Welcome to our definitive guide on ‘Availing GInsure Bill Protect.’ In a world where financial uncertainties can loom large, safeguarding your financial stability is paramount. This blog is your key to unlocking the power of GInsure Bill Protect, a valuable resource designed to empower your financial resilience. Join us as we delve into the details, uncovering the step-by-step process that allows you to secure your financial future with confidence. It’s time to take charge of your financial security – let’s dive in!

We tend to overlook insurance these days. In general, the layperson doesn’t really appreciate insurance until he or she has experienced an insurable event (such as a family death or critical illness).

The GCash app already contains everything you need to get insurance with GInsure, as I’ve discussed before. The insurance company does not require you to fill out any forms, and all you need to do is pay for the insurance you want.

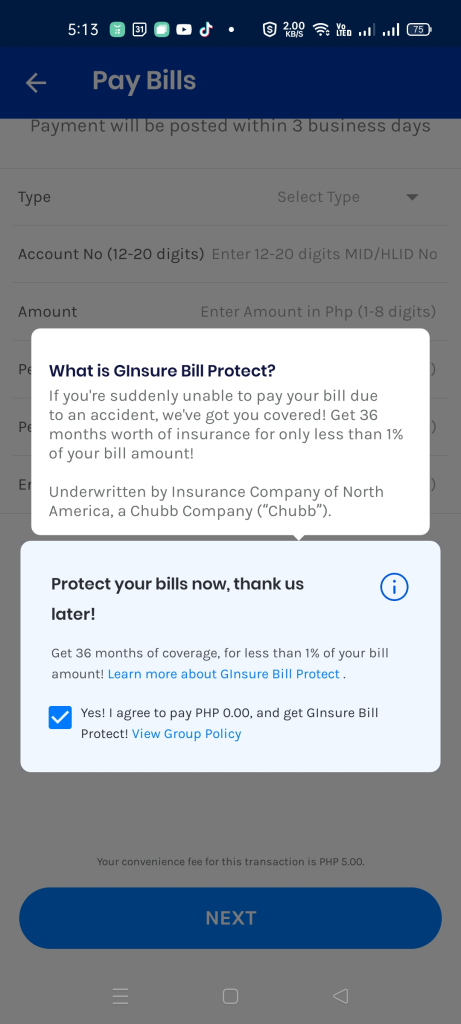

GInsure Bill Protect is the topic of this blog post. Insured people can use this to pay their bills if something happens to them, for a little bit more than what they usually pay.

What is GInsure Bill Protect?

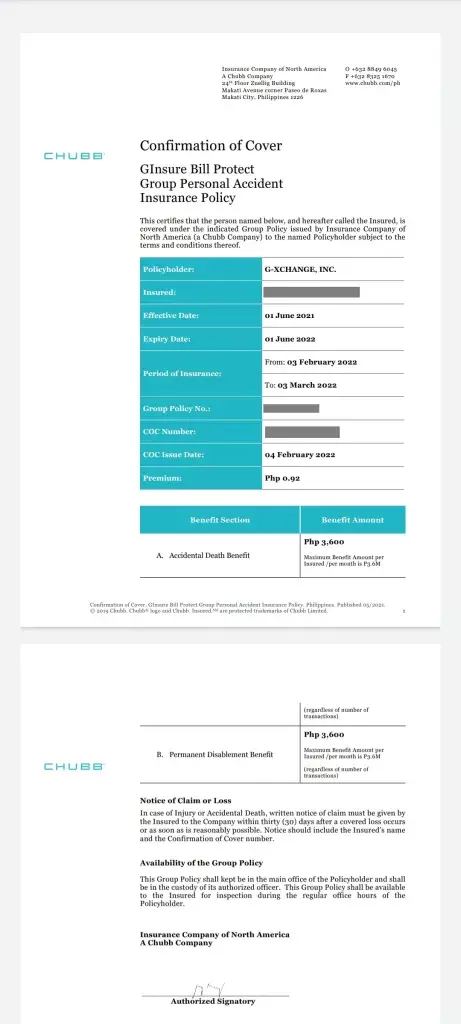

In case of permanent disability or accidental death, GInsure Bill Protect offers protection to the bill payer.

Insured users are able to settle their bills for 36 months (3 years) after payment is made.

Who Can Avail GInsure Bill Protect?

As long as you meet these requirements, you can apply for GInsure Bill Protect:

- A person between the ages of 18 and 75

- Account verified with GCash

- Citizens of the Philippines or legal residents of the Philippines

- GCash will be used to pay a biller

The person who pays the bills on behalf of the GCash-registered account is the one insured. Therefore, even if you pay a family member’s bill, you are the one who is insured, not the person on the bill.

Availing GInsure Bill Protect: How does it work?

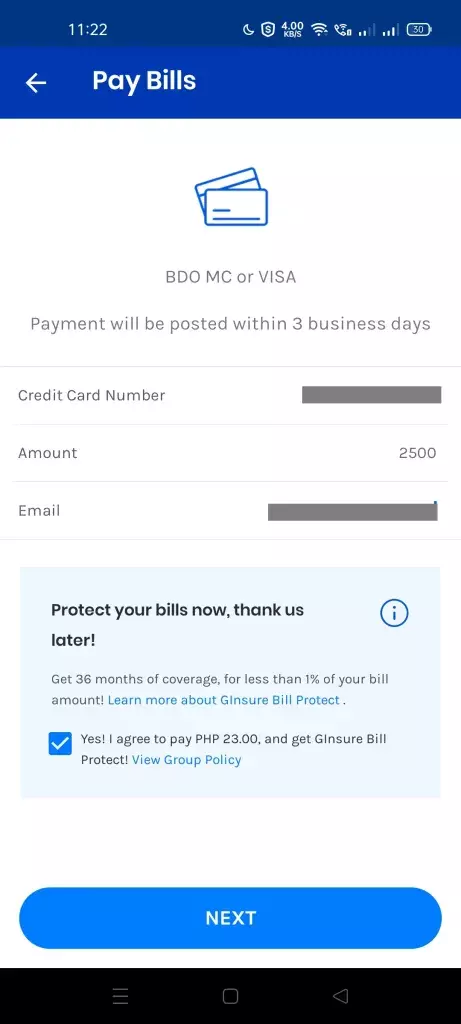

Essentially, it’s life insurance, but the insurer pays your bills in the event of your death. As soon as you pay your monthly bill, you’ll have the opportunity to pay for the premium.

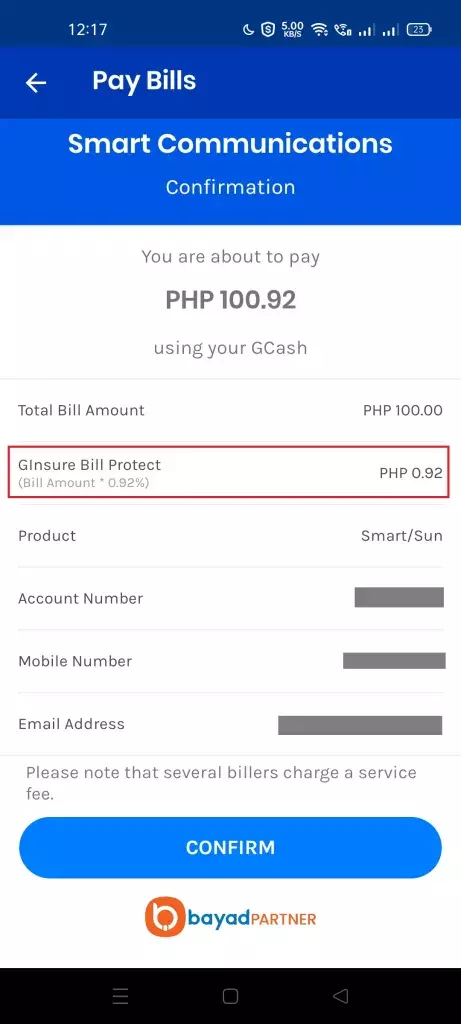

The amount is less than 1% of your total payment. The premium you paid for this particular bill covers you for 30 days after it has been paid.

Insurance coverage will be provided to whom?

The insured is the GCash user who pays the bill. As long as you own the GCash account, you’re insured even if you pay someone else’s bill.

How does it benefit you?

In the event of accidental death or permanent disability, the insurance covers 36 times the amount of the bill.

Beneficiaries: who are they?

In the case of permanent disability, benefits are payable to the insured, but in the event of death, beneficiaries are your spouse, children, parents, and siblings in that order.

Is it possible to enroll in more than one GInsure Bill Protect policy?

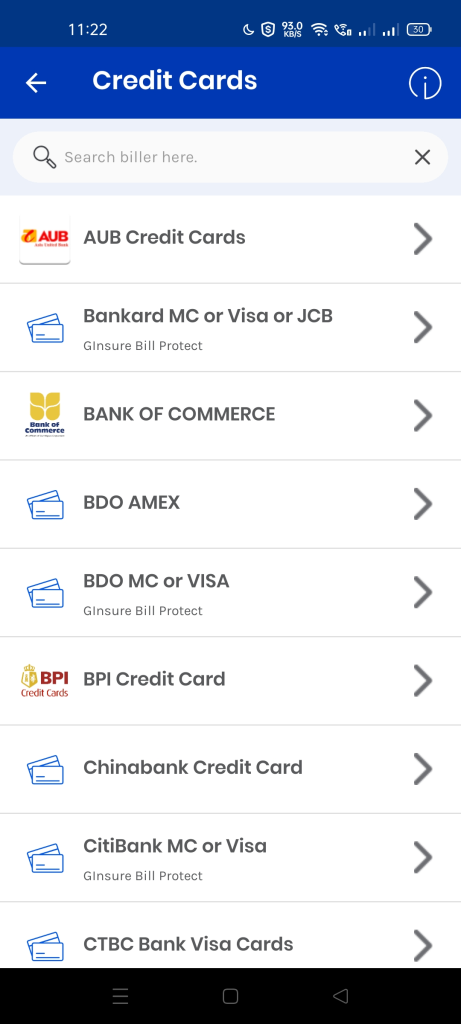

The answer is yes, as long as it’s covered. Using the biller list, you can see if Bill Protect covers a particular bill.

GInsure Bill Protect: How do I get it?

The option to enroll in Bill Protect will appear for certain bills. You’ll find it at the bottom of the biller.

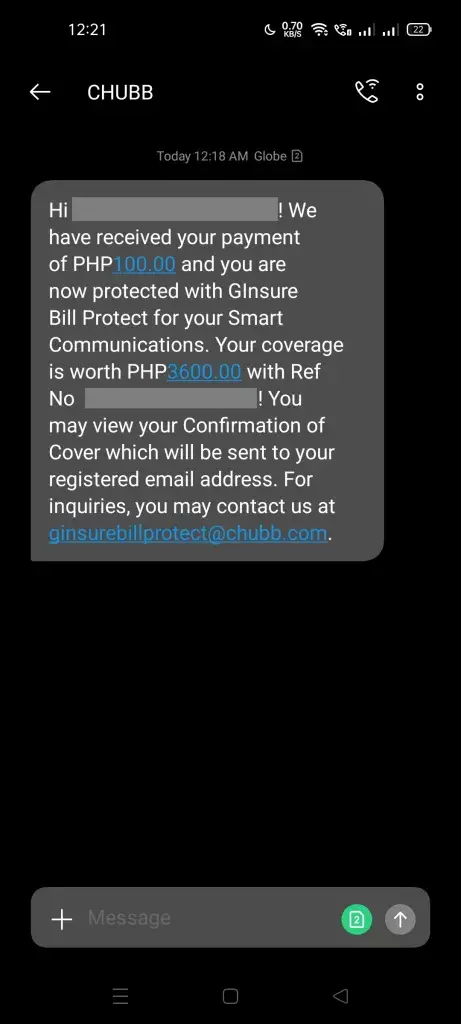

On the confirmation page, the amount will automatically appear once you’ve entered it. After paying for the biller, you will also receive an SMS informing you of your coverage.

If I want to file a claim, how do I do it?

The following requirements must be collected before filing:

- An ID which is valid for either the insured (GCash User) or the beneficiary of the insured (GCash User)

- Certificates of Birth & Death of Insured

- Beneficiary Proof of Relationship

- Report of the attending physician

- A copy of the original police report

- Affidavit of Witness Notarized

- Report of autopsy or medical-legal statement

Your claims can then be submitted to the Chubb Claims website. The office is open from 8:30 a.m. to 5:30 p.m. Monday through Friday.

How Can I Cancel GInsure Bill Protect

After paying your bill, you have 7 days to cancel your insurance coverage. A GCash ticket can be submitted to request this.

Your policy will not be refunded once you cancel it. Due to this, we recommend you don’t cancel it. Furthermore, the policy only covers 30 days.

Alternatively, you can uncheck the GInsure dialog when you are about to pay your bill if you do not want to use GInsure Bill Protect.

How to File a Claim with GInsure Bill Protect

In the event of an accidental death or permanent disability, you or any beneficiaries can claim your benefits. The steps are as follows:

Step 1: You should make sure that the date of the accident is covered within 30 days of its occurrence through your GInsure insurance policy.

Step 2: The requirements should be prepared as follows:

- An insured person’s valid ID (GCash user) or beneficiary’s valid ID

- Certificates of birth and death for insured individuals

- Report of the attending physician

- Providing proof of a beneficiary’s relationship

- Medical-Legal Report/Autopsy Report

- Report of the police in its original form

- A witness’ affidavit that has been notarized

Step 3: Contact the Chubb Claims Center to submit your claim

Step 4: Be patient and wait for their response

It is likely that you will receive a payout from your insurance policy if your policy covers the accident.

Your beneficiary may be any of the following in the event of death or inability to claim:

- Legal spouse

- Children

- Parents

- Siblings

Summary

In our discussion, we discussed how GInsure Bill Protect helps GCash users pay for their billers during times of need. It is possible to have 36 times your bill covered with a premium of less than 1% of what you spent.

As a result, GCash users who normally cannot enroll in insurance policies can receive a security blanket.