Unlock Financial Mastery: Welcome to our guide on ‘9 Little Known GCash Tips That Definitely Work.’ In the world of digital finance, these tips are the hidden gems that can supercharge your financial journey. Get ready to discover the secrets to maximizing the potential of your GCash account, taking your financial prowess to new heights. These tried-and-true strategies are your key to financial empowerment. Let’s dive in and transform the way you handle your finances with these GCash power tips!

GCash Tips:

You can borrow from GCredit and pay it off the same day to avoid interest charges.

It has been explained previously that GCredit’s interest is compounded daily. It allows you to do this tip as well as make payments more flexible. In the case of a same-day payment, there is no interest. Quite useful if you lack cash in the meantime. You can pay it off later in the day by cashing in.

Avoid ATM withdrawal fees.

In terms of cash-out options, it’s a bit of a hassle – either you have to do it manually, or there’s a fee involved. It is possible to Bank Transfer the amount to your bank and withdraw from that bank using your ATM, however, if you have your own ATM debit card (or one of the integrated banks like BDO or Unionbank). The GCash Mastercard withdrawal fee of Php20 will not be charged this way.

In October 2020, GCash will implement a Php 15 fee per Bank Transfer, so this will no longer be valid. By using GSave and withdrawing through your CIMB ATM, you can avoid the ATM withdrawal fee.

Get an instant boost in GScore by linking your bank account.

It can seem so mysterious how GScore is calculated. However, here’s a definite tip: link your bank account with GCash (BPI or Unionbank) and your GScore will automatically increase by 5 points. However, if you unlink it, it will decrease by the same amount.

Buy Load allows you to buy more than phone load.

GCash only GoSakto products are one of the perks of buying load in GCash. However, you can also buy some semi-hidden load credits:

- Google Play Store Credits

- iTunes Credits

- Steam Wallet Codes

- Garena Shells

- Mobile Legend PINs

- PUBG PINs

- Rules of Survival PINs

- Ragnarok Online Mobile PINs

- Grab Promo Code Vouchers

- Globe at Home Prepaid Broadband Promos

- Cignal and Skydirect Prepaid Credits

- Maxicare Prepaid Health Insurance

- I’ve also written an in-depth post about this in here.

Sometimes it’s better to request money than to send it

Request Money is a better option when you have an agreement with a friend that he will pay you because GCash will handle most of the work.

With GCash, the receiver can simply initiate a Request Money in the app, and the app will do all the reminding. Once the reminder arrives, the sender will only need to confirm the payment.

Send Ang Pao lets you send money to multiple people at once.

Ang Paos aren’t just for gifts. You can also use them if you need to send money in bulk. Send Ang Pao allows you to send a maximum of 99 people at once. It is true that all of them need to receive equal amounts.

Get more GCash Forest Energy Points by waking up early.

Every day, except on weekends, GCash Forest Energy Points (EPs) spawn around 6 AM and 1 PM. By waking up earlier than your friends, you can get a head start and steal a lot of EPs. Additionally, your tree will grow faster as a result.

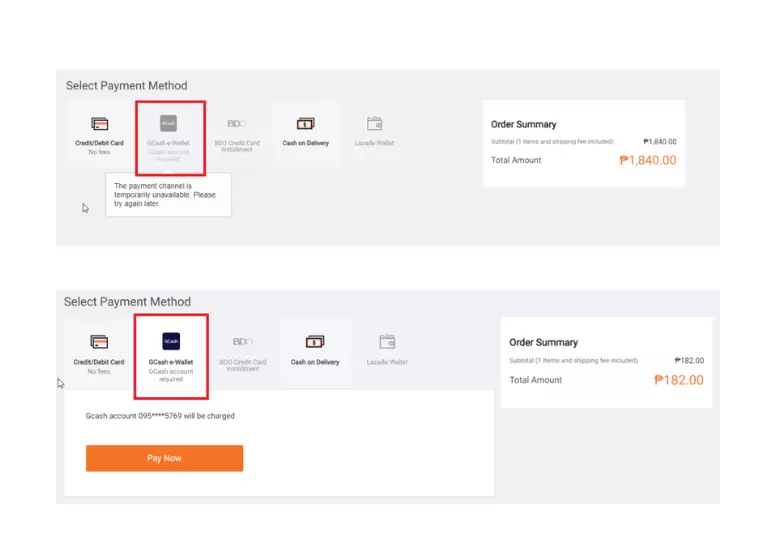

Before allowing you to select GCash as a payment option, Lazada checks your wallet balance.

You don’t even need to check GCash’s app to see if you have enough balance.

GCash balances below total are shown here

When my GCash balance exceeds my total balance, you’ll see this

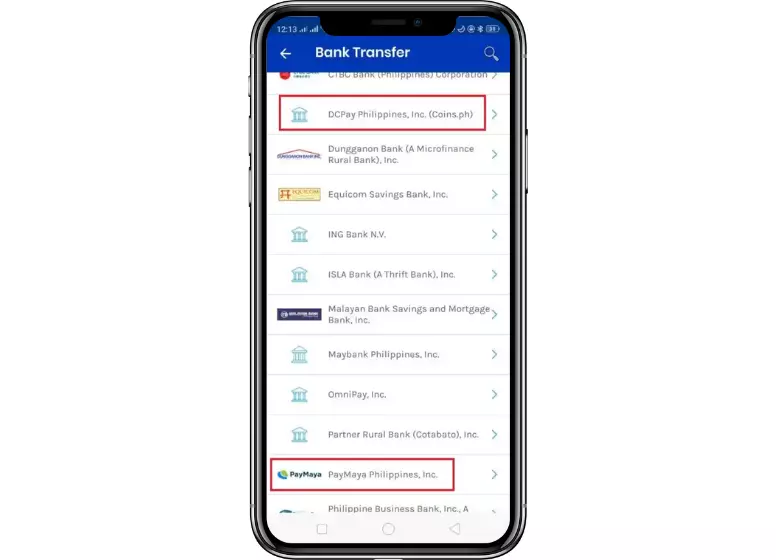

Transferring money from GCash to Paymaya, GrabPay, and Coins.ph is possible via bank transfer.

GrabPay now accepts bank transfers as well.

Here is proof that GCash serves all types of “banks ”:

Summary

There are a few lesser known GCash tips I’d like to share with you. Do you know any of these tips? Is there anything else you can suggest? If you have any comments, please let me know.