Introduction

If you’ve looked at your bank statement and seen a charge labeled “PAI ISO,” you might be curious about what it means. PAI ISO is a usual charge you might find on your bank or credit card statement. It stands for “Payment Alliance International ISO.”

Must see WUVISAAFT

In this article, we’ll explain what PAI ISO is, what it means for your bank account, and why it’s important to know about this charge.

What is PAI ISO?

PAI ISO means Payment Alliance International ISO. Payment Alliance International (PAI) is a big company that helps with ATMs. They process transactions, fix ATMs, and give equipment to banks and shops. ISO stands for Independent Sales Organization. An ISO is a company that a bank lets sell its services, like processing credit card payments, to stores.

Explore GU ICLOUD

So, when you see PAI ISO on your bank statement, it’s because you used an ATM or bought something with your card, and Payment Alliance International handled the transaction through a company they work with called an Independent Sales Organization.

Why is PAI ISO on my bank statement?

PAI ISO shows up on your bank statement when you use an ATM or buy something with your debit or credit card that Payment Alliance International works with. Your transaction went through an ATM or store connected with PAI using their payment services.

Visit Converting Load to Gcash

If you use an ATM that is not from your bank, you might see PAI ISO charges, too. That’s because your bank could charge you for using an ATM not in their network, and they label it PAI ISO on your statement.

What does PAI ISO mean for my bank account?

If you spot a PAI ISO charge on your bank statement, you’ve either used an ATM or bought something, and Payment Alliance International handled the transaction. Usually, it will show the name of the place where you made the transaction.

If you used an ATM not from your bank, the PAI ISO charge might also include a fee from your bank for using an ATM that’s not theirs. This fee can be different depending on your bank’s rules and the type of account you have.

Remember, PAI ISO charges aren’t fake charges. Real charges pop up when you use an ATM or buy something that Payment Alliance International deals with.

Why is it important to understand PAI ISO charges?

It’s essential to understand PAI ISO charges for a few reasons. First, it helps you stay on top of your spending and know where your money goes. By knowing what PAI ISO means and how it shows up on your statement, you can easily see transactions handled by Payment Alliance International.

Secondly, understanding PAI ISO charges can save you from paying unnecessary fees. If you’re aware that your bank charges for using ATMs not from their network, you can stick to using their ATMs to avoid these fees.

Lastly, knowing PAI ISO charges can help you spot unauthorized transactions on your account. If you notice a PAI ISO charge for a transaction you didn’t make, it might signal fraudulent activity. In that case, it’s crucial to immediately contact your bank to report the charge and protect your account.

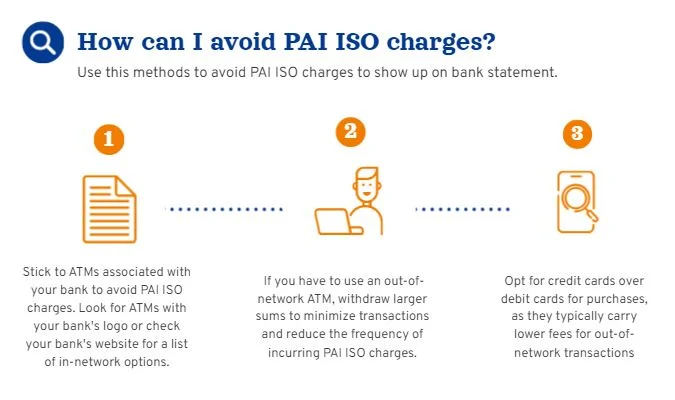

How can I avoid PAI ISO charges?

Stick to ATMs connected to your bank to steer clear of PAI ISO charges. Look for ATMs with your bank’s name or logo. You can also check your bank’s website or app to find nearby ATMs in their network.

If you have to use an ATM not from your bank, take out more cash immediately to reduce how often you use it and get charged. Consider using a credit card instead of a debit card when buying things. Credit cards usually have lower fees for transactions outside your bank’s network.

How It Works to Prevent Fraud

Collaboration with Authorities

PAI takes fraud seriously and fights it with the United States Secret Service and local law enforcement. Together, they aim to stop “man-in-the-middle” attacks at ATMs, where criminals place a device to tamper with cash withdrawals.

Real-Time Reporting

PAI uses real-time reporting software to alert officials of possible attacks as they happen. This helps law enforcement catch criminals immediately, reducing the risk of big financial losses. PAI estimates that these attacks have cost thousands of dollars, but their real-time system aims to lower this number significantly.

Conclusion

In summary, PAI ISO shows up on your bank statement when Payment Alliance International handles your ATM withdrawals or purchases. Knowing about this charge helps you manage your spending, steer clear of extra fees, and spot any fishy transactions. Stick to using your bank’s ATMs and understand their rules to reduce charges and handle your money better.