Empower your financial journey by expanding your transaction horizons with our guide on how to increase your GCash limit. In this comprehensive guide, we’ll walk you through the process of enhancing your transaction capacity and accessing advanced features for a more versatile digital wallet experience. Discover the steps to elevate your financial capabilities and maximize the potential of Increase Your GCash Limit.

It pays to be aware of your GCash transaction limits when transferring funds, cashing in or withdrawing. When transferring money between wallets, knowing the GCash limit can help you avoid minor inconveniences. Additionally, it indicates when you need to upgrade your GCash account in order to unlock new features and lift any account restrictions.

We’ve all enjoyed the ease of sending and receiving money with mobile wallet apps like GCash, which allow us to instantly transfer funds. GCash is a mobile payment solution that lets you send money to anyone with a GCash account located anywhere in the Philippines using just your smartphone. Despite this, you can’t transfer as much as you want, because there are daily and monthly limits on the amount of money you can send and receive.

Based on your verification level, you have a limited number of GCash transactions. In the basic level of GCash, an unverified user has a maximum wallet limit of $50,000 along with monthly incoming and outgoing limits of $10,000. You are able to increase your cash in limit to $150,000 per month by upgrading your GCash account to fully verified. Additionally, users with full verification can send up to $100,000 a day.

You can also increase your wallet limit and monthly cash in limit by linking your fully verified GCash account to BPI, UnionBank or Payoneer. The GCash app typically asks you to enter your bank account credentials when you link your wallet. Your GCash account should be linked so you can use it for top-ups and cash-ins, in addition to increasing your transaction limits.

When you become a new GCash user, you can easily upgrade your account by completing the Know Your Customer or one-time verification process. Take a selfie and upload a picture of your valid ID. You can upgrade your GCash account by following the instructions in this article.

Table of GCash Transaction Limits

You can find information about GCash’s wallet balance limits, incoming and outgoing transactions in the table below.

What is the GCash Wallet Limit?

In terms of GCash wallet limits, you can only carry a certain amount of funds at any given time in your wallet. An account with a basic wallet limit is capped at 50,000 dollars, while one with a fully verified wallet limit is capped at 100,000 dollars. An account with a linked wallet can hold up to five hundred thousand dollars for fully verified users.

There is a limit on the number of GCash wallets per customer, instead of a limit on the number of wallets per wallet. There is no limit on the number of GCash wallets you can have, meaning you can have multiple wallets.

Wallet limits are refreshed every month on the first and revert to the full amount on the last day. Suppose you have a balance of 60,000 and you have a wallet limit of 40,000 for the current month, which will increase to 100,000 next month.

What are Transaction Limits?

Within a given time frame, a transaction limit sets the maximum amount that can be transacted. Each GCash account has its own daily, monthly, and annual limits, based on the account type and verification level (e.g. basic, fully verified).

It is important to note that GCash transaction limits are determined on a per-customer basis, not on a per-wallet basis. Therefore, owning two or more GCash accounts cannot multiply this limit.

On the first day of each month, the monthly transaction limit is reset to the full amount. An example would be that, if you have already cashed in 80,000 of your monthly incoming limit, you can only receive 20,000 for the rest of the month if you are a fully verified user. You will be able to receive up to $100,000 on the next month when there will be a reset in your incoming limit.

You can only transact a certain amount in a single day, so the daily transaction limit is the highest amount you can transact. On the following day, the daily limit is reset.

Incoming Transaction Limits

You are allowed to receive the maximum amount of cash within a month. This is known as the incoming transaction limit. Among the incoming transactions you may encounter are:

- Other GCash accounts can be credited with money

- The transfer of funds from a bank account (such as BDO, BPI, Metrobank, UnionBank, et cetera)

- The ability to transfer funds from another digital wallet (e.g. PayMaya, Coins.ph, GrabPay, etc.).

- The Palawan Pawnshop, Tambunting, Bayad Center, 7-Eleven, etc., are some places where you can cash in.

- The withdrawal of funds through PayPal and Payoneer.

Incoming transactions from basic accounts are limited to 10,000 per month, while incoming transactions from fully verified accounts are limited to 100,000 per month. Cash-outs and payments can be made to fully verified users with linked accounts and enterprise users up to a monthly cap of $500,000. GCash does not have a daily incoming limit.

Outgoing Transaction Limits

During any day, month, or year, your outgoing transaction limits determine how much you can spend or transfer out. As an example of an outgoing transaction in GCash, here are some examples:

- Money can be sent from one GCash wallet to another

- Transfers using GCash Padala

- Payments could also be made via other mobile wallets (PayMaya, Coins.ph, GrabPay).

- The transfer or withdrawal of funds to a bank account (such as BDO, BPI, UnionBank)

- Payments made over-the-counter (e.g. Villarica, Tambunting, Puregold)

- Shopping online and in-store

- Paying your bills online

- Purchases of prepaid loads

- Withdrawals from GCash MasterCard ATMs

- Using GSave, you’ll save money

- GInvest is a great place to invest

The daily outgoing limit is set at $100000 for full verified, full verified with linked accounts, and enterprise users, while there is no monthly or yearly limit. Outgoing limits for basic users are $10,000 per month and $100,000 per year. Payments can be made and loads can be purchased by basic users, but they can’t send money.

How to Check Your GCash Limit

According to this writing, the GCash app does not provide a convenient way of checking your remaining transaction limit. You can, however, determine how much GCash you have remaining by adding up all your transactions for the month, then subtracting the amount from the transaction limit on your account.

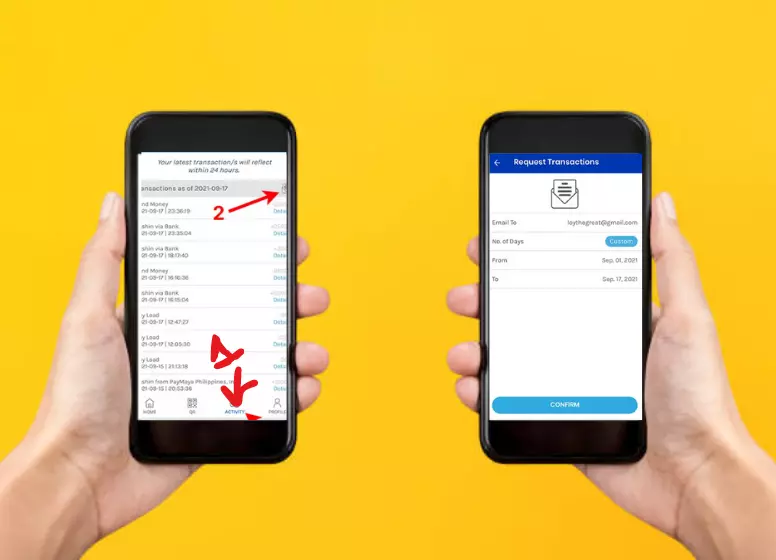

GCash’s Activity tab allows you to see your transaction history. The transaction history includes all incoming and outgoing transactions, though your latest ones may not be listed because of the 24-hour delay between transactions reflecting in your account.

A simple way to add up your transactions and separate them into incoming and outgoing is to add them up and sort them into incoming and outgoing this. Send an email request for a copy of your transaction history.

The answer is as simple as tapping the mail envelope icon on the “Transaction History” page and entering the following information:

- This field is auto-filled in most cases, but you can enter your own email address if you wish.

- Choose “Custom” for the number of days.

- Choose a month’s first date (e.g. September 1, 2021).

- Choose a date for the end of the project

Click “Confirm.”

A PDF copy of your transaction history will be emailed to you after a while. If you want to know your password, you can read your email. Download the PDF document and open it using its password.

You will find the following data at the end of the document below “Ending Balance”:

- Outgoing transactions – Total debit

- The total number of transactions incoming is the total credit

GCash transaction limits (see above) help you determine your monthly incoming limit, which you subtract from your total credit. You will be able to receive or cash in your remaining bank account balance for the remainder of the month based on that information.

The remaining incoming (or cash in) limit is equal to the maximum incoming limit minus the total credit

It means that the total credit (the total incoming transactions) for September 1-17, 2021 is ₱48,835.49. Due to full verification with linked accounts, the maximum incoming limit is ₱500,000 per month. Consequently, the remaining incoming limit for the remainder of the month is 451,164.51 (500,000.00 – 48,835.49 = 451,164.51).

Additionally, you can subtract the total debit from your outgoing limit if you are making outgoing transactions.

Limit of maximum outgoings minus total debits = limit of remaining outgoings

How to Increase Your GCash Limit

If you’re still a basic user, you can increase your GCash limit by upgrading to fully verified. When the app is verified, all its features will be unlocked, including the ability to withdraw money, send money to other GCash users, cash in from online banking accounts, apply for a GCash MasterCard, and many more.

You will be able to double your wallet limit from 50,000 to 100,000 as well as your monthly incoming limit (or cash in limit) from 10,000 to 100,000 when you upgrade your GCash account from basic to fully verified. Additionally, outgoing transaction limits will be removed on a monthly and yearly basis. You can upgrade your GCash account by reading this guide.

GCash has partner accounts in BPI, UnionBank, and Payoneer and you can link your GCash to these accounts to increase your wallet limit and monthly incoming limit!

By opening a GSave or GInvest account and having at least a $100 deposit or investment, you can increase your wallet limit to $500,000 as well. Your wallet and transaction limits will not be increased by PayPal, GCash MasterCard, and American Express Virtual Pay.

After two business days, the limits for all linked accounts will be reset to $150,000 if you unlink all of them. Creating a support ticket will allow you to change your account limit without unlinking it. Please allow seven business days for us to process your request.

FAQs

How do I check my GCash limit?

How can I increase my GCash limit?

How can I increase my GCash limit to 1000000?

At least two years as a Globe Platinum subscriber.

Globe Bill payer who pays on time.

An active GScore for GCash Plus users

How much is GCash over-the-counter limit?

Conclusion

It is GCash’s responsibility to comply with anti-money laundering regulations and prevent abuse through transaction limits. While these limitations and restrictions are helpful, they can be inconvenient, especially if you are sending money to family members or paying important bills. GCash accounts with unverified status are easier than those with unverified status, or you can link your account to BPI, UnionBank or Payoneer to enjoy the maximum₱500,000 limit. Individuals and nonbusiness users should be able to get by with that amount.

Call (02) 7730-2882 (for non-Globe subscribers) if you have any questions about GCash transactions and cash in limits. Support tickets can also be submitted or an email may be sent to [email protected].