Security Bank’s branches are less crowded than other commercial banks in the Philippines, so over-the-counter transactions are smooth and efficient at Security Bank.

A convenient and secure method of transferring money is essential in today’s digital age. Mobile wallet transfers from your bank account to your Security Bank or GCash account are seamless with these platforms. Your financial transactions will be even more convenient with the Security Bank Online app. You can use this mobile app easily by following this guide.

A step-by-step guide to making hassle-free financial transactions will be provided to you in this article about transferring money from Security Bank to GCash.

Online banking and mobile payment platforms have become increasingly popular in this digital age. There are numerous platforms in the Philippines that allow users to perform financial transactions conveniently, including GCash.

If you have a Security Bank account and want to transfer money to GCash, you’ve come to the right place. Our step-by-step guide will take you through the entire transaction, providing you with ease and convenience.

Security Bank Online Registration

You must enroll in Security Bank Online before you can use any of its online banking features.

Downloading the Security Bank app on your mobile device will allow you to use it in conjunction with your Security Bank Online account. You will receive a one-time password to your registered cell phone number when you first log in with your SBOL login credentials. You will need to enter the password for your first log-in in the one-time password you receive.

Read more: How to Send Money from Metrobank to GCash 2023

Online enrollment is available for what types of accounts?

Security Bank allows the enrollment of the following types of active accounts:

- An account for savings

- Keeping a checking account

- Visa, MasterCard, etc.

- Investing

- Deferred payment

Why Choose Security Bank and GCash?

You can manage your finances with both Security Bank and GCash using easy-to-use platforms. Through the GCash wallet, you can make bill payments, buy mobile loads, shop online, and more with your Security Bank account. You can maximize your financial flexibility by transferring money between these two platforms.

Steps How to Transfer Money from Security Bank to GCash:

Step 1: Enter your PIN code in the Security Bank APP

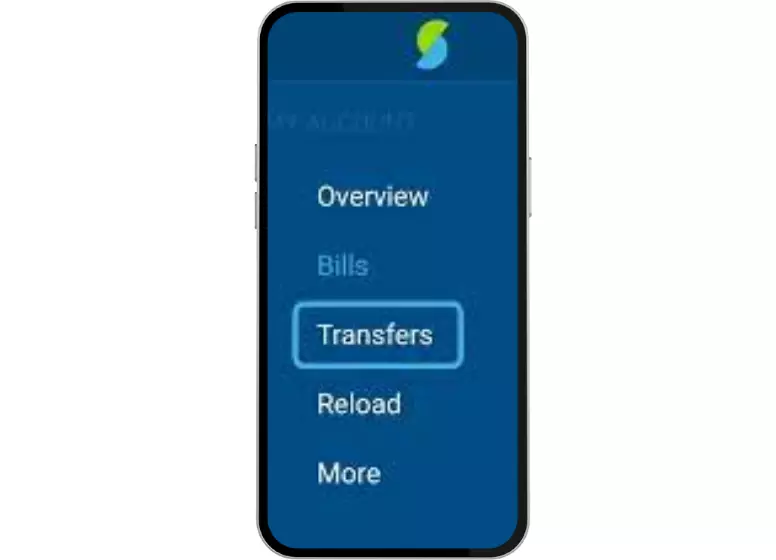

Step 2: Then click on Transfers by clicking on the vertical three dots.

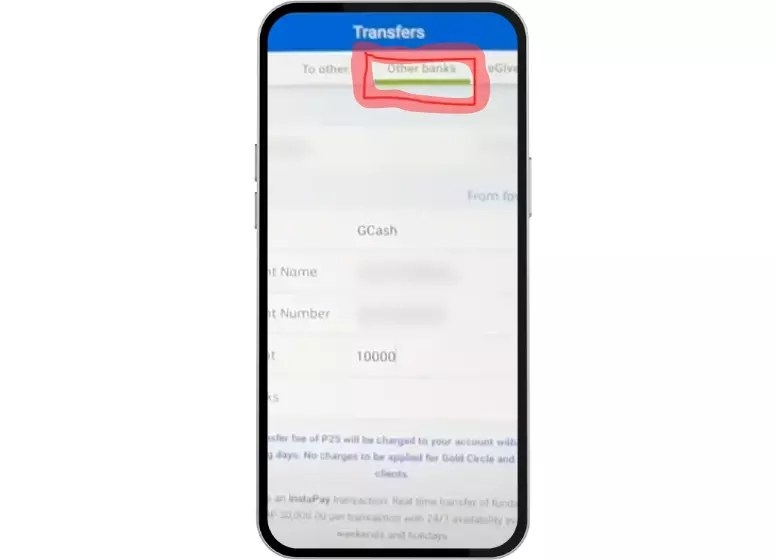

Step 3: Please enter the account number, account name, and amount you wish to transfer into the other bank’s section.

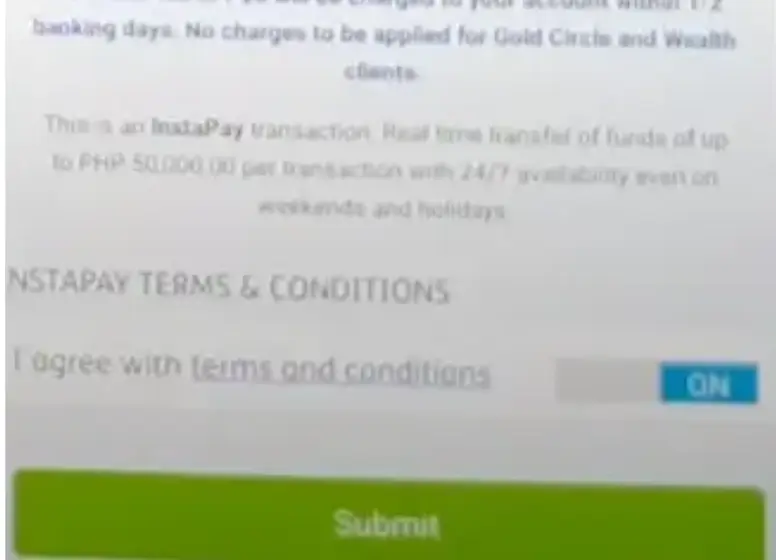

Step 4: Ensure I agree with the terms and conditions is checked, and click Submit.

Step 5: Please enter the OTP you received on your mobile device.

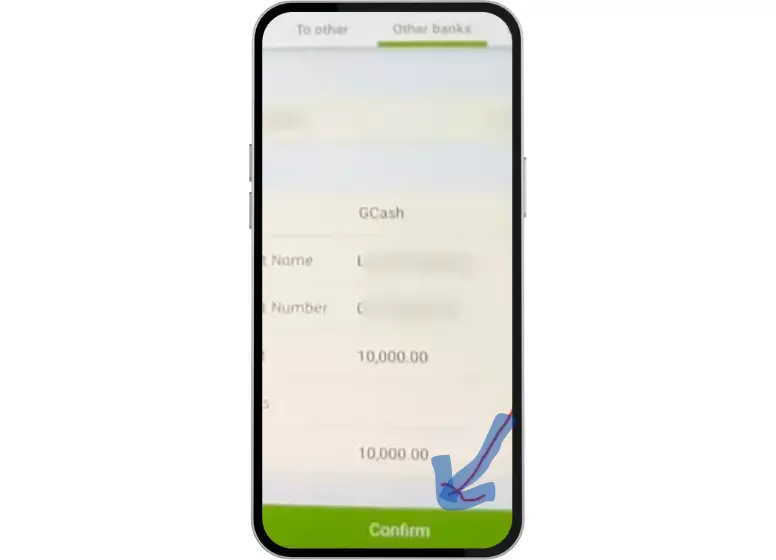

Step6: Then click the Confirm button

Your money has been successfully transferred from the security bank to GCash. All the details will also be sent to your registered mobile number.

In 2023, the Security Bank to GCash transfer fee will be:

Transfer fees of P25 will be charged to your account within 1-2 business days.

Note: Clients in the Gold Circle and Wealth Circle will not be charged.

FAQs

How do I transfer money from the Security Bank?

Select ‘Other Banks’

Please provide the recipient’s account information.

Your transfer will be confirmed once you enter the OTP.

How do I transfer money from my bank account to my GCash account?

How do I transfer money from the Security Bank app?

Select the destination for the money transfer.

Make sure all fields are filled out.

Click the “Confirm Transfer” action button at the bottom of the form to complete your transaction.

Conclusion:

In conclusion, transferring money from Security Bank to GCash has never been easier thanks to the streamlined and user-friendly process outlined in this article. By following these step-by-step instructions, you can seamlessly navigate through the necessary procedures and successfully initiate transfers with confidence.

The partnership between Security Bank and GCash empowers users to conveniently manage their finances, enabling swift and secure transactions that bridge the gap between traditional banking and digital convenience. Embrace the power of this seamless money transfer method and unlock a new level of financial flexibility at your fingertips.

Experience the future of banking today with the hassle-free integration of Security Bank and GCash, making your financial journey smoother than ever before.

Related Posts: