Welcome to the world of GLoan Cash Loans in GCash – your gateway to seamless, instant financial solutions. In this comprehensive guide, we’ll walk you through everything you need to know about GLoan, the innovative cash loan service within the GCash ecosystem. Discover how GLoan empowers you to access quick funds, manage unexpected expenses, and achieve your financial goals with ease. Whether you’re a seasoned GCash user or new to the platform, this introduction will shed light on how GLoan can be your trusted partner in times of financial need. Let’s dive in.

A joint venture between GCash and Fuse Lending operates GCash under the name Mynt. E-wallets and everything related to them are handled by GCash, and loans are handled by Fuse Lending. A number of loan products are available through Fuse Lending. Fuse Lending handled GCredit before it was transferred to CIMB.

The question of whether GCredit users could encash the loan was often asked when the service was introduced. In addition to Pay QR and Pay Bills, GCredit is mainly a virtual loan. The GLoan gives us the option to obtain an actual loan.

Why Choose GLoan Cash Loans in GCash?

- Fast Approval: There can be a lot of time and effort involved in traditional loan applications. In contrast, GLOAN is designed to be as fast and efficient as possible. The application process for a cash loan is simple and quick, so you can get approved in no time. As a result, you will not have to wait long for your financial needs to be addressed.

- Flexible Terms: It is important for GCash to understand that every financial situation is unique. Because of this, we offer a wide range of loan amounts and repayment plans to meet your specific needs and budget. The amount and terms of repayment can be tailored to meet your needs, whether you need a small sum for a short period or a substantial sum with a longer repayment period.

- Convenient Access: There is no doubt that the convenience factor is a game-changer with GLoan. The bank does not need to be visited in person or endless forms must be filled out. The GCash app allows you to apply for a loan, check the status of your loan, and make repayments directly from the app. Having access to your finances 24/7 is like carrying a bank branch in your pocket.

- Low Interest Rates: Achieving good financial management does not have to be expensive. You can borrow funds from GLOAN at competitive interest rates, ensuring that you’re not breaking the bank. There are few other lending options in the market that are as affordable as this one.

- Secure and Reliable: You can be confident that your financial information is secure with GCash. To safeguard your personal information and transactions, the app is equipped with robust security measures. The secure and efficient handling of your financial transactions is a top priority for GCash.

- Empowering Your Financial Future: Make informed decisions about your money if you want to empower your financial future. You can achieve this by applying for a GLoan cash loan with GCash. It is our goal at GLoan to empower you to take control of your finances in a way that suits your unique circumstances by providing quick and convenient access to cash, flexible terms, and affordable interest rates.

It doesn’t matter what your financial need is, whether it’s an unexpected medical bill or pursuing further education, you can use GLoan. Because GCash is simple and easy to use, Filipinos choose it to secure their financial future.

Steps must be taken now to improve financial security. GLoan cash loan applications can be started by downloading the GCash app today. When you work with GCash, you’re managing your finances, but you’re also empowered to take charge of your financial future. Discover a world of possibilities by taking control of your financial future!

What is GLoan? and how we apply for GLoan Cash Loans in GCash?

Cash can be borrowed through GLoan, which is available in your GCash balance. By using this, you can withdraw or cash out your money, make a bank transfer, or send money to a friend or family member. GCredit will accept applicants with GScores above 740, and credit histories similar to GScores.

In addition to paying the loan monthly, you’ll also have to pay interest.

What are the terms and how much can I borrow?

Based on your GScore, you will receive a loan with different terms.

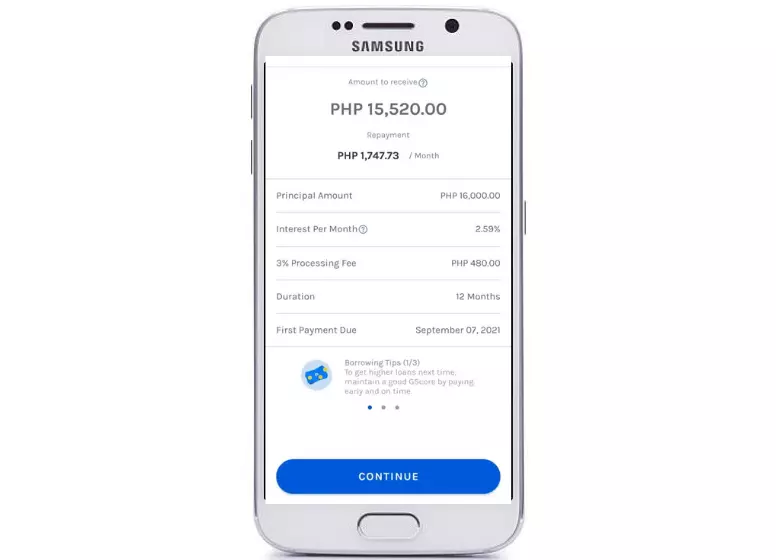

5,000 pesos is the minimum and 125,000 pesos is the maximum. A loan can last for five, nine, twelve, fifteen, eighteen, or twenty-four months. Interest rates range from 1.59-6.57% per month for add-ons.

In addition, there is a 3% fee that you will be responsible for outright, so you may not receive the full amount.

Can you activate GLoan with a low GScore?

It is unfortunately not known to the public. GLoan can only be unlocked by having a good credit history and GScore.

My GLoan can be withdrawn or cashed out?

Yes, you must use your GCash Mastercard or a partner to cash out. In addition to charging for cash-outs, ATM withdrawals are subject to a fee. Bank transfers are also available for transferring funds to any bank account.

What is the process for applying for GLoan?

When you decide to proceed, it only takes a few minutes.

Utilizing GCash for GLoans

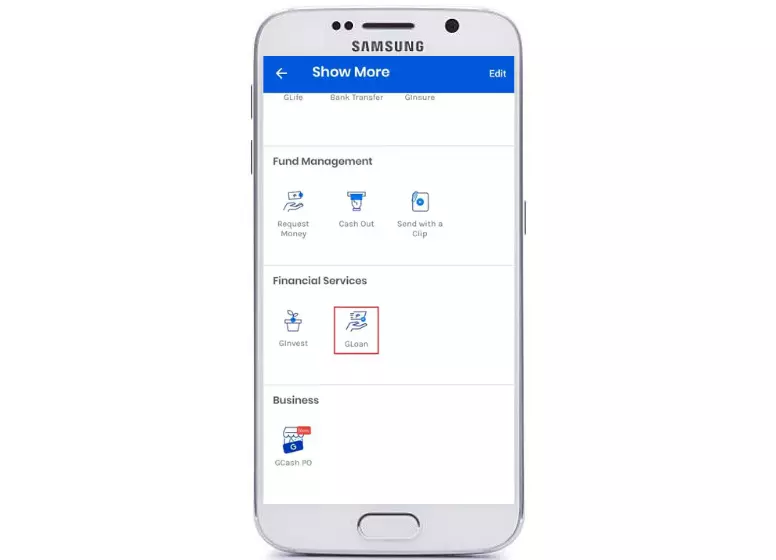

- GLoan can be found alongside GInvest in the “Show More…” section of the main GCash page.

- The intro pages can be accessed by clicking the button and then clicking Next. Select your loan terms, if applicable, once you are at the loan selection screen. Depending on your GScore, your terms may differ.

- Fill out some KYC information and confirm your loan term selection.

- You will need to input your SMS OTP in order to proceed with your application.

- Your GLoan will be credited to your GCash account as soon as it is processed.

Would it be possible to provide a sample computation of the dues and interest included in the calculation?

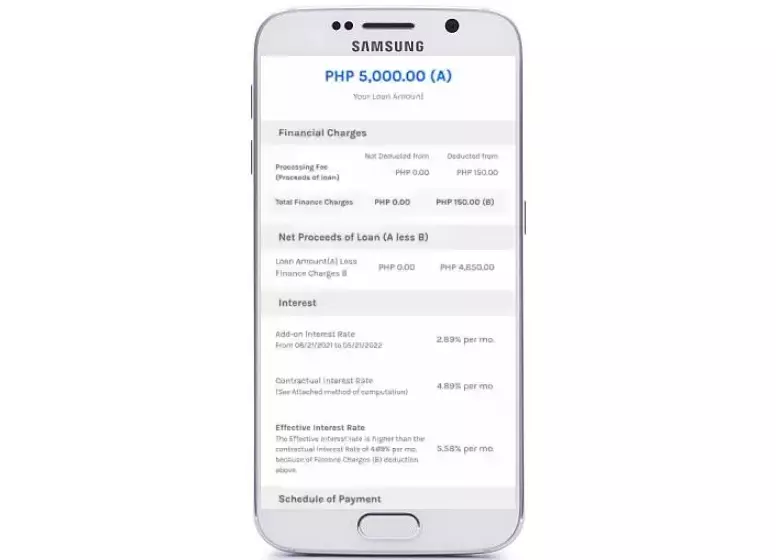

In an add-on loan, the interest rate is calculated using the full amount, including the 3% processing fee. This is equivalent to a monthly interest rate that takes into account the principal amount.

I chose Php 5000 as the loan amount above, with an interest rate of 2.89%, and a 9-month repayment period.

There is a 3% processing fee added to the computation, so even though you receive Php 5000, you will only receive Php 4850.

Is there any penalty?

Based on the disclosure statement, we see the following:

In addition to the fixed fee of Php 100, the penalty is 0.15% of the daily outstanding principal balance. The following example illustrates what would happen if I was unable to pay for the second month as mentioned above:

Every day that goes unpaid incurs a variable penalty.

How does the disclosure statement define “effective interest rate” and “contractual interest rate”?

As the principal decreases every month, these two interest rates are calculated. These are included here as part of due diligence since we are already using an add-on rate (which only accounts for the full principal per month). In order to make this as simple as possible, we will only use the add-on rate.

Based on the remaining balance per repayment, the contractual interest rate calculates the interest payable.

When principal repayments are deducted from the outstanding loan amount, the effective interest rate becomes what you are paying. Taking the actual loan amount out and deducting the processing fee gives you the actual loan amount.

Conclusion

The GLoan in GCash can be obtained in the same manner as we described earlier. Any GCash service can be used with GLoans, which are actual loans. You will be charged a monthly fee, which is usually deducted from your GCash balance, as this is a loan.

There are no complicated steps involved in applying for this loan. If you have a high GScore and a good credit history, this app also offers better terms than other loan apps available on Google Play.

FAQs

Why is GCredit different from GLoan?

How do GGives and GLoans differ?

What is the maximum number of GLoans I can get? My GCredit will be affected by this?

Your GScore will likely decrease if you fail to make either of those payments. As your GScore decreases, subsequent loans will become harder to obtain.

Could you please tell me why I can’t access GLoan?

What is the process for repaying my GLoan?

If you pay by the due date, you can either make a partial payment or a full payment.

Do you accept advance payments for the loan?

If you pay in advance, you may be able to get a rebate as a result of unused interest. A 12-month loan with a 3-month repayment period would be refunded to you if you paid it off in full after only three months.

If I have to pay my GLoan in full, how much should I pay in advance?

GLoan transaction history is also available, or you can pay extra – if it goes over, an error will appear.

I can take out another loan once I have paid off my current GLoan?

In some cases, it didn’t show up again for several months after receiving it. GScore may have been recalculated. I have a maximum GScore of 750 at the present time.

There were no funds received from my GLOAN or it didn’t push through. Is there anything I need to do?

More Related articles

Money Transfers:

- Money Transfer using GCash

- Money From Wise to GCash

- Money From UnionBank to GCash

- Money From GrabPay to GCash

- Money from GCash to GrabPay

- Money Between Bank Accounts

- Money From GCash To GCash

- Money From ShopeePay To GCash

- Money From GCash To PayMaya

CAsh In, Cash Out:

New Features: