When utilizing mobile wallets like GCash, understanding the associated fees for each transaction is crucial. These fees can accumulate rapidly, particularly with frequent transactions.

In this blog post, we’ll delve into the comprehensive details of GCash fees. We’ll discuss the charges related to cashing in and out, transferring money to other GCash users, settling bills, withdrawing cash, and more. Additionally, we’ll offer insights and strategies to reduce your GCash fees, enabling you to maximize the utility of your mobile wallet. Let’s embark on this journey to explore the realm of GCash fees together!

What are Gcash Fees?

Gcash fees refer to the charges levied by the platform on specific transactions conducted through Gcash. These fees can fluctuate based on the transaction type, amount, and recipient.

Also, read gcash hotline 24/7

Types of Gcash Fees

Are you interested in learning about the fees and service charges linked to GCash? Here’s the essential information you need. To ensure you’re informed about any extra expenses related to cashing in, cashing out, or transferring money with GCash, we’ll provide you with a comprehensive and up-to-date list of GCash fee types.

Cash-In Fees

This fee is applicable when you top up your Gcash wallet via cash-in partners such as 7-Eleven, SM Business Centers, or banks. Depending on the chosen cash-in partner, the cost varies between 0% to 2% of the transaction amount.

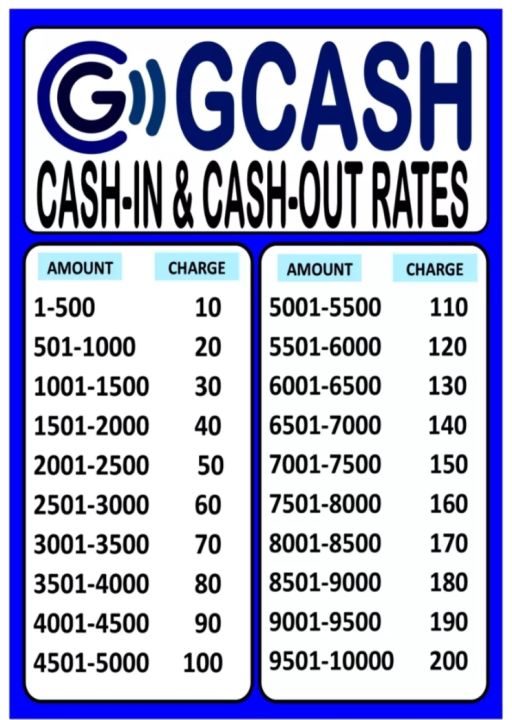

Cash-Out Fees

This fee is charged when you withdraw money from your Gcash wallet. The cost varies between 0% to 2% of the transaction amount, contingent on the chosen cash-out partner.

Send Money Fees

This fee is incurred when transferring funds to another Gcash user. The cost varies between 0% and 2% of the transaction amount, depending on the recipient’s account type (Gcash or non-Gcash).

Online Payment Fees

This fee applies when you use Gcash to purchase goods and services online. The fee varies depending on the merchant.

Bill Payment Fees

This fee is applicable when you settle bills using Gcash. The cost varies based on the biller and the amount paid.

How To Minimize Gcash Fees

Opt for Cash-In Partners with Reduced Fees:

Explore the list of Gcash cash-in partners and prioritize those with lower transaction fees to minimize your expenses.

You may also see Converting Load to Gcash

Utilize Gcash as a Payment Method:

Take advantage of merchants who offer discounts or cashback when you make payments using Gcash, helping to mitigate the impact of fees.

Schedule Bill Payments:

Leverage Gcash’s feature to schedule bill payments in advance, preventing late payment fees and providing time to prepare for upcoming expenses.

Consolidate Transactions:

Minimize fees by consolidating multiple smaller transactions into fewer, larger ones since Gcash fees are often based on a percentage of the transaction amount.

Upgrade Your Gcash Account:

If you frequently utilize Gcash, consider upgrading your account to a higher tier to access lower fees and increased transaction limits.

How can I minimize my GCash fees?

You can reduce your GCash fees by opting for more affordable cash-in and cash-out methods, like bank transfers or authorized partners. When using GCash for bill payments or purchases, consider conducting transactions in more significant amounts to lessen the frequency of transactions and associated fees. Furthermore, stay alert for GCash’s promotions and cashback offers, which can help mitigate costs. Monitor the app for such opportunities and utilize them whenever available.

What fees come with cashing in and out with GCash?

GCash imposes fees on different cash-in and cash-out methods, which fluctuate based on the transaction amount and the selected process. For instance, cashing in at a 7-Eleven outlet generates a charge of 1.5% of the transaction amount, whereas cashing in through a bank account is fee-free for transactions up to PHP 8,000.

Are there any fees for sending money to other GCash users?

Sending money to other GCash users is free of charge, regardless of the transaction amount. However, withdrawing the money at authorized cash-out points may incur fees.

Final Words

Incorporating Gcash fees into your digital payment experience is essential. Familiarizing yourself with the various fee structures and mitigating strategies enables you to optimize your Gcash transactions. Remember that fees are subject to change without advance notice. Hence, periodically reviewing updates on Gcash’s website or mobile app is crucial. Enjoy seamless transactions!