Can’t you imagine shopping right now and paying for your purchases later? GCash GGives allows you to purchase now and pay later without a credit card and without the hassle of applying. The GGives feature on the GCash app is super easy to use and it doesn’t cost you anything to activate.

The Philippines still rely heavily on cash in many areas. Cash is still the most common mode of payment, despite the growing popularity of credit cards, online banking, and virtual wallets. There is a possibility that this will change in the near future, as the country slowly transitions into a digital economy. Mobile wallets like GCash and online payment platforms like PayPal enable millions of Filipinos to perform cashless transactions.

By using GCash’s new GGives “buy now, pay later” feature, Filipinos will have yet another reason to use their e-wallets rather than cash when shopping. The store will accept GCash instead of cash, so you do not need to bring large amounts of cash with you. It’s amazing because anyone with GCash can use GGives, and no proof of income or application is required.

Millions of GCash users will be able to use Gives to buy now and pay later at thousands of partner stores and retailers across the country. You don’t even have to top up your GCash wallet to pay the cashier with your mobile phone. GGives allows you to pay for your purchases in easy monthly installments so you can start shopping right now.

This comprehensive guide will help you decide if GGives is right for you if you’re eager to give it a try. This tutorial will show you how to activate GCash and use it when shopping. Not yet a GCash member? For more information on how to open a GCash account, read this article.

How to Activate and Use GGives:

GGives – what is it?

By using GGives, you can shop without worry while paying in easy installments thanks to GCash’s “buy now, pay later” feature. The interest rate is as low as 0% on loans up to ₱30,000 and payments can be made in 3, 6 or 12 monthly installments or “gives.”.

User GScores are used to pre-approve GGives users, which are trust ratings based on GCash transactions. Your maximum spendable amount and credit limit increase as your GScore increases.

GGives can be used at more than 5,000 participating merchants nationwide once you activate it in GCash. Using the GCash app, you just need to scan the QR code of your partner merchant to make a payment using GGives. It is indicated on your GGives dashboard in GCash how much you are allowed to borrow and spend.

GGives vs. GCredit: What’s the Difference?

There are several differences between GGives and GCredit, both of which offer short-term loans to qualified GCash users.

A wholly owned subsidiary of GCash operator Mynt, Fuse Lending, Inc., operates GGives. On the other hand, GCredit is powered by CIMB Bank, which is a Malaysian universal bank that has its head office in Kuala Lumpur. Security and Exchange Commission (SEC) regulates both entities.

GGives is currently only available for scan-to-pay purchases at select partners, while GCredit can be used for both static QR scan-to-pay and online payments.

The credit limit offered by GGives appears to be higher than that by GCredit for the same GScore. If a GCash user has a GScore of 515, their credit limit on GGives is ₱6000, but on GCredit it is only ₱1000.

GIVES: Who Is Eligible?

The following requirements must be met in order to use GGives:

- Your GCash account must be fully verified.

- Philippine nationals between the ages of 21 and 65 are eligible to apply.

- It is important that you have a good GScore.

- Your credit record must be good and you must not have committed any fraud.

Activating GGives in GCash

You can activate your GGives in GCash by following this step-by-step guide. You must meet the eligibility requirements and have your GCash account verified before you can apply.

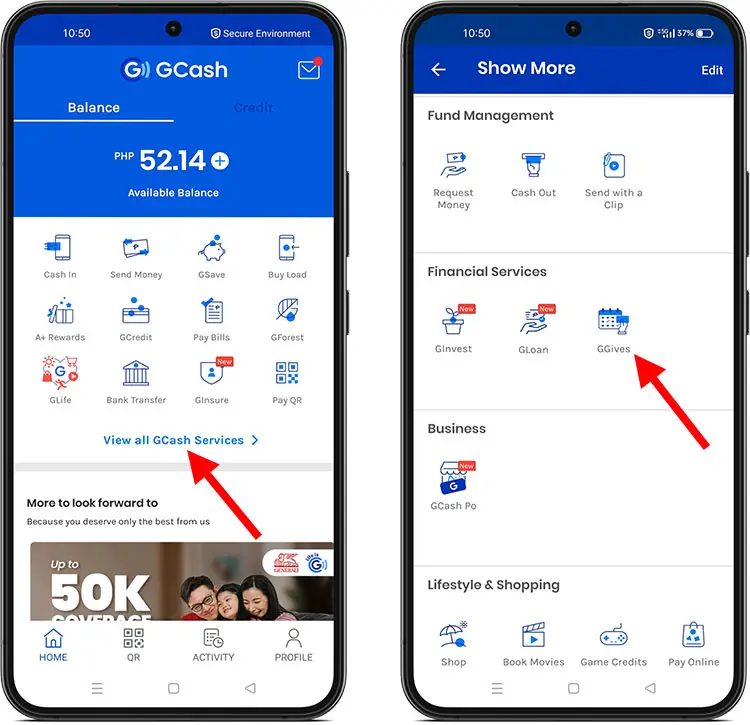

Step 1: Choose GGives in GCash

Login to GCash with your MPIN by opening the app. Under the “Financial Services” section, select “GGives” once logged in.

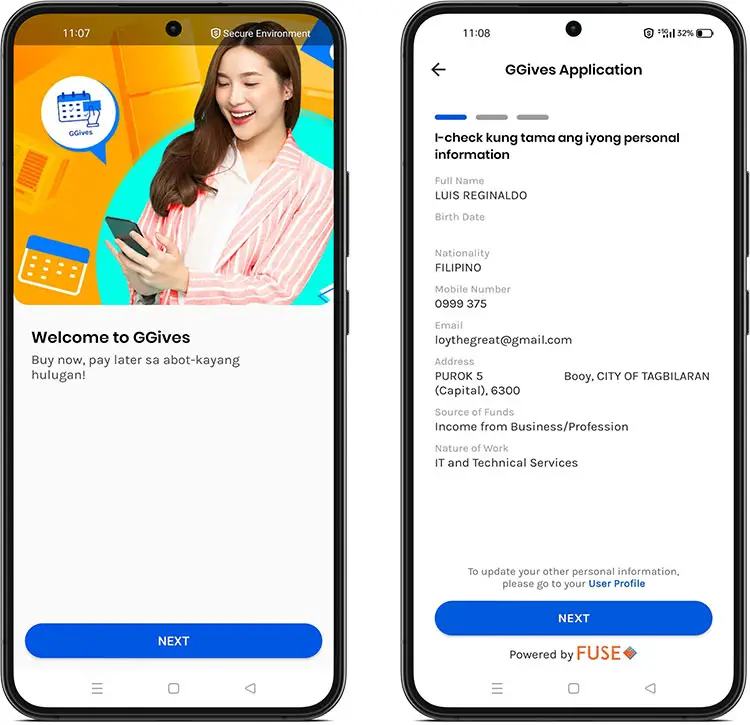

Step 2: Ensure your personal information is accurate

Tap the “NEXT” button until you reach the GGives application screen once you’re in the GGives dashboard.

Check your personal information and make sure it’s accurate, then click on “NEXT.”

Note: Before applying for GCash, you may need to update your personal information. You can update your account information by clicking “UPDATE ACCOUNT INFO“. It takes less than five minutes to update your information. Your application will be reviewed and approved by GCash within minutes in most cases, but it may take up to seven days in rare cases.

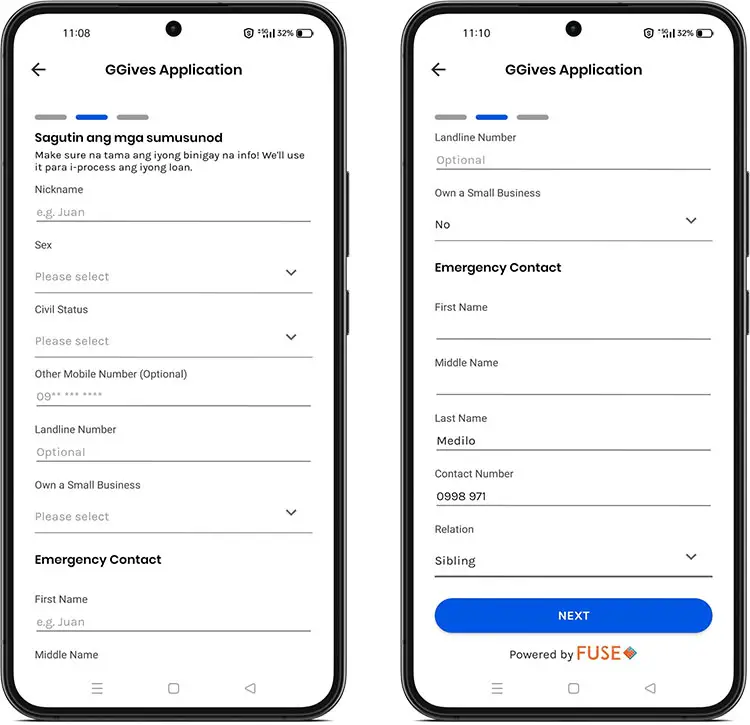

Step 3: Complete the GGives application

Next, you need to complete your application. In your application, please provide the following information:

- The nickname of a person.– Example: Robert.

- Gender – Select “Male” or “Female.”

- Status as a citizen

- (Optional) Other mobile phone number

- (Optional) Landline number

- Small Business Owner – Check “Yes” if you own a small business.

- Contact person for an emergency – In case of an emergency, this person will be contacted.

- First Name

- Last Name

- Contact Number – Specify your emergency contact’s phone number or mobile number.

- The relationship you have with your emergency contact – Choose the relationship you have with them. An example would be “sibling.”

After you’ve completed your application, click “NEXT.”.

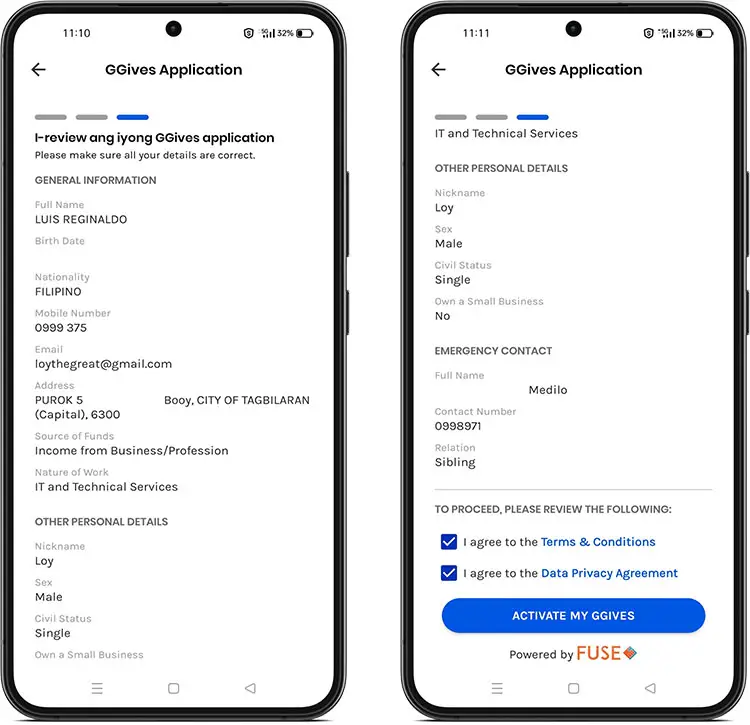

Step 4: Take a look at your application

Make sure all details in your application are accurate and correct before submitting it.

Please select both the “I accept the Terms & Conditions” and “I accept the Data Privacy Agreement.” Finally, click on the button “ACTIVATE MY GGIVES.”

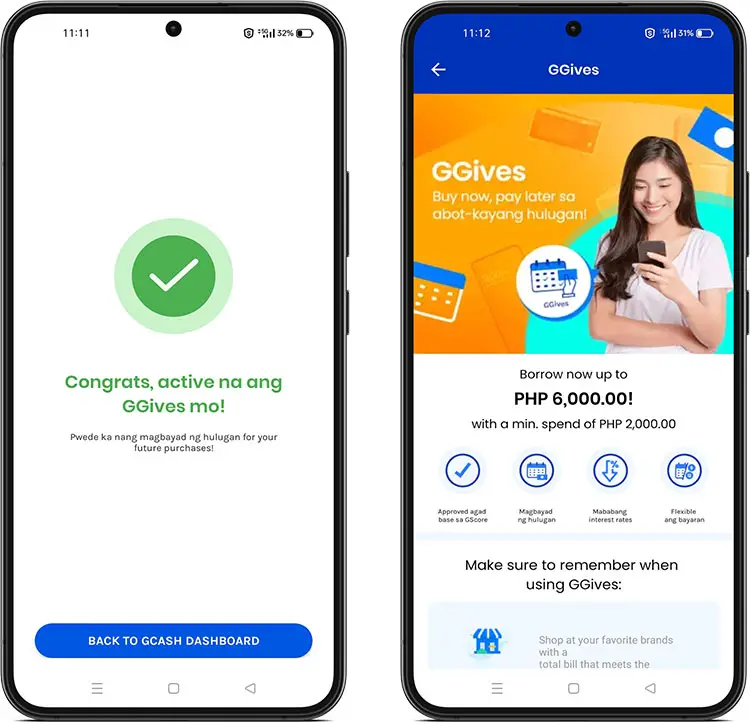

Step 5: GGives has now been activated

Greetings! Now that your account is activated, you can pay for future purchases using installment payments. Your activation will be confirmed by email and SMS.

Go to your GGives dashboard in the GCash app to view your maximum borrowing and minimum spending limits.

GGives: How to use them when you shop or dine

Over 5,000 merchants across the country offer GGives when you shop or dine. The following stores are among our partner merchants:

- Watsons

- Kenny Rogers Roasters

- LBC Express

- Nike

- Samsung

- SM Supermarket

- Robinsons Department Store

- Puregold

- Mercury Drug

To use GGives now and pay later with GCash, follow these steps:

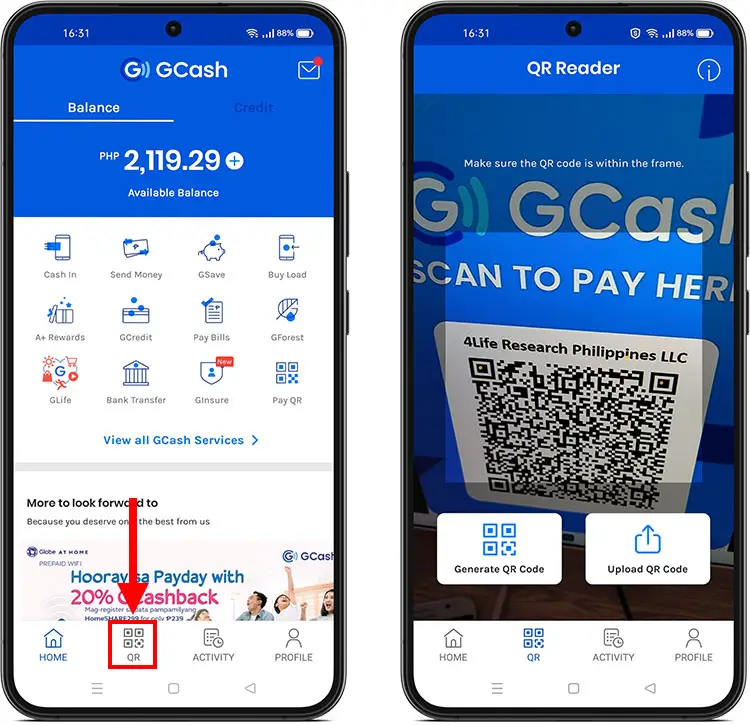

Step 1: Using GCash, scan the merchant’s QR code

Choose the “QR” tab in GCash on your mobile device as shown in the screenshot. The QR reader will be launched. Make sure that the QR code of the partner merchant is within the frame when scanning it.

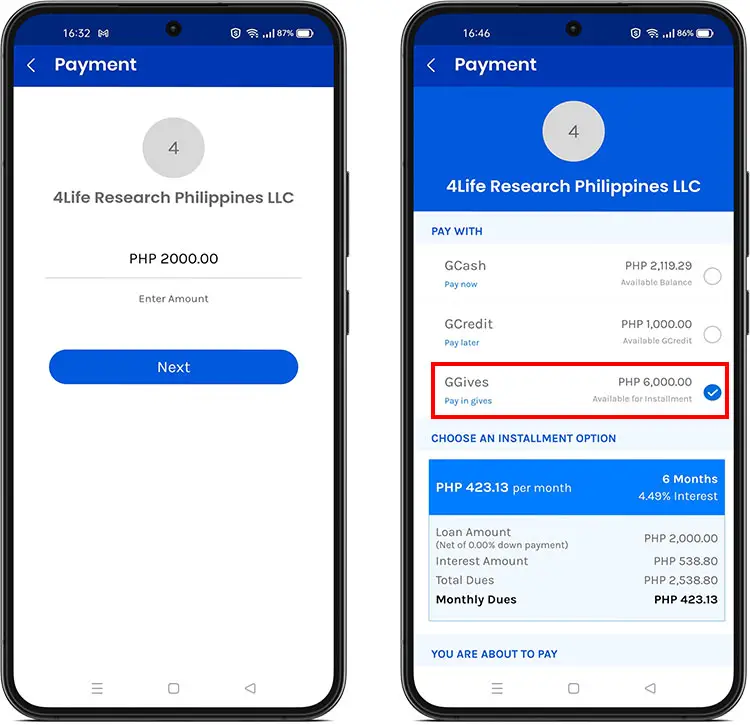

Step 2: Choose GGives as your payment method

Press “Next” when you have entered the amount to be paid. Make sure it is at least as much as your minimum spending limit, but not more than your credit limit.

The next step is to select the payment option “GGives“.

Step 3: Select an installment plan

Whether you want to pay in three months, six months, or twelve months, you have three easy installment options. Tap “NEXT” after selecting your desired monthly installment duration.

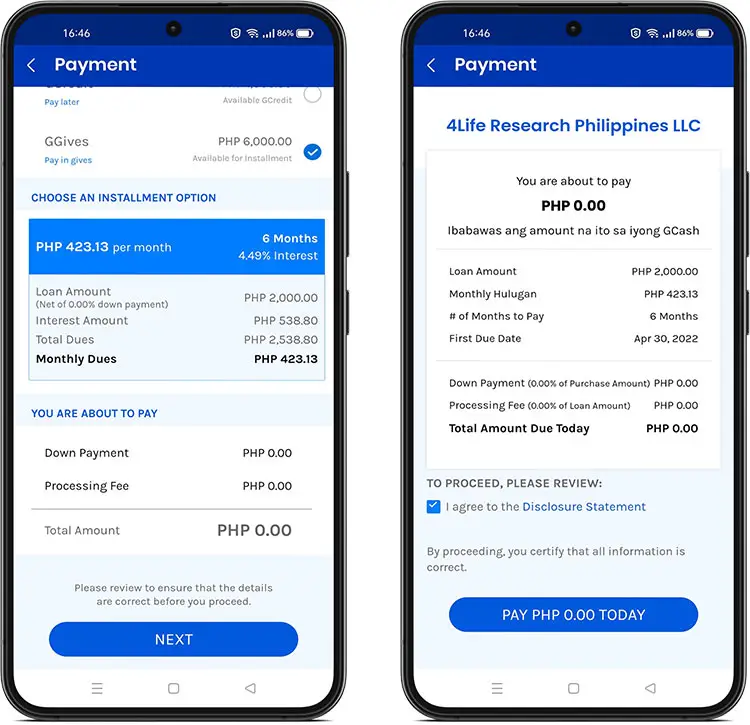

Step 4: Verify your payment and confirm it

Pay attention to the following terms as you review your payment details:

- Interest and penalties are not included in your loan amount.

- Hulugan – The amount you should pay each month.

- Payoff Period – The number of months it will take you to repay your loan.

- Pay your first monthly due or hulugan by the first due date.

As required by Republic Act 3765 (the Truth in Lending Act), please check the box for “I agree to the Disclosure Statement” and take some time to read it.

To proceed with the transaction, click “PAY PHP 0.00 TODAY” if you understand and agree with the loan terms.

Step 5: Congratulations on your purchase!

A big congratulations! Your GGives payment has been successfully processed in GCash. You can find the Disclosure Statement and Loan Payment Schedule in your email. Keeping track of your charges and payments is easy with the GCash app.

Gives information about fees and interest rates

It depends on your GScore and the loan term (number of months to pay) to determine the GGives interest rate. There is a range of interest rates from 0% to 4.99% per month. The GGives dashboard in the GCash app allows you to view your interest rate and fees.

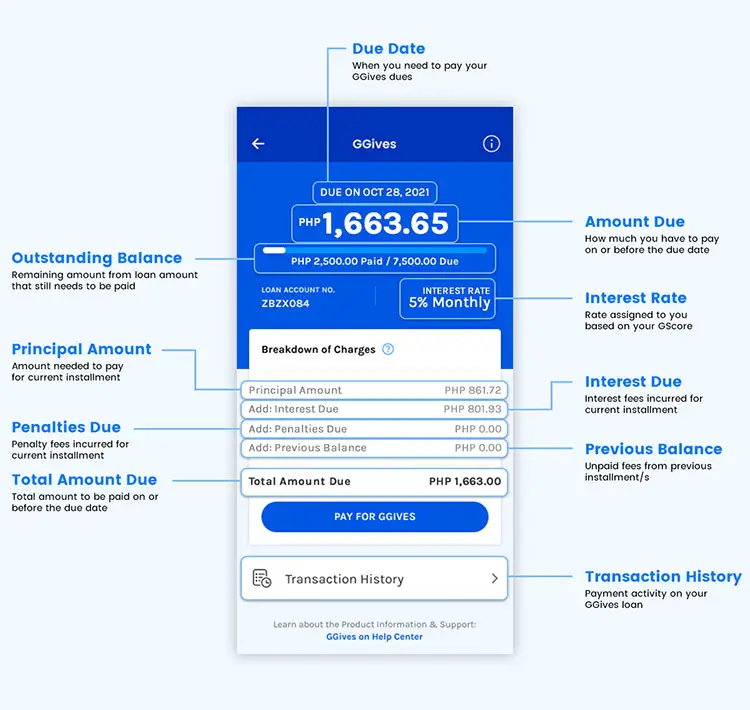

I have included a sample amortization schedule with interest rate and fees in the dashboard below:

Late payment penalties are computed according to the following formula, with a fixed penalty fee of ₱100 per due date and a variable penalty fee calculated according to the following formula:

The variable penalty fee is calculated as follows: 0.15% x the number of days past due x the outstanding principal balance

In the given scenario, let’s say you have an outstanding principal balance of ₱3,000, and your payment was due on March 15th, but you made the payment on March 20th, which is 5 days after the due date. In this case, the penalty fee is calculated as follows:

The variable penalty is determined by multiplying 0.0015 (the penalty rate) by the number of days you were late, which is 5, and the outstanding balance of ₱3,000. This results in a variable penalty of ₱22.50. Additionally, there is a fixed penalty fee of ₱100. Therefore, the total penalty fee amounts to ₱122.50.

FAQs:

Why is GGives unavailable to me?

Is it possible to make online payments through GGives?

Can I apply for multiple GGives loans simultaneously?

How can I settle my loan?

Will I receive a cashback if I repay my loan ahead of schedule?

Can GGives be used to pay bills?

Conclusion

The article provides a comprehensive guide on how to activate and use GGives, a “Buy Now, Pay Later” feature within the GCash mobile app. It highlights the convenience of making purchases without the need for a credit card and emphasizes that GGives is accessible to a wide range of users without income verification or a complex application process. The article also discusses the eligibility criteria, activation steps, and usage instructions, making it user-friendly.

In conclusion, GGives emerges as a promising tool in the Philippines’ evolving digital economy, offering consumers a flexible and accessible payment option. With its low-interest rates and various installment plans, GGives has the potential to transform the way Filipinos shop and transact, reducing the reliance on cash and promoting the adoption of mobile wallets like GCash. As the country transitions towards a cashless future, GGives serves as a noteworthy solution for those looking to shop now and pay later, bridging the gap between traditional payment methods and the digital age.