Unlocking Effortless Transactions: Welcome to our guide on ‘Paying via GCash through Paymongo,’ where convenience meets security. In today’s fast-paced digital landscape, the power to make transactions seamlessly is paramount. Join us as we delve into the world of efficient and secure payments, harnessing the full potential of GCash through the Paymongo platform. These insights will empower you to navigate the evolving financial landscape with confidence and ease. Let’s embark on this journey to streamline your payment experience, ensuring every transaction is a breeze!

When selling online, applying for different payment methods can be difficult. Since we’re all used to paying with cash, not everyone has a credit card or debit card payment option.

In light of how digital wallet usage has grown during this pandemic, we can also see how merchants can offer different payment methods and buyers can choose the most convenient payment method.

This space has been addressed by Paymongo for the first time. You can also use Magpie, JustPay.To, or Bux as alternatives. Both merchants and buyers benefit from their services by providing web links with different payment options for buyers, as well as dashboards and settlement options for merchants.

Paying via GCash through Paymongo: steps

How does Paymongo work?

Using Paymongo is a very convenient payment solution for SMEs. For other payment gateways, you’ll need a landing page to be able to use their services. In other words, an online presence is necessary. E-commerce sites or something similar can be used for this.

Instead of providing payment pages, Paymongo provides payment links. How does this work? Create a payment link in the Paymongo dashboard when you need someone to pay. You will only be able to use this link once, and it has the transaction details embedded in it. One of the things that makes it unique is that you have many ways to pay when you visit the link.

There are several ways to make payments, including credit/debit cards, digital wallets, and over-the-counter methods like 7-11 or Cebuana. As soon as your payment is complete, you can confirm your payment right in the link. In the case of the merchant, he will be able to see whether or not the link he provided was actually paid by the buyer using his dashboard. It simplifies the process of paying and receiving payments.

Do I need to be onboarded as a GCash merchant?

No, GCash merchants are not onboarded as Paymongo merchants. Onboarding with Paymongo means using it as a payment gateway to provide multiple payment options, including GCash. Being a GCash merchant means directly using GCash QR or other GCash payment methods.

How is the payment settled with the merchant?

In addition to your bank information, they will ask you to register with their service. A bank transfer is used to settle the account the next business day. Again, this helps merchants as they can spend less time handling finances and more time focusing on the daily operations of their business.

How about refunds?

Under the Payments section of the dashboard, Paymongo allows merchants to request refunds.

What payment methods are supported by Paymongo?

As of now, they accept Visa, MasterCard, GCash, GrabPay, Coins.ph, 7-11, Cebuana Lhuillier, and M Lhuillier. In addition, Paymongo already supports all of these options out-of-the-box, so merchants would not need to onboard with them.

This looks like something that can be automated. Does Paymongo have an API?

Yes, and their documentation is easy to understand. A sandbox environment is also available for testing their integration with your system.

I have an e-commerce store. Can Paymongo support my site?

A Shopify and WooCommerce plugin is currently available. You will need to register as a merchant first in Paymongo in order to use this feature. Alternatively, you can always create your own using their API.

You should keep in mind, however, that Shopify charges fees as well. As part of the Basic subscription, they take a 2% fee on top of Paymongo’s fees. It can go down for other subscription levels.

What is Paymongo’s cut of the purchase?

For debit/credit cards, they charge 3.5% plus Php 15; for e-wallets (GCash and GrabPay) they charge 2.9%; for over-the-counter channels like Coins.ph they charge 1.5%. A calculator is available on their pricing page.

As a seller, it can be useful for convenience.

Does Paymongo support Bank Transfers as a payment method?

No, at the moment. However, if you need that type of payment method, you can go with bux.ph since they are partnered with UnionBank. BPI, UnionBank, and RCBC are supported.

How do I sign up in Paymongo?

Signing up is free, you just need to provide some personal information. As soon as your account is created, you can log in and view your dashboard. The first transaction you can make is a test transaction. You would have to go through verification before you could do actual ones.

How do I generate and use Paymongo links?

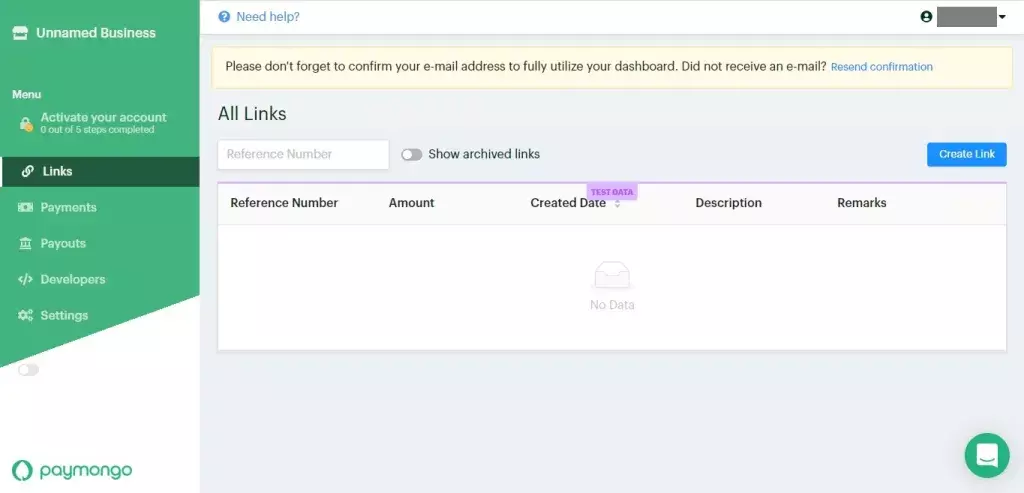

Your test environment will be accessible once you confirm your email address.

In the dashboard, you will see the following options:

- Once your KYC/KYB (Know Your Customer/Know Your Business) information is complete, you can activate your account.

- Payment links – contains the links you generate for payments

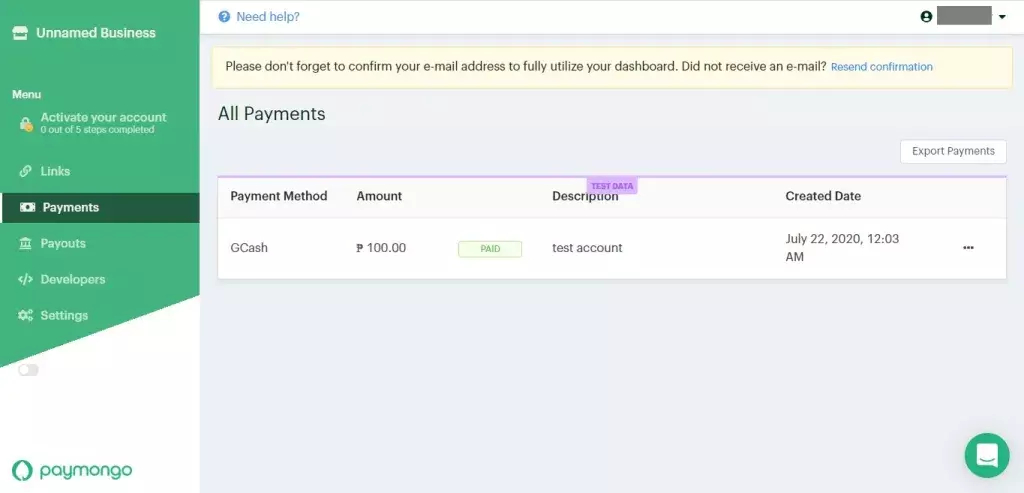

- You will find a list of payments you have received using your links in the Payments section

- Payouts – displays the settled amounts to your bank account

- API keys are shared with developers who want to extend Paymongo’s functionality

- Account settings – you can update certain information regarding your account here

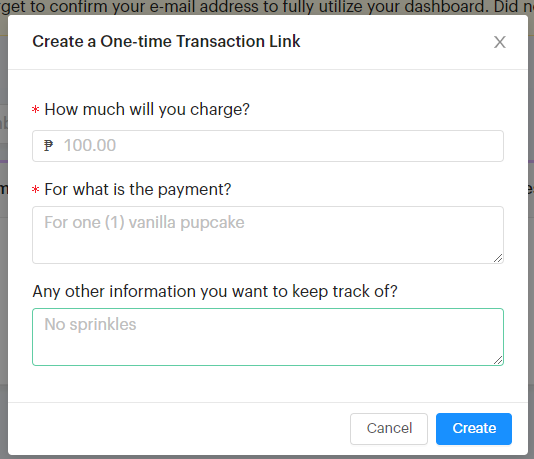

How to Generate Links

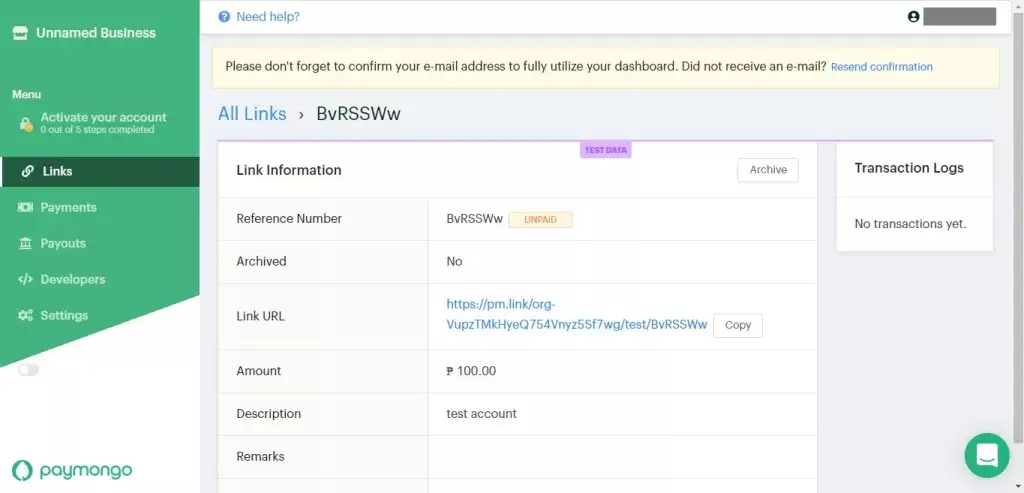

In this case, the links serve as the main function. A single payment link can be generated per transaction. Links cannot be reused. You need to put in the details like the amount and the reason why you’re making the payment before you can create a link.

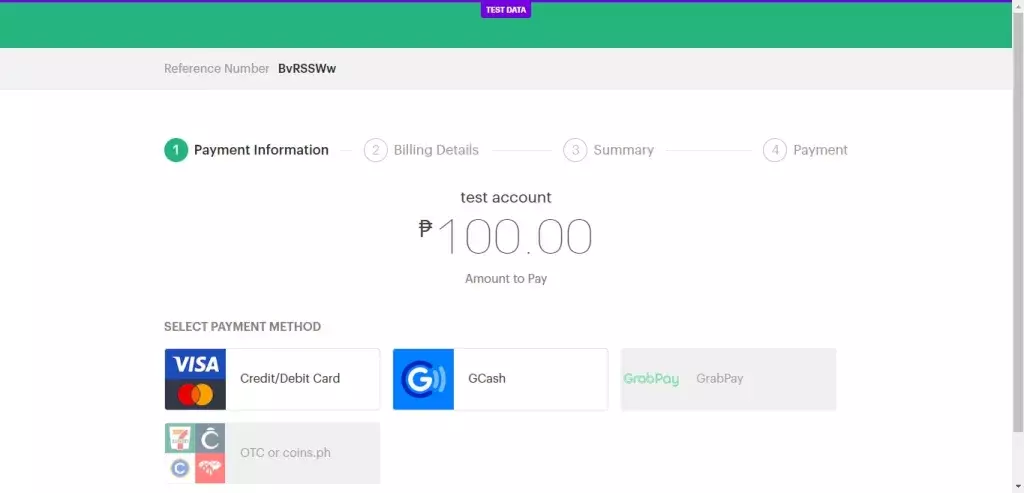

Once the link has been created, you can copy it and send it to your customer. This page will then appear to the customer. There are different payment methods available, such as credit cards and debit cards, as well as over-the-counter options like 7-11 and Cebuana Lhuillier, but GCash is the most compelling.

The Payments section will show you the details once payment has been made.

Settlement usually occurs the next business day via bank transfer to your account. In the Payouts section, you can see the details.

What’s the purpose of having an API?

Through Paymongo’s API, you can extend the functionality with your own payment implementation and handle it programmatically instead of manually.

You can also use the API to configure webhooks, which allows Paymongo to notify you once a customer has paid, which makes it easier for you to chain event-driven rules.

For more information, please refer to their documentation.

Using GCash with Paymongo

Paymongo makes it simple to pay. When you click on the GCash payment method, you will be taken to the GCash cashier page. The transaction can be confirmed by entering your mobile number, the OTP, and the MPIN.

Can I link my GCash debit cards (GCash Mastercard, AMEX) with Paymongo?

However, I recommend using GCash straight away since it is easier.

How do I fund my GCash wallet?

You can fund your GCash balance in a variety of ways. Online banking and over-the-counter options are both available for cashing in.

Summary

In my talk, I explained how Paymongo supports different payment methods, including GCash. Additionally, I explained how the service handles payments and settlements by providing some how-tos.

There is also an API for Paymongo, as well as an integration with Shopify. Neither the buyer nor the seller will have to worry about making payments with Paymongo.