Pera Outlets offer GCash services in association with official GCash affiliates. How to apply for one is explained in this post.

With GCash, payments and money movements have become easier thanks to various ways of harnessing technology. One of these is establishing your own Pera Outlet. Creating your new account doesn’t even require you to leave the house. The GCash app is all you need to get started.

All of the requirements can be met through the app, without the need for a physical office visit, lowering the bar for stores that want to participate.

GCash Pera Outlets: what are they?

In a nutshell, in order to support all supported transactions, you become officially GCash-accredited as a merchant. It has actually been done by a few sari-sari shops already, but users’ personal GCash accounts are used. QR codes are even used to collect payment by some smart individuals.

GCash users are provided with greater protection when accredited, while sari-sari stores are able to earn more revenue as a result. Merchants can also earn commissions from certain transactions processed through Pera Outlets, as they do not charge extra fees. In addition, Pera Outlets are able to offer merchants value-added services (such as GCash Padala) that other outlets cannot.

Benefits of setting up a Pera Outlet?

- If you cash out, cash in, or make a padala transaction, you’ll receive 0.5% of the transaction.

- If your account is used by a biller, you get Php 3 for each transaction.

- As a GCash customer, you receive free signage kits.

- GCash Padala provides free advertising on the main sites.

- With a Php 500k limit, you’ll receive a separate merchant wallet.

There is currently only one commission-based service listed above.

As a GCash Pera outlet, what services can I offer?

Your current service offerings are as follows:

- Get paid

- Payout

- Paddleta

- Bills to be paid

- Load up

- QR code payment

More features may be added as more merchants sign up.

Which is better, GCash Payments or GCash Pera Outlets?

GCash is a payment method that can be accepted by any retailer, SME, or entrepreneur.

Stores offering GCash services to users are called GCash Pera Outlets. A GCash Pera Outlet usually starts out as a sari-sari store. Additionally, GCash QR payments are accepted by GCash Pera Outlets.

GCash Pera Outlets: What do I need to do?

GCash PO is right there in GLife, just search for it. After entering, your store can be registered as a Pera Outlet.

Can you tell me what I need to do?

In order to transact with customers publicly, you need a storefront. In general, GCash Pera Outlets are dominated by sari-sari stores. However, being an accepted store does not imply you are a sari-sari store.

Another requirement is that Pera Outlet transactions be conducted on a separate phone. GCash PO applications need to be done in a separate GCash account by you as the owner. A new account must be verified before it can be created, but creating multiple accounts is easy.

Here is a list of valid IDs needed for GCash verification and receiving GCash Padala:

- UMID

- Driver’s License

- SSS ID

- Passport

- Phil Postal ID

- PRC ID

- Pag-IBIG ID

- Philsys / ePhilID

- Alien Certificate of Registration (ACR) – if you are a foreign national

- Student ID, Birth Certificate – if you are a minor, and applying for GCash JR

Help Support will assist you in verifying your ID if you do not have one from this list.

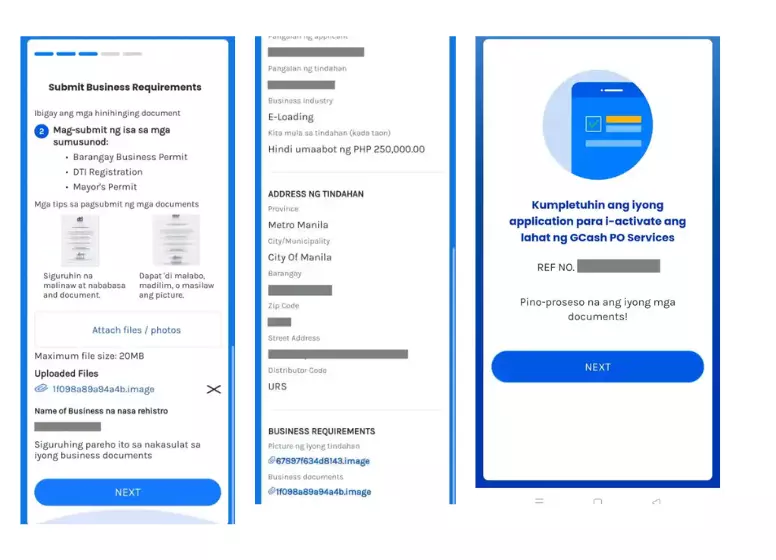

You would need to take pictures of the following for the GCash PO application:

- Permit for doing business in a barangay

- Registration with the DTI

- Permission of the Mayor

- The storefront of your store with you as the owner in the picture

- Self-portrait

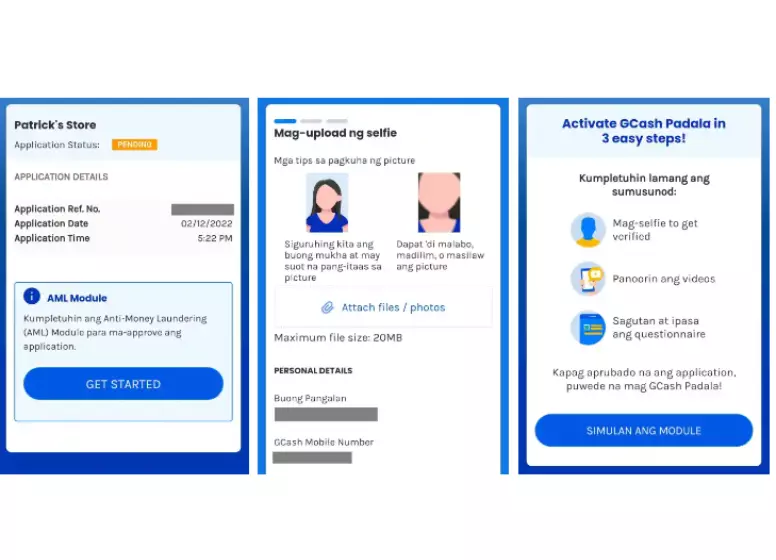

Also, you will need to become knowledgeable about the Anti Money Laundering Act (AMLA) as there will be an exam. Before then, you will have to watch a training video.

If I want to start an application, how do I do that?

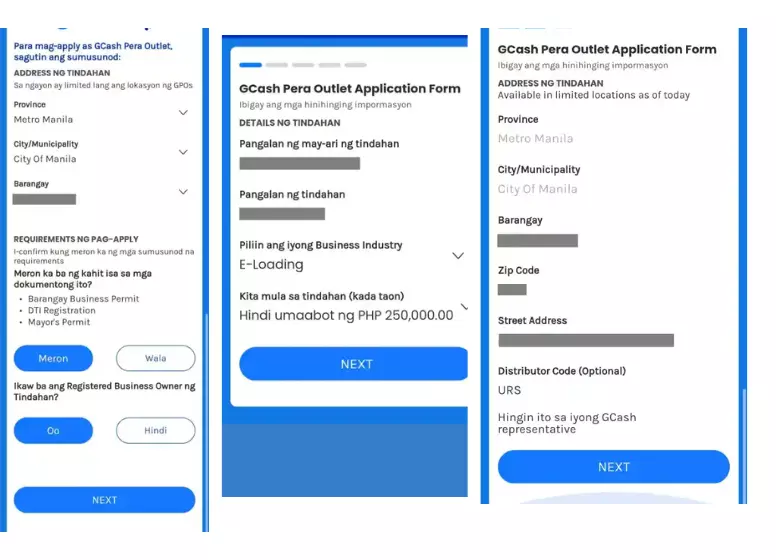

For more information on registering as a GCash Pera outlet, please follow these steps:

- Application for GCash PO can be started from the PO Apply page.

- Fill out the form and upload the necessary photos on the following pages. You will be approved or rejected within 3-5 days after submitting your application.

- An Anti Money Laundering (AML) module should be available on the main GCash PO page.

- You will need to complete the application by entering the required information, watching an AMLA video, and taking a short exam. You can take the AMLA exam as many times as you want if you get it wrong. Correct answers account for 11/15 in the passing rate.

Screenshots of the registration process:

Here are a few screenshots of the AML Module:

Amla testing is necessary because of the Anti Money Laundering Act (AMLA)?

In order to prevent money laundering and terrorist financing, the BSP requires entities that handle funds, such as GCash, to undergo this verification.

It is extremely important for everyone to be informed about AMLA and report suspicious fund transfers as GCash Pera Outlets accept and release funds for many people.

Could you please let me know the most important points of AMLA that will assist me in answering the exam?

Those interested in reading the full text can find it here. Nevertheless, I have distilled it down into a little summary below to make it easier to read:

- Also known as Republic Act 9160, the Anti-Money Laundering Act of 2001 provides for the prevention of money laundering.

- Those who commit money laundering use dirty money to make transactions appear legitimate by using money they have obtained from illegal activities.

- There are several direct penalties, including:

- The act of transacting with dirty money itself can result in seven to fourteen years in prison (and a fine exceeding Php 3 million)

- An individual enabling dirty money transactions faces a maximum of four to seven years in prison (plus a fine of Php 1.5 to 3 million)

- Failure to report dirty money transactions can result in a six-month to four-year prison sentence (and a fine of 100k to 500k)

- Criminal activities generate dirty money when they are committed. There are several items on the list:

- An attempt to extort money by kidnapping

- Offenses related to drug trafficking

- Corrupt practices and graft

- Exploitation

- Taking advantage of people and extorting them

- There are two Juetengs and one Masiao

- Plagiarism

- Stealing that qualifies

- Fraudulent activities

- The illegal trade

- ECPA violations

- Attacks by terrorists on non-combatants and similar targets, including hijackings, destructive arsons, and murders

- The Securities Regulation Code of 2000 prohibits fraudulent practices and other violations

- Infractions punishable under the penal laws of other countries, such as felonies or offenses of a similar nature

- The financial funding of terrorism and the organization or direction of others to engage in this activity (R.A. 10168)

- (R.A. 10168) Organising or directing others to engage in terrorism financing is an attempt or conspiracy to finance terrorism.

- Attempting to violate the law by misusing or conspiring with someone else’s property or funds

- Complicit in financing terrorism or conspiring in its financing

- Terrorist financing accessory

- In addition to the AMLC, there are the following groups:

- As chairman of the BSP, the governor

- Insurers’ Commission commissioner

- A statement by the SEC chairman

- In any given day, covered transactions total Php 500k.

- Regardless of the amount, suspicious transactions are transactions with these circumstances:

- Economic justification does not exist.

- There is no proper identification of the client.

- There is a discrepancy between the amount and the client’s financial capacity.

- Reporting requirements do not appear to apply to this transaction.

- In contrast to past transactions, the client seems to be deviating from his normal behavior.

- Unlawful activity is involved in the transaction.

- As mentioned above, any similar transaction

- Reporting covered and suspicious transactions to the AMLC is required by the AMLA for covered institutions. The following are among them:

- The BSP supervises the following banks

- Regulatory agencies, such as the Insurance Commission, that regulate insurance companies

- A company regulated by the Securities and Exchange Commission that deals in securities

- The AMLC should be treated confidentially, otherwise, it will prosecute and fine you for 3-8 years.

- A five-year period should be set aside for retaining records of transactions. Without following the rules, you may be sentenced to 6 months to 1 year in prison and to a fine between Php 100k and Php 500k if you do not comply.

- Reporting falsely or maliciously can also lead to a 6-month or 1-year imprisonment penalty and a fine of Php 100k – Php 500k.

- Whenever funds associated with unlawful activities are seized, AMLC can petition the Court of Appeals for a freeze order. Up to 20 days have passed since the freeze order was issued.

- If there is probable cause that the AMLA has been violated, the AMLC may examine any bank deposit or investment.

Which banners and guides are free?

A local distributor visited us after we submitted an application for GCash PO status and got approved. Now, they are posted on the outside of our store.

Conclusion

GCash Pera Outlet applications have been discussed. Helping people with their GCash transactions can earn you extra money. To qualify for a license, you must own and operate a store, and you must also have the permits that are associated with that store. The AMLA exam is also part of the process.

Through GLife and GCash PO, you can submit applications from within the app.