Explore innovative methods for Expanding GCash Limits without Linking a Bank Account. This guide offers practical insights and strategies to help you unlock higher transaction capabilities while maintaining control over your financial data, ensuring a secure and versatile GCash experience.

In the era of digital finance and mobile payment solutions, GCash has emerged as a versatile and widely-used platform for financial transactions and money management in many parts of the world. Designed to provide users with a convenient and efficient way to handle their finances, GCash offers an array of features, from bill payments and online shopping to money transfers and investments. However, like many digital financial services, GCash has certain limits in place to ensure security, adhere to financial regulations, and safeguard user accounts.

One of these limitations is the need to link a bank account to your GCash wallet to unlock higher transaction limits. While this is a common and straightforward method, there are situations where users may prefer not to link their bank accounts for various reasons. These could include concerns about sharing financial information or simply not having a bank account to link.

This guide delves into the intriguing topic of expanding your GCash limits without the necessity of linking a bank account. We will explore alternative methods and strategies that users can employ to access higher transaction limits and make the most of their GCash accounts. By understanding these methods, you can take full advantage of GCash’s capabilities while maintaining control over your financial information and security. Whether you’re a GCash user looking to explore new avenues for financial freedom or someone contemplating the use of this digital wallet, this guide aims to provide valuable insights into expanding your GCash limits without the need to link a bank account.

As buyers increase, the default transaction limits (Php 100k in and out) may become problematic for a lot of users, especially sellers using their own QR codes. You might also discover that you have been making transactions exceeding Php 100k lately.

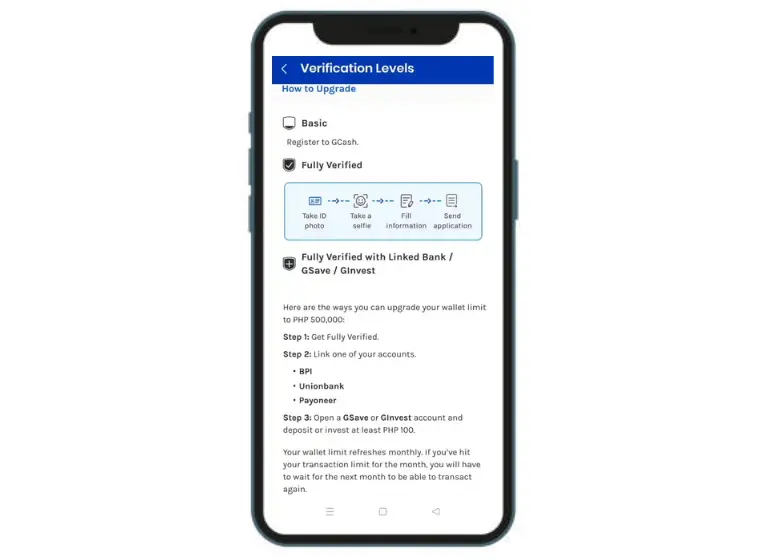

To be eligible for the Php 500k transaction limits, you must:

- Make your GCash account accessible through BPI, UnionBank, or Payoneer

- A minimum Php 100 deposit or investment in a GSave or GInvest account is required.

Some of these conditions may, however, be problematic in certain situations. CIMB may blacklist you from accessing your GSave account if you fail to create a savings account just for the purpose of taking advantage of the account extension.

As an alternative to GCash, they have developed GCash Pro 99.

How we are Expanding GCash Limits without Linking a Bank Account

As of my last knowledge, expanding the limits on your GCash account typically involves linking a verified bank account or completing the KYC (Know Your Customer) process. These measures are in place to comply with financial regulations and to ensure the security of your account. However, GCash may have introduced new features or updated their policies since then, so it’s essential to check their official website or contact their customer support for the most up-to-date information.

Here are the general steps to expand your GCash limits:

1. Link a Bank Account: This is the most common method to increase your GCash wallet limits. You can link a bank account to your GCash account by following these steps:

- a. Open the GCash app.

- b. Go to the Menu (usually represented by three horizontal lines) and select “My Linked Accounts.”

- c. Choose “Banks.”

- d. Follow the prompts to link your bank account.

2. Complete KYC: If you haven’t already completed KYC, you may be prompted to do so when trying to increase your limits. KYC involves verifying your identity by submitting valid identification documents. This process typically includes providing a photo of your ID and taking a selfie for facial recognition.

3. Use GCash Regularly: Sometimes, your limits can be increased over time as you use GCash for transactions. The more you use the app for payments and other financial activities, the more likely you are to be eligible for higher limits.

4. Contact Customer Support: If you are still unable to expand your limits after trying the above steps, you can reach out to GCash customer support for assistance. They may be able to provide additional guidance or manually adjust your limits if necessary.

Please keep in mind that GCash’s policies and procedures may have changed since my last update, so it’s crucial to refer to the most recent information on their official website or directly contact their customer support for the latest instructions on expanding your account limits without linking a bank account.

What is GCash Pro 99?

The GCash account extension subscription costs Php 99 per month and is available to all GCash users.

This subscription offers the following benefits:

- A monthly limit of P500k has been added to the wallet

- The total amount credited once used per month will be Php 75 since all fees are covered (PhP 15 per transfer, maximum of 5 times).

- Coverage provided by Insureme39

- Cashback of 10% after full repayment of your GLoan

After the subscription period ends, rebates are credited five business days later. Following full repayment of the loan, the GLoan rebate will be credited within five days.

How does GCash Pro 99 work?

There are only a few things you need:

- GCash account that has been verified

- You have a balance of Php 99

When does the subscription start and for how long?

Upon receiving the SMS notification, your subscription begins and lasts for 30 days. If you would like to continue with the subscription, you’ll need Php 99 in your balance.

How does the Insureme39 insurance work?

This insurance provides the following coverage:

- GCash users are covered by one month’s term life insurance:

- A life insurance policy covering up to 25000 pesos

- Insurance coverage for personal injuries (up to Php 25000)

- The hospital will pay you Php 750 or Php 250 each day for three days in cash

What is the procedure for obtaining GCash Pro 99?

This form must be completed, and Php 99 will automatically deducted from your wallet after a while. Within three business days, you will receive your benefits.

Other Questions

Do I have the option of canceling my subscription at any time?

Subscriptions cannot be canceled nor refunded once they have been started. As long as you opt-out three days before the renewal date, you will not be charged.

A GCash subscription fee debit will be re-tried two more times if it is not successful the first time. Otherwise, they will automatically opt you out if they are unable to debit.

Summary

In a world where digital financial solutions are becoming increasingly prevalent, GCash stands as a formidable player in the realm of mobile wallets and digital payments. While the convenience it offers is undeniable, the requirement to link a bank account has been a point of contention for many users. This guide has explored alternative avenues for expanding GCash limits without the need to divulge your bank account information, catering to the preferences and needs of a diverse user base.

By delving into the methods and strategies outlined in this guide, you have uncovered new possibilities for maximizing the utility of your GCash wallet while maintaining control over your financial data. From completing the Know Your Customer (KYC) process to actively using your GCash account for transactions, these alternatives have the potential to unlock higher transaction limits, empowering you to take full advantage of GCash’s extensive features.

As you navigate the evolving landscape of digital finance, it’s crucial to stay informed about the latest updates and policies of GCash. The methods discussed here were based on information available up until September 2021, and the platform may have introduced new features or revised its policies since then. Therefore, periodically checking GCash’s official website and reaching out to their customer support for the most up-to-date information is advisable.

In conclusion, GCash offers a world of financial convenience and opportunity, and there are pathways to expand your limits without linking a bank account. By embracing these alternatives, you can harness the full potential of GCash while ensuring your financial security and privacy remain under your control. Whether you’re using GCash for everyday transactions or exploring its capabilities for the first time, this guide has provided valuable insights into navigating the digital financial landscape with confidence and ease.

The transaction limit is Php 500k, and you can expand it without linking your online bank account to GCash. Your extension and some other benefits can be obtained by simply paying Php 99 every month.

Here are GCash’s main features after you read about what it is:

Money Transfers:

- Money Transfer using GCash

- Money From Wise to GCash

- Money From UnionBank to GCash

- Money From GrabPay to GCash

- Money from GCash to GrabPay

- Money Between Bank Accounts

- Money From GCash To GCash

- Money From ShopeePay To GCash

- Money From GCash To PayMaya

CAsh In, Cash Out:

New Features: