash, add money via over-the-counter outlets, and link your bank account in this article Netwyman Blogs.

GCash Fees : Cash Out

Withdrawing money from an ATM or over-the-counter outlet will incur the following fees:

| Description | Fee |

| Using over-the-counter cashout outlets | 2% of cash-out amount |

| Withdrawal from a bank account or cash out | ₱15 |

| Withdrawal from GCash MasterCard ATMs | ₱10 to ₱18 |

| Withdrawals from GCash MasterCard ATMs outside the Philippines | ₱150 |

GCash offers over-the-counter partners such as Palawan Pawnshop, Villarica, and Bayad Center for the withdrawal of money.

GCash Fees: Send Money

You will incur the following fees when sending money via bank transfer, or transferring funds to another GCash user:

| Description | Fee |

| Transfer funds using Express Send | Free |

| Transfer funds via Send with a Clip | Free |

| Ang Pao money transfer | Free |

| Transfer money via bank transfer | ₱15 |

| Use Maya and other e-wallets to send money | ₱15 |

| KKB or Request money | Free |

| Use GCash Padala to send money | ₱5 or 15% |

A transaction fee of ₱15 is applied to GCash-to-bank transfers via InstaPay. (continue)

Fees for GCash Bill Payments

The fee for paying bills with GCash depends on the biller. Actual charges per biller can be found in the GCash app.

| Description | Fee |

| Fixed-fee payments to billers | Free to ₱60 |

| Using percentage-based fees to pay billers | 2% of bill amount |

Fees associated with GCredit

You can see the list of GCredit interest and penalty fees below if you’re a borrower or considering a loan:

| Description | Fee |

| Within the billing period, interest is charged | 3% to 5% |

| 1-30 day late payment penalty for loans | ₱200 |

| Late payment penalty 31-60 days after due date | ₱500 |

| 61-90 day late fee for unpaid loans | ₱900 |

| Unpaid loans 90 days or more after due | ₱1,500 |

Fees associated with the GCash MasterCard

For purchases of cards, balance inquiries, dormancy, and dormancy fees, please see the following table. GCash MasterCard ATM debit cards can be obtained by reading this article.

| Description | Fee |

| ATM balance inquiry | ₱3 |

| ATM balance inquiry outside the Philippines | ₱50 |

| Fees for dormancy | ₱50 |

| Offline purchase of GCash MasterCard | ₱150 |

| Online purchase of GCash MasterCard (delivery fee included) | ₱215 |

FAQs:

Is there a way to withdraw money without paying fees from GCash?

Does GCash impose charges?

Can I transfer 10,000 pesos using GCash?

Conclusion

In 2024, GCash users should be aware of various fees associated with cashing in, cashing out, and sending money. These fees include cash-in charges for certain partner banks, cash-out fees, transfer fees, and fees for bill payments. Additionally, GCredit and GCash MasterCard transactions also have associated fees. It’s important for users to understand these fees to manage their finances effectively while using GCash.

Call GCash hotline 2882 or email [email protected] if you have any questions or concerns about GCash.