There has never been an easier way to transfer money from the Bank of the Philippine Islands (BPI) to GCash. We have outlined all the steps you need to take to move your funds securely and quickly in this guide.

GCash can enhance your mobile banking experience by transferring money from your Bank of the Philippine Islands (BPI) account to the app. When you link your BPI account with GCash, you can use it to pay bills, shop online, or send money to loved ones more quickly and easily.

Using the BPI mobile app and BPI, you can securely transfer money from your account to banks through the Philippines’ BPI money transfer system.BPI accounts can also be used to transfer money to GCash accounts.

Money can be transferred from BPI to GCash in a variety of ways. This can be done on the web, the GCash app, or the BPI app.

In a few easy steps, we’ll guide you through the process of transferring money from BPI to GCash using an online banking account. Using this convenient and reliable way of transferring money, you can make payments and purchases without ever having to touch cash.

Let’s start now!

Here is a video guide on how to transfer money between BPI and GCash.

Steps that will guide you through each process

The BPI app PlayStore or App Store can be downloaded to get started. You’ll need a BPI account for each of these.

Option 1. The BPI website is now accessible from the GCash app

GCash accepts online transfers from the BPI account. Don’t worry, you can do it in a couple of steps.

- By visiting online.bpi.com.ph, you can access your account.

- You can transfer money by selecting it from the menu.

- Here are the details you need to fill in:

- Funds should be withdrawn from this BPI account.

- Your desired transfer amount.

- To which bank should the money be transferred (Transfer to another bank).

- Select a bank or QR code to transfer money. GCash is a good choice.

- The mobile number associated with your GCash account.

- The name of the account.

- A short message can be included (this is optional).

- Make sure all transfer details are confirmed. Verify the transaction’s authenticity by entering the OTP.

- GCash app users should verify successful transactions by checking their GCash app.

Option 2. Fund transfer /cash in process time

Real-time crediting of your GCash wallet occurs from your BPI source account.

Transfer Fees and limits

- GCash allows daily transfers of Php 50,000 from your BPI account.

- With GCash, you can cash out free of charge from your linked BPI account.

- GCash will charge you Php25 for transfers from the BPI app.

- Transactions must be at least Php1 each.

RemitBee: The best alternative to GCash Money Transfer

With RemitBee, you can now send money directly to a GCash account in the Philippines.

In addition to not charging fees for signing up, there is no charge for purchases over $500. Prior to sending your money, you will also enjoy the most competitive exchange rate between CAD and PHP.

Time required for processing

You will receive your Remitbee transfer within a few minutes or within one business day. When funds are credited to a GCash account, the recipient receives a text message notifying him or her of the credit.

Typical transaction rates

Our transaction rates are competitive, so you can rely on Remitbee for your transaction. It’s easier and cheaper to send money through RemitBee than it is through banks or any other digital money transfer service.

Once you complete the transaction, there are no hidden fees or fluctuations in exchange rates. Give yourself a $10 credit to your account as an instant reward when you make your first transfer to the Philippines.

Fees associated with transactions

First and future transactions through RemitBee are charged at the most competitive rates.

Your first transfer is usually the only time you’ll see low costs from other competitors. For transfers of $500 or more, RemitBee offers free transfers.

Troubleshooting

Ensure your transaction limits have not been exceeded, your GCash number is correct, and your balance is sufficient to cover any transfer fees if you experience problems. The transfer might need to be retried at a later time if problems persist due to downtime.

What is the best way to link BPI and GCash?

For money transfers from GCash to BPI or vice versa, you need to link these two accounts.

Here are the steps involved in linking:

- To access your profile, open the GCash app and click the icon.

- Then click on My Linked Accounts.

- Enter the username and password for your BPI account.

The funds can now be transferred quickly from BPI to GCash after the link has been established.

The steps to transfer money from BPI to GCash are as follows:

Here are the steps for transferring funds from BPI to GCash without a key. It is important to ensure that they are linked together and have a balance in their wallets.

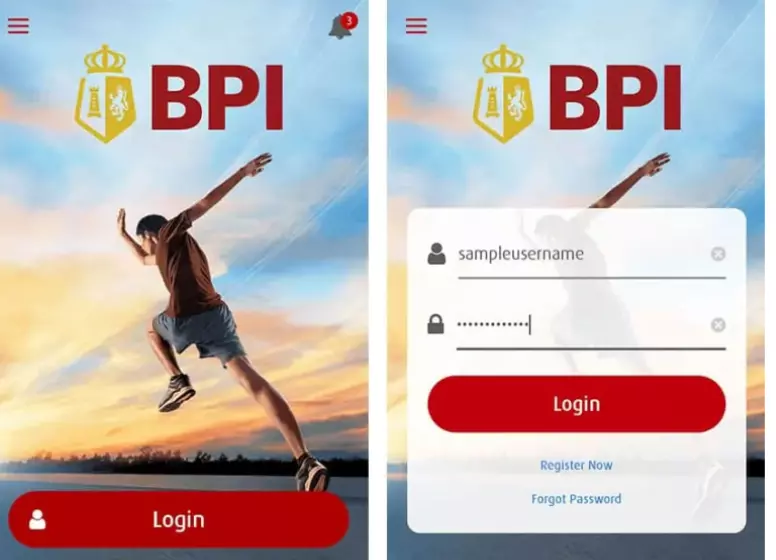

Step 1: BPI App Download or Open

For the first time, simply download the BPI app from Google Play or Apple App Store and open it.

Step 2: BPI Account Login

Click on Login and enter your username and password. You must first register yourself and create an account if you are a new user. To register, click the Register Now button.

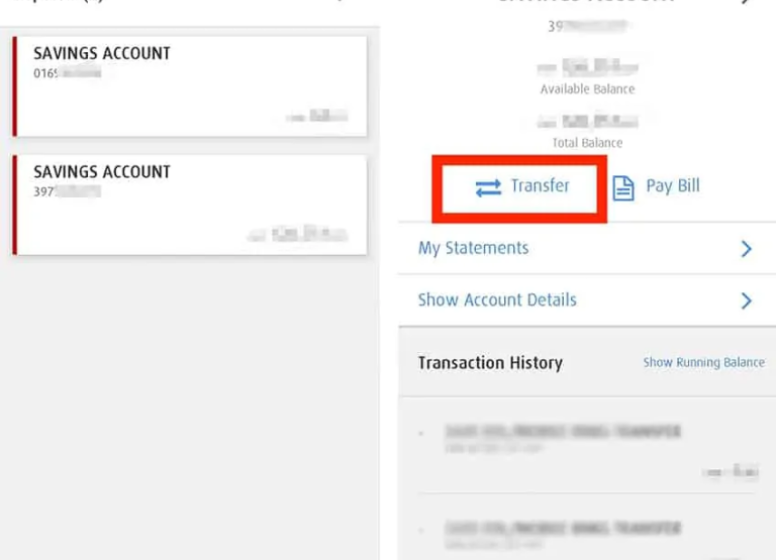

Step 3: Please select your account

If you have multiple accounts or different accounts, log in to your app and select the account you want to transfer money to.

Step 4: Click On Transfer

Once you’ve selected the account to transfer then, click on transfer under the given account details.

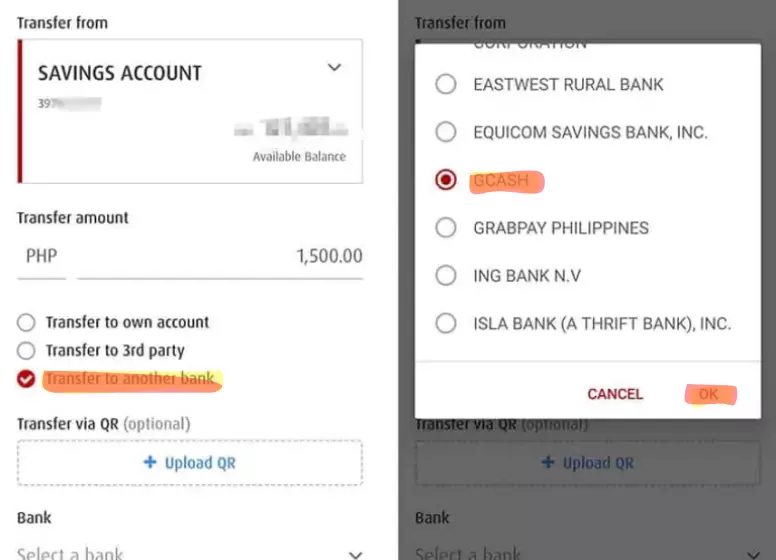

Step 5: Select a bank

Please enter the amount you want to send. Click “Transfer to other banks”. On the screen, select GCash.

Step 6: Account details

Enter your GCash account title, number, or your registered mobile number that works for GCash, and the amount that was sent. You can also transfer money using a QR code by scanning it and tapping the upload QR. Enter all the necessary information and then tap Next.

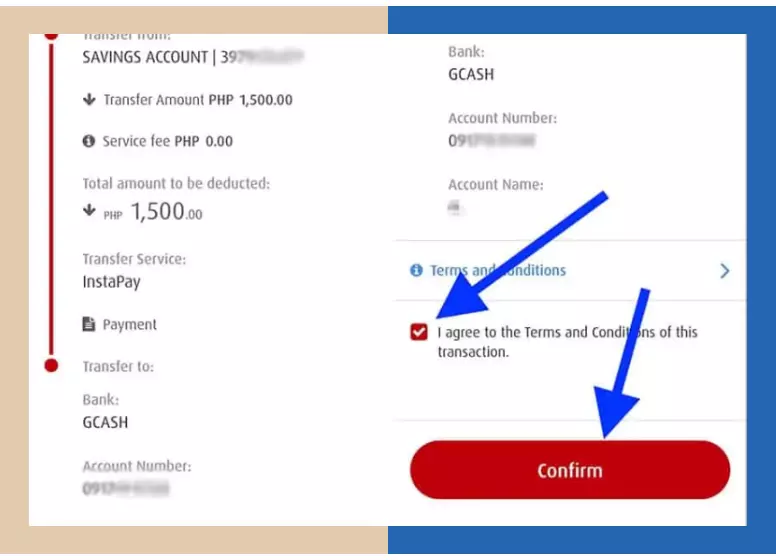

Step 7: Verify the details

Check the transaction summary on the screen to ensure you entered the correct information. Make sure you read and agree to the terms and conditions. Then click the Confirm button.

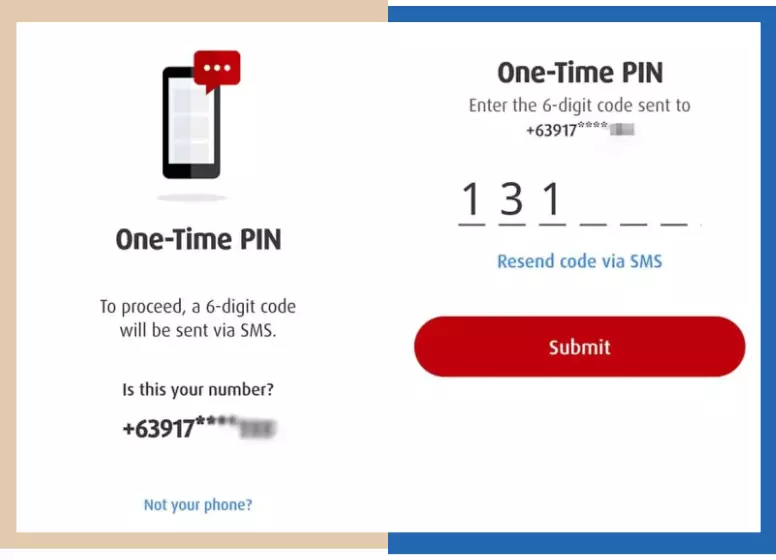

Step 8: Provide One Time PIN

An alert appears in the form of a pop-up. If the number is correct, Click Yes to send the code. A one-time PIN will be sent to your mobile device via SMS. Enter the OTP code and click “Submit”.

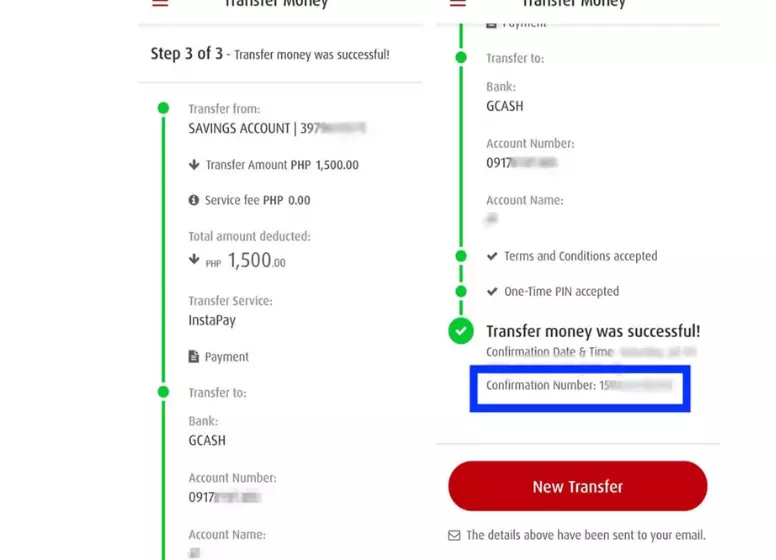

Step 9: Please note the confirmation number as follows

Once you enter PIN the summary will be displayed on your screen, along with the status of the transaction.

FAQs

Is it possible to transfer funds from BPI to GCash without paying a transaction fee?

· Log in to the BPI app.

· Choose a payment method from the list.

· Then select “load e-wallet”.

· Select an e-wallet and enter the details.

· Tap on Confirm to confirm the transaction details.

· Please enter your PIN code and click “Submit”.

· It’s done.

When I transfer money from BPI to GCash, a message appears saying “No Money Can Be Transferred”.

Can I transfer money from BPI to GCash without linking my accounts?

What are the charges for transferring money from BPI to GCash?

Why am I unable to transfer money from BPI to GCash?

Is there a limit to how much I can transfer from BPI to GCash?

How long does it take to transfer money from BPI to GCash?

Conclusion

Finally, transferring money from BPI to GCash in 2023 allows for seamless and efficient digital financial management.

As a result of the integration of these platforms, users can now easily move funds between their BPI accounts and GCash wallets, enjoying the convenience of online transactions. By following the straightforward steps outlined above, users can take full advantage of this transfer option, further embracing the era of digital financial flexibility and convenience.

Read more articles:

Money Transfers:

- Money Transfer using GCash

- Money From Wise to GCash

- Money From UnionBank to GCash

- Money From GrabPay to GCash

- Money from GCash to GrabPay

- Money Between Bank Accounts

- Money From GCash To GCash

- Money From ShopeePay To GCash

- Money From GCash To PayMaya

Cash In, Cash Out:

New Features: