Mobile wallets like GCash provide a convenient means to pay bills, send money, or make purchases using your smartphone. Although using GCash for cashless transactions and phone-based buying is straightforward, some Filipinos encounter challenges when it comes to loading their GCash wallet. So, how can you add funds to your GCash wallet or perform a GCash cash-in?

For new or first-time GCash users, especially those less familiar with online payment platforms and electronic wallets, loading their GCash wallet may appear daunting. Thankfully, GCash has simplified the process of adding money to your wallet. This can be done not only through online methods like Internet banking and credit cards but also through over-the-counter options such as remittance centers and convenience stores. This inclusivity ensures that even individuals without bank accounts can easily utilize GCash.

Recognizing that many GCash users face difficulties when it comes to adding funds to their mobile wallets, we have prepared a comprehensive guide on how to perform GCash cash-in transactions. We will provide you with step-by-step instructions for cashing in to your GCash wallet and also suggest the most convenient places to load your GCash wallet.

Upon reading this article, you will discover how quick and uncomplicated it is to top up your GCash wallet, especially if you possess an online banking account or a credit card. If you don’t have access to online banking or cards, fret not, as there are still numerous avenues available for loading your GCash account through over-the-counter payment facilities.

Related Article: How to Buy Steam Wallet Funds Using GCash

How To Load GCash: What Are the Different Ways To Fund Your Mobile Wallet?

GCash wallets can be topped up in two ways.

GCash app users can cash in through mobile money transfers, while GCash Partner Outlet customers can choose to cash in over the counter.

1. How to Load GCash via the GCash app

GCash wallets can be loaded at any time and anywhere as long as you have access to an online bank account, Payoneer, or PayPal. The instructions below will show you how to convert these channels’ money into GCash.

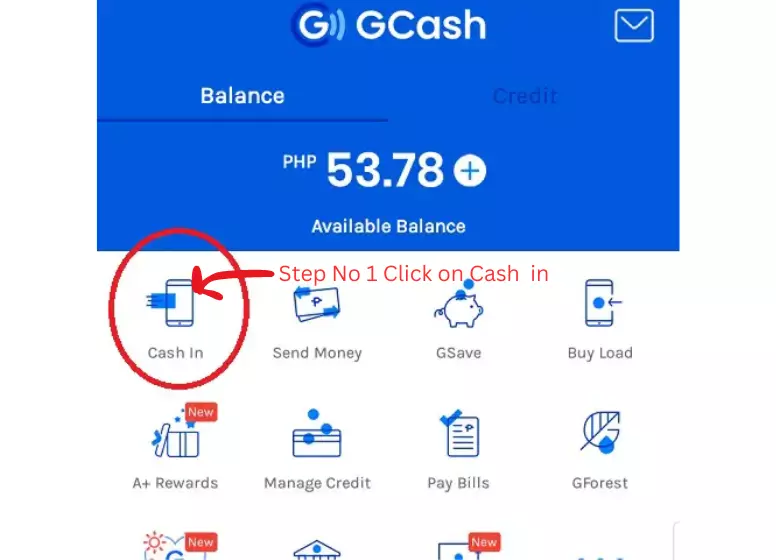

Step 1: Log in to your GCash app and click the “Cash-In” option

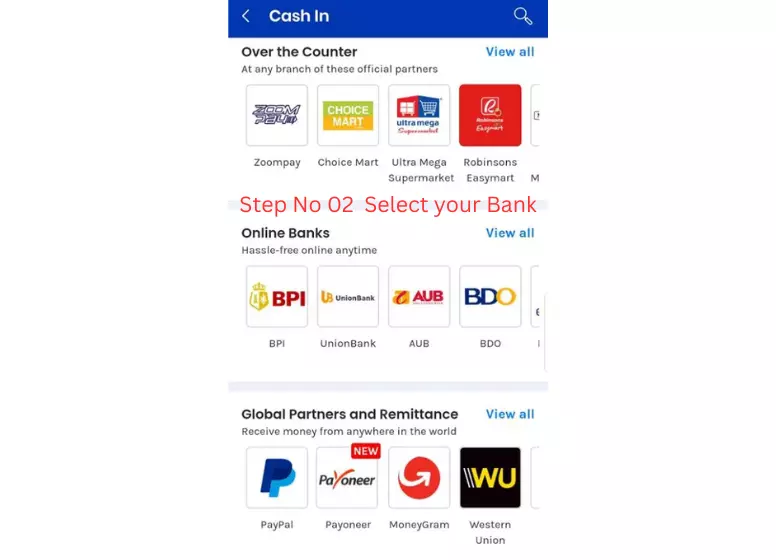

Step 2: Choose the online cash-in method you prefer

In addition to bank accounts enrolled in online banking, PayPal and Payoneer balances, and remittances sent by family and friends, you can fund your GCash account through the mobile app.

If you would like to load GCash quickly on your mobile device, you have a variety of options to choose from.

i. Online Banking

- BPI

- UnionBank

- BDO (Related: How to Pay Your BDO Credit Card Bills Using GCash)

- RCBC

- EastWest Bank

- LandBank

- PNB

- AUB

- Maybank

- Metrobank(Related:How to Send Money from Metrobank to GCash 2023?)

- PBCOM

- PSBank

- UCPB

- Security Bank(Related: How to Transfer Money from Security Bank to GCash?)

ii. Partners in remittances.

- MoneyGram

- Western Union

iii. Partners from outside the United States

- PayPal

- Payoneer

iv. Mobile payments and international remittances

- AliPayHK

- Azimo

- bWallet

- Cross Remittance

- Denarii Cash

- EMQ Send

- GmoneyTrans

- Instant Cash

- Payit

- Remitly

- Rocket Remit

- SABB

- SBI Remit

- Siammali Remittance

- Singtel Dash

- Skrill

- Telcoin

- Transfer Galaxy

- Wall Street Exchange

- Warba Bank

- WireBarley

Step 3: Complete the cash-in process by providing the requested information

No matter which option you choose, GCash will be there to assist you. Following the instructions once you have tapped the mobile facility of your choice, you will be guided through the process.

The online banking process requires you to log in to your online banking account, enter your 6-digit PIN, or provide your GCash phone number and 11-digit account number.

Remittances will require you to provide the money transfer control number (MTCN) or transaction reference from the sender to fund your GCash wallet.

Your mobile number associated with online banking and GCash will receive a confirmation message once the transaction is approved.

2. How To Purchase GCash From GCash Partner Retailers

There are thousands of GCash partner outlets across the country where you can cash in in addition to using the app. GCash can be converted into cash over the counter at these outlets.

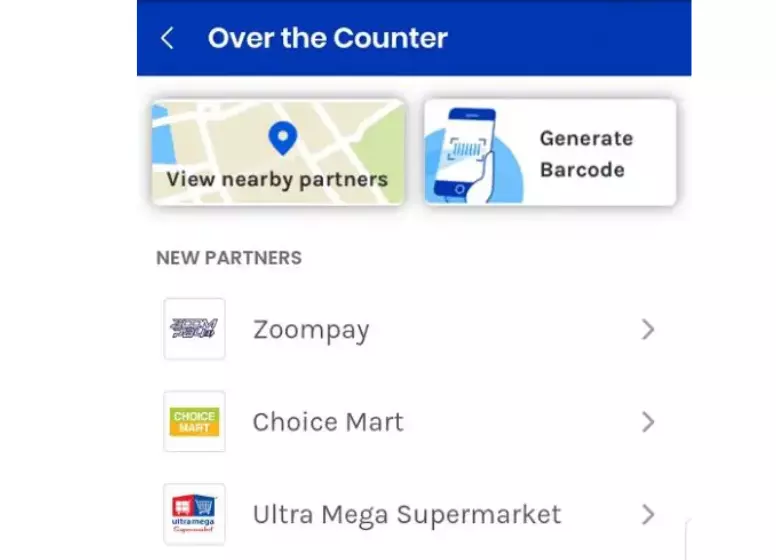

Log in to the GCash app and tap “Cash In” under the first tab, “Over the Counter,” to see the list of most popular and accessible GCash Partner Outlets in the Philippines.

GCash Partner Outlets where you can cash out your money over the counter are listed below for your convenience:

a. Cashing in at the machine

- TouchPay

- eTap

- Pay & Go

b. Grocery store

- Choice Mart

- Ultra Mega Supermarket

- Robinsons Easymart

- The Marketplace

- Robinsons Supermarket

- Puregold

- Shopwise

- Ever Supermarket

- SM Group of Supermarkets

- Waltermart

- Gaisano Grand

- All Day Supermarket

- Easy Day Shop

c. Supermarkets

- Robinsons

- SM

d. Lending shop

- Villarica

- Tambunting

- RD Pawnshop

- Palawan

- Jaro Pawnshop

- CVM Pawnshop

- Cebuana

e. Facilities for making payments

- Globe Store

- Bayad Center

- ECPay

- DA5

- iBayad

- Panao Express

- Expresspay

- PERA Hub

- TrueMoney

- Posible

- VIP Payments Center

f. Convenience stores, garages, and petrol stations

- 7-Eleven

- Ministop

- AlfaMart

- Puremart

- Family Mart

- Shell SELECT

g. Transportation

- LBC Express

You can load GCash over the counter by tapping your preferred outlet and completing the transaction in a few easy steps.

Most of these outlets will require your 11-digit GCash mobile number, along with your GCash account number.

Go back to the main article: How to Register Globe Sim Card in the Philippines?

Frequently Asked Questions

1. How much can you cash-in to your GCash wallet?

When we speak about GCash “cash-in“, we mean loading or funding our accounts. This means you can finally use your regular cash online and offline once you convert it into GCash.

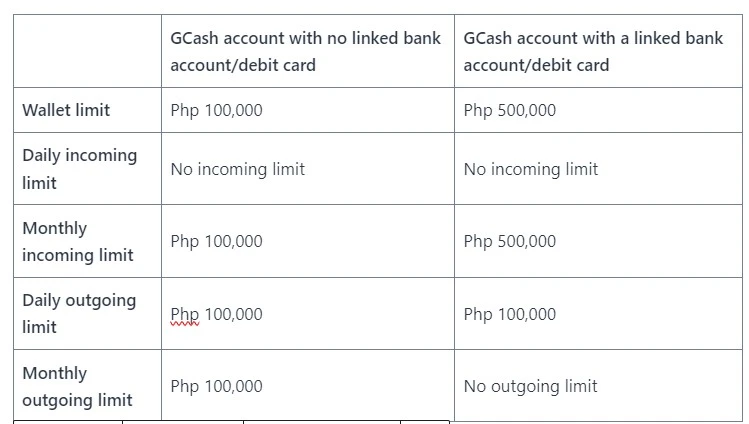

GCash users with fully verified accounts can now cash in as much as Php 500,000 a month by linking any of the following to their GCash wallets:

GCash wallet can be linked with any of these via the mobile app. Tap My Linked Accounts and then select BPI, Unionbank, or My Bank Cards. Follow the instructions and provide all the required information.

Your wallet limit should be increased via text message.

GCash wallet limits will not be increased if you link these to your wallet:

- GCash Mastercard

- Paypal

- American Express Virtual Pay card

GCash wallet limits increase as follows when linked to a bank account or debit card mentioned above:

2. Is there a transaction fee every time you cash-in?

To fund your GCash wallet, you must use a cash-in channel.

GCash wallet holders can cash in for free if they use their BPI, UnionBank, or PayPal accounts. Instapay also accepts withdrawals from other banks with service fees, though they vary by bank.

The convenience fee for loading GCash wallets via bank card (Mastercard/Visa) will increase to 2.58% as of July 6, 2020. Payment partners for the mobile app directly charge the app’s users.

In other words, if you use Cash In via Bank Card to load your wallet with Php 100, for example, your source account will deduct Php 102.58 from your wallet balance.

Likewise, Gcash partner outlets accept over-the-counter cash-in transactions for up to Php 8,000 per month. If you reach this limit throughout your subsequent transactions, you’ll be charged a 2% service fee.

3. How can I load GCash via BPI?

GCash accounts that are both fully verified and associated with an active BPI Online account will be able to cash in for free. Follow these steps to load GCash with BPI:

- Linking your BPI account to your GCash account requires full verification of your GCash account.

- You need to make sure both your GCash and BPI Online accounts are fully verified before linking them. Launch the GCash app on your mobile device to get started.

- On the upper left of the screen, click Profile and then select My Linked Accounts.

- To link your BPI account to your GCash wallet, select BPI and enter your BPI username and password.

- GCash can now be loaded via BPI after the two accounts have been linked successfully. Simply select Cash In from the GCash dashboard to begin.

- Choose BPI from the list of online banks.

- The amount you wish to cash in would need to be entered along with the bank account information you wish to cash out. Before proceeding with the transaction, click Next and review the details. For BPI users, the daily cash-in limit for GCash is Php 50,000 since BPI only allows fund transfers of Php 50,000 per day. New GCash users, however, will only be allowed Php 15,000 per day in cash-ins for the first 30 days. It takes as little as two weeks for your daily cash-in limit to increase to Php 50,000 when you keep using GCash.

- The BPI will send you a code for authentication to your mobile number registered with the BPI. Click Submit once you have entered the one-time password.

- Your screen will display a confirmation message. Your successful transfer will be confirmed by text and email. Real-time money should be deposited into your account.

4. How can I load GCash via UnionBank?

UnionBank Peso savings and checking accounts are also available to verified GCash users. Cash-in service is available only after the bank account is linked to GCash.

Here are the steps you need to follow to cash in using your UnionBank account:

- GCash accounts that have been verified should be linked to UnionBank accounts if you haven’t already done so. Click Profile at the bottom of your GCash app’s main menu once logged in.

- You can select UnionBank from the list of Linked Accounts after choosing My Linked Accounts.

- Enroll now by clicking the button.

- By entering your UnionBank username and password, you can access your UnionBank account. As an alternative, you can secure your account by answering security questions on Guest Checkout.

- The UnionBank-registered mobile number on your account will send you a One-Time Password (OTP). Click Submit after entering this password. You probably have a poor internet connection if you are not receiving OTPs because you have not updated your UnionBank mobile number.

- Choose the bank account that you would like to use. The GCash account can only be linked to one bank account at a time.

- The enrollment process will be confirmed by a confirmation page. When both accounts are successfully linked, you’ll receive a text message.

- By linking your GCash and UnionBank accounts, you will be able to start withdrawing from the latter. You can start by selecting Cash In from your GCash app.

- Select UnionBank from the Online Banking section.

- Click Next after entering the upstream you wish to cash in. The next screen will ask you to confirm the cash-in transaction.

- Check your mobile phone for a confirmation message. You should receive the credit in real time in your GCash account. In any case, wait two working days before contacting us. If two working days have passed and the money is still not credited to your account, please contact the GCash hotline.

5. How can I load GCash using BDO?

BDO does not support linking its accounts to GCash, unlike BPI and UnionBank. BDO Online Banking and Mobile Banking are required to cash in through BDO, so the process is a bit more complicated..