Philippines users love GCash because it is a powerful and popular mobile wallet. You can use GCash’s many financial services like buy loads, pay bills. if you or a friend work abroad and want to send money to GCash.

The best way to remit money to GCash is with Remitly, which we highly recommend. Our guide will show you how to send money to GCash using Remitly’s service in order to help you save money when receiving remittances.

Transferring money from Remitly to GCash is a simple and secure way to send funds from overseas to your GCash account, providing a convenient solution for your financial requirements. It ensures a hassle-free process for securely moving money abroad into your GCash account. Here, we’ll guide you through the steps necessary to make the transfer, so you can access your money as quickly and easily as possible.

What are the steps to send a remittance via Remitly to GCash?

First, you must download the Remitly mobile app or register on Remitly’s website in order to send money to GCash. A straightforward and easy signup process guided us through the process.

You must be a fully verified GCash user to send money from Remitly to GCash. It is therefore necessary for you to provide a valid ID. As an example:

- UMID;

- Driver’s License;

- Passport.

The following steps will guide you through the GCash sending process once you are logged into your Remitly account:

REMITLY TO GCASH TRANSFER STEPS:

Remitly requires the following information before sending money.

- A recipient’s GCash mobile number that is registered with GCash

- Recipient’s first and last names

- Using Remitly’s app

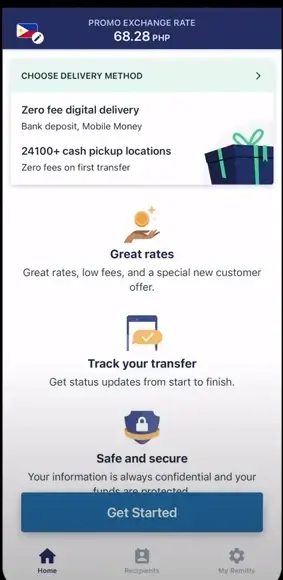

Step 1: Click on the Remitly app

Login to your account on Remitly and click on “Get Started” after registering an account

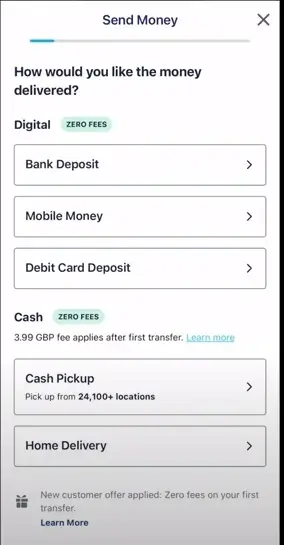

Step2: Click on Mobile Money

You have the option of “ in what way do you want the money delivered ”? Select the Mobile Money option

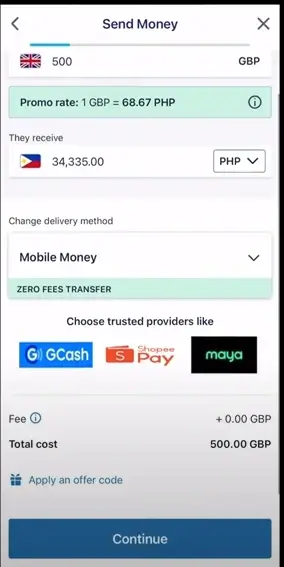

Step 3: Provide basic information

Enter the amount you would like to send. Click “Continue” after you’ve checked that everything is correct

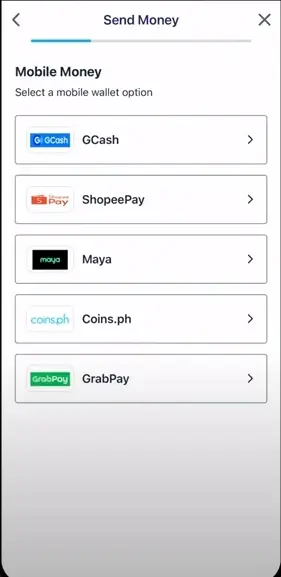

Step 4: Choose a mobile wallet

Go to “Select a Mobile Wallet Option” and select GCash

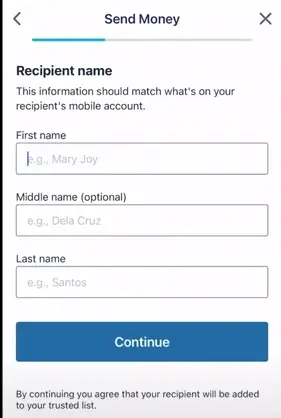

Step 4: Enter the Name of the recipient

Once the recipient’s first and last name has been entered, click Continue. Your recipient’s mobile account information should match this information.

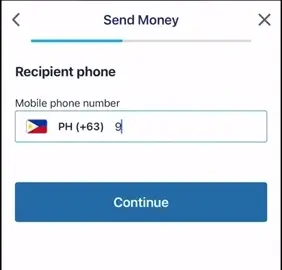

Step 5: Enter the recipient’s phone number

Once you have entered your recipient’s registered phone number, click on Continue. Check to make sure that’s right

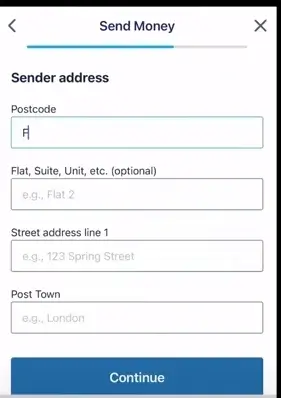

Step 6: Provide your address

Click on the Continue button after entering your postcode, street address line1, and town

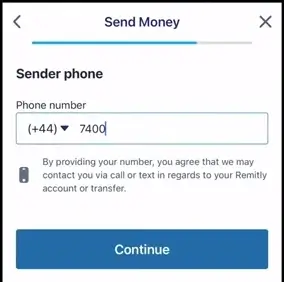

Step 7: Phone number

Click Continue after entering your phone number

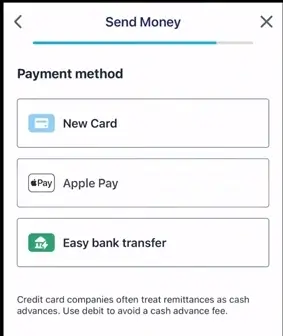

Step 8: Choose a payment method

Credit cards may be charged fees if you use them. Try to avoid using them. Wire transfers or debit cards are the best options. Selecting Apple Pay and selecting my debit card will be my next step

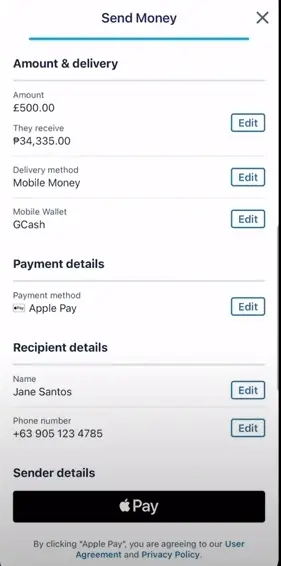

Step 9: Review the details

Make sure the transfer details are correct. Check everything to ensure it’s accurate. Once you have confirmed the transfer, select Pay.

Fees for sending a remittance to GCASH through Remitly

From anywhere in North America, Europe, or Asia, Remitly is an excellent option for sending money to GCash. Our recommendation is to use Remitly when sending money from the United States, India, Japan, and other countries.

Fees for transferring funds to GCash:

Remitly charges a fixed fee depending on the delivery service you choose for sending money to GCash. Transfers made using the Economy service are free, whereas transfers made using the Express service cost $3.99.

Remitly to GCash exchange rates:

When transferring money to GCash, Remitly uses the same exchange rate regardless of whether the service is Economy or Express. Depending on the country and currency of the transaction, Remitly’s foreign exchange rate is typically 0.5% to 2.0% weaker than the actual mid-market rate. You can trust Remitly with your remittances to the Philippines.

GCash Remittance Limits:

A GCash wallet can hold a maximum of P100,000, while it can hold a maximum of $30,000 (or an equivalent amount).

Here are Remitly’s fees and the types of services they offer compared to those offered by GCash.

| Service | Payment | Fee | Exchange Rate | Speed |

| Express | Debit Card | $3.99 | 0.5% — 2% | Instant |

| Economy | Bank Account | Free | 0.5% — 2% | 3 to 5 Business Days |

FAQs:

GCash: How do I send money?

Remitly to GCash: How does it work?

* Choose the Philippines as the country to receive the money;

* The delivery location should be “Mobile Money”;

* The wallet destination should be “GCash”;

* Name of beneficiary (as registered on GCash);

* Please enter the GCash account number of the beneficiary;

* There must be an exact match between this information and the registered information.

* It is possible to use a debit card, a credit card, or a bank account;

* Once the remittance has been sent to your beneficiary’s GCash Wallet, he or she will receive an SMS notification.

What are the steps to claim Remitly in GCash?

Is it possible to transfer dollars to GCash?

Is GCash available internationally?

Conclusion

In this comprehensive guide, we’ve explored the straightforward process of sending money from Remitly to GCash, catering to the needs of users in the Philippines who appreciate GCash’s versatility as a popular mobile wallet. The article takes you through the essential steps, emphasizing the importance of being a fully verified GCash user and providing details such as the required recipient information and the Remitly to GCash transfer steps. The guide also sheds light on fees associated with the service, recommending Remitly for users in North America, Europe, and Asia, while noting the wallet limits and exchange rates involved in GCash remittances.

By breaking down the Remitly to GCash transfer procedure and offering insights into fees and exchange rates, the article serves as a helpful resource for individuals looking to efficiently and cost-effectively send money to their GCash accounts. It empowers users with a clear understanding of the process, ensuring they can navigate the steps confidently and make informed decisions about their remittances, ultimately facilitating a smoother financial experience for both local and overseas users.